[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/opera_VI2E5YJhIC-1024x566-duVwL8.jpg)

Buffett’s AI investment strategies are reshaping portfolio allocation as Warren Buffett commits $92 billion across eight artificial intelligence…

Buffett’s AI investment strategies are reshaping portfolio allocation as Warren Buffett commits $92 billion across eight artificial intelligence companies within Berkshire Hathaway‘s $280 billion portfolio. With Apple stock commanding his largest position and also Amazon stock driving cloud dominance, this Buffett AI investment approach coincides with Apple’s June 9 WWDC 2025 event unveiling iOS 26.

Also Read: Warren Buffett’s Complete AI Portfolio Breakdown for 2025

From Silicon Valley to Shanghai: 4 Global Stocks Buffett Backs

Berkshire Hathaway’s massive Buffett AI investment allocation represents roughly 33% of the conglomerate’s public equity holdings, marking a strategic shift toward companies leveraging artificial intelligence technology right now and also expanding globally.

1. Apple (AAPL) Stock: $62 Billion Position Despite Recent Sales

The Apple stock remains Buffett’s largest holding with approximately $62 billion invested, representing 22.2% of Berkshire’s entire portfolio at the time of writing. This position exists even after Buffett sold over half of the Apple (AAPL) holdings in 2024, which originally peaked at over $170 billion in value.

CEO Tim Cook said:

“AI is making a difference for growth, with the iPhone 16 performing better in markets where Apple Intelligence is available than in markets where it has yet to be launched.”

Apple’s WWDC 2025 on June 9 will showcase iOS 26, featuring the biggest iOS update since version 7. Buffett’s AI investment reflects confidence in Apple’s AI transformation right now.

2. Amazon (AMZN) Stock: Nearly $2 Billion Cloud Computing Bet

The Amazon stock is only just about 0.7% of the entire Berkshire’s portfolio, translating to nearly $2 billion invested right now. Berkshire bought Amazon (AMZN) shares in 2019, and the position benefits from AWS generating $29.3 billion in Q1 2025 revenue alone.

CEO Andy Jassy had this to say:

“AI revenue within AWS is now at a multibillion-dollar annual run rate, and it’s growing at a triple-digit percentage year over year.”

Buffett’s AI investment reflects recognition of cloud computing’s central role in AI development and also shows his willingness to admit past mistakes.

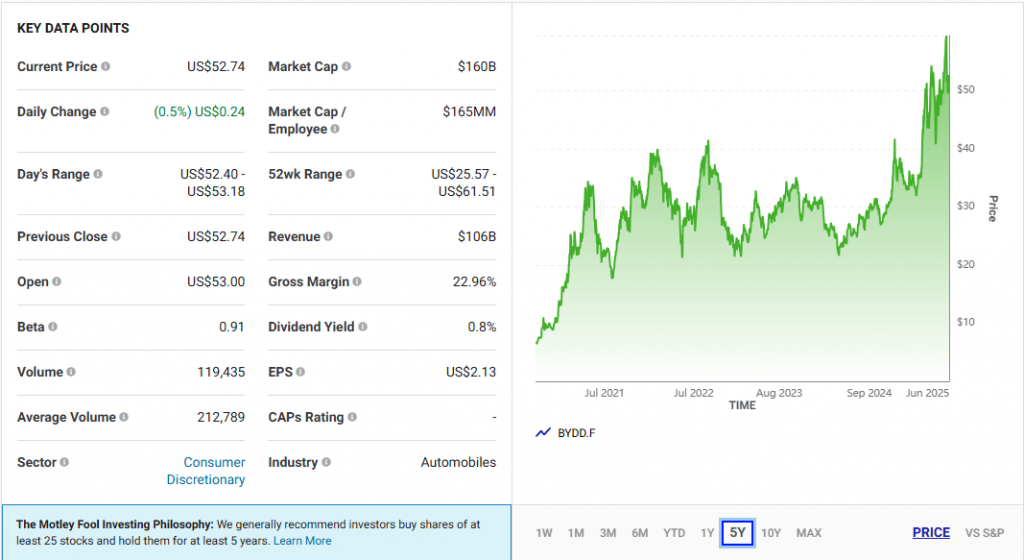

3. BYD Stock: Multi-Billion Dollar EV Investment

The BYD stock represents at least $2 billion invested in the Chinese electric vehicle manufacturer. The company surpassed Tesla in 2024 to become the world’s top EV company by revenue, validating Buffett AI investment thesis at the time of writing.

4. Japanese Trading Houses: $25+ Billion Across Five Companies

The five Japanese trading houses – Mitsubishi, Itochu, Mitsui, Marubeni, and also Sumitomo – collectively represent over $25 billion in Berkshire investments, with at least $2 billion in each company. These “sogo shosha” companies integrate artificial intelligence technology across Japan’s economy and also diversify across multiple sectors.

Susan Prescott, Apple’s vice president of Worldwide Developer Relations, stated:

“We’re excited to mark another incredible year of WWDC with our global developer community. We can’t wait to share the latest tools and technologies that will empower developers and help them continue to innovate.”

Also Read: Global Trading Giants Embrace AI Transformation

The $92 billion Buffett AI investment allocation across Apple stock, Amazon stock, BYD stock, and also Japanese trading houses positions Berkshire for diversified AI growth as WWDC 2025 approaches with iOS 26’s debut right now.