[#title_feedzy_rewrite]

The stablecoin market showcases continuous innovation within the Web3 ecosystem. Among its most dynamic and rapidly evolving sectors is the emergence of yield-bearing stablecoins. These digital assets ingeniously combine the fundamental stability of traditional stablecoins with the attractive prospect of generating passive income for their holders. This represents a profound evolution in how users can interact with decentralized finance (DeFi) and the broader crypto economy, effectively transforming a formerly inert “digital dollar” into a productive, interest-earning asset.

Understanding the Mechanics: How Yield-Bearing Stablecoins Generate Returns

At their core, yield-bearing stablecoins differ from their non-yielding counterparts (like basic USDT or USDC) by actively working to generate returns. While standard stablecoins maintain a peg to fiat currencies, typically the US dollar, yield-bearing variants go a step further. They are designed to distribute accrued interest or rewards back to the token holders.

This yield generation is achieved through a variety of sophisticated, yet increasingly accessible, mechanisms:

- DeFi Lending Protocols: This is one of the most common methods. Users deposit their stablecoins into established DeFi lending platforms such as Aave, Compound, or MakerDAO. These protocols then lend out the stablecoins to borrowers, who pay interest. A portion of this interest is then passed back to the stablecoin holders, often in the form of a specific “yield-bearing” stablecoin (e.g., aUSDC from Aave, or sDAI from MakerDAO’s Dai Savings Rate).

- Real-World Asset (RWA) Backing: A rapidly growing segment involves stablecoins backed by tokenized traditional assets. Foremost among these are short-term U.S. Treasury bills. By holding these interest-bearing government securities as reserves, stablecoin issuers can pass on the yield generated from these highly liquid and secure assets to their token holders. This bridges the gap between traditional finance yields and the efficiency of blockchain.

- Derivative Strategies: More complex and often higher-yielding protocols employ sophisticated derivative strategies. A prominent example is Ethena’s USDe, which utilizes a delta-neutral perpetual futures strategy. This involves taking a long spot position in a cryptocurrency (like Ethereum) and simultaneously shorting its corresponding perpetual futures contract to neutralize price fluctuations, while earning funding rates from the perpetual futures market.

The Unprecedented Growth Trajectory: Key Statistics (June 2025)

The trajectory of yield-bearing stablecoins has been nothing short of explosive, marking them as one of the standout performers in the digital asset landscape:

- Market Cap Surge: As of May 2025, the aggregated market capitalization of yield-bearing stablecoins has soared to an impressive over $11 billion. This represents a dramatic increase from just $1.5 billion at the beginning of 2024, showcasing robust investor appetite and product development.

- Growing Market Share: This expanding segment now commands a significant 4.5% of the total stablecoin market. This is a notable increase from just 1% market share at the start of 2024, illustrating its burgeoning importance within the broader stablecoin ecosystem.

- Staggering Annual Growth: The combined market cap of yield-bearing stablecoins experienced an astonishing growth of over 5284% from February 2024 to February 2025. This meteoric rise underscores the immense investor demand for capital-efficient and yield-generating stable assets.

