[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/RonPaul-1024x576-CrHOQf.jpg)

De-dollarization is majorly affecting the US economy and is changing the way how the world trades. Cross-border transactions…

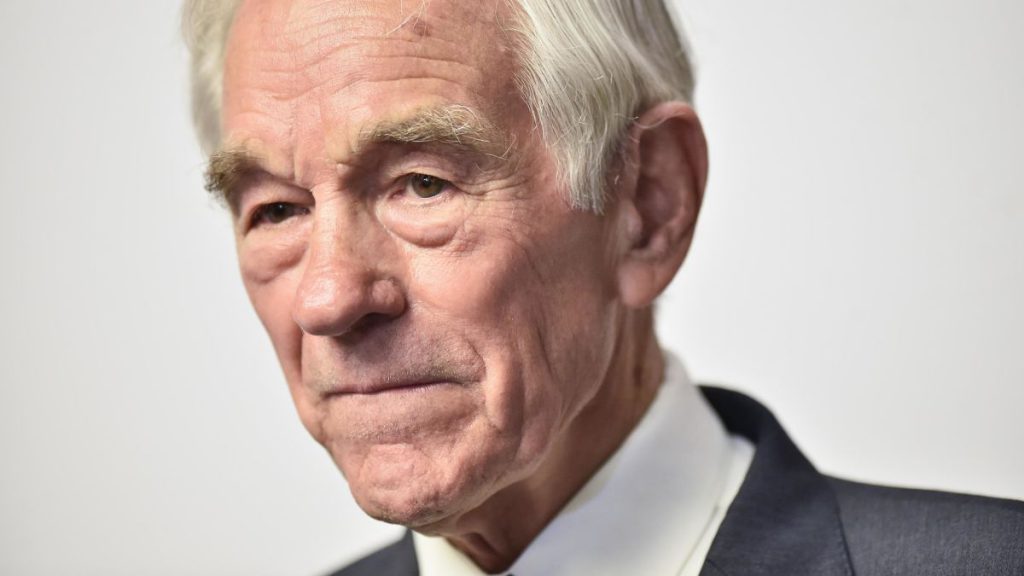

De-dollarization is majorly affecting the US economy and is changing the way how the world trades. Cross-border transactions are being settled in local currencies while the US dollar is being sidelined for payment settlements. Former U.S. Congressman from Texas, Ron Paul reaffirmed that the US dollar is on its way out of the financial system as de-dollarization takes shape in 2025.

The race to become the next ‘global currency’ is on and the euro and Chinese yuan are the frontrunners. Both believe that their currency is capable of replacing the US dollar and ushering the world into a new era. De-dollarization has now become a common word as ‘apples’ and there seems to be no turning back from hereon.

Also Read: BRICS: 50+ Nations Now Use Yuan, Rupee, Ruble, Not US Dollar in Trade

De-Dollarization: US Dollar Is on the Way Out, Says Former Texas Congressman

Ron Paul explained that the last time a financial reset occurred, the US dollar replaced the pound as the reserve currency. “The last time the world’s financial system underwent such a seismic shift, the dollar replaced the British Pound as global reserve currency. But today, it’s the dollar that’s on the way out,” he wrote, indicating that de-dollarization will replace the US dollar.

Also Read: De-Dollarization Surge in Asia: Bloomberg’s Stephen Chiu Discusses Dollar Crisis

The former Congressman urged Americans to buy gold as the value of the commodity rarely declines and cannot be manipulated. “Gold represents real, honest money that can’t be manipulated or devalued,” he said urging investors to accumulate the precious metal. Ron Paul revealed that de-dollarization is a serious threat that even the US cannot do much to stop the force.

Many developing countries are buying billions worth of gold and diversifying their reserves. Countries like China, India, and Russia have purchased tonnes of gold worth billions of dollars in the last three years. “The signs of this coming shift are already visible. Central banks worldwide are buying more gold than ever,” he said, as de-dollarization grows.