For more: The Rise of Stablecoins: 2025 Market Update and Key Statistics

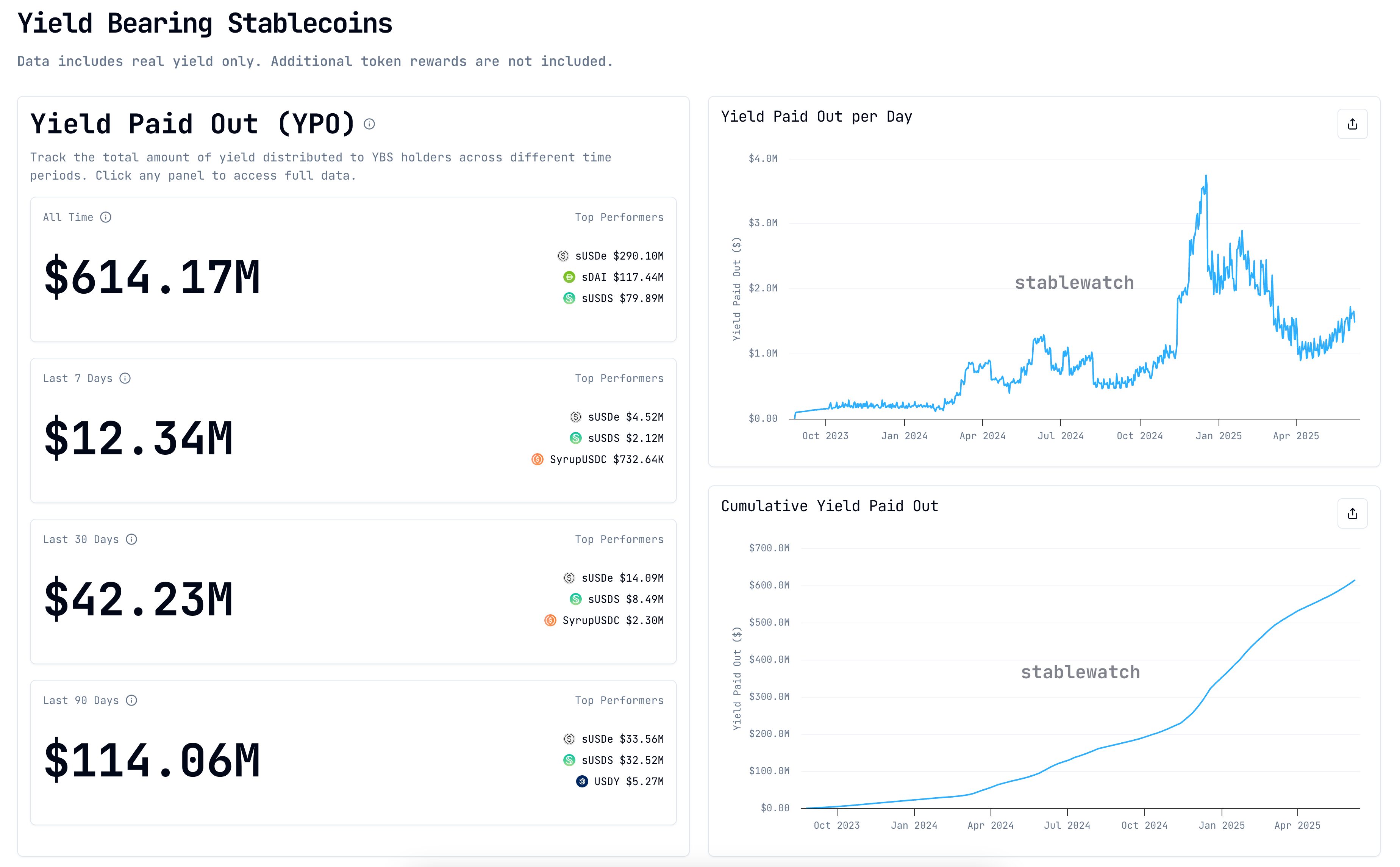

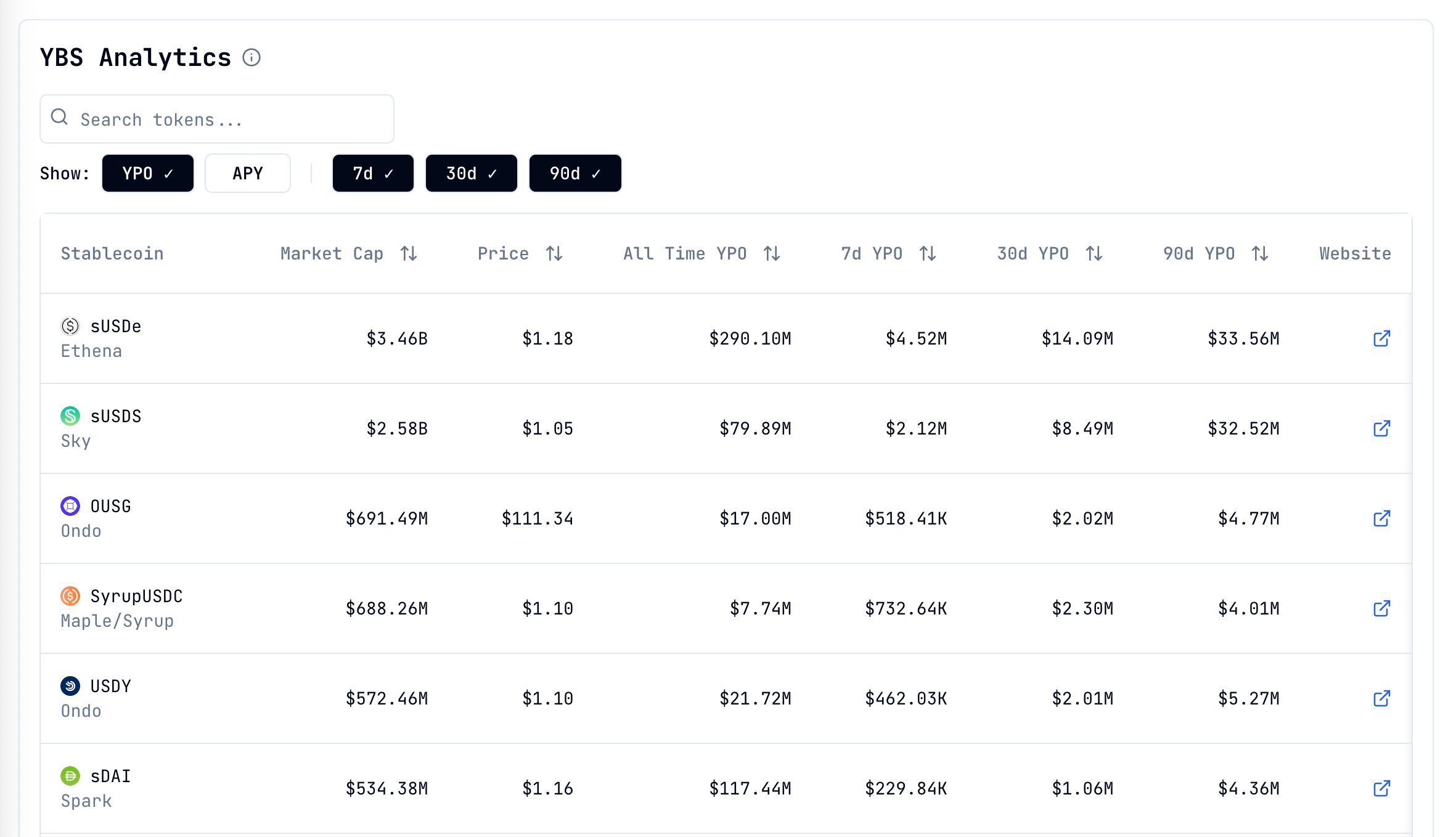

Source: Stablewatch

Key Players and Driving Forces: Ethena, Tokenized Treasuries, and Institutional Interest

Several innovative projects and broader market trends are propelling this rapid expansion:

- Ethena (USDe): Ethena’s synthetic dollar, USDe, has undeniably been a major catalyst for this sector’s growth. Its market cap remarkably crossed $3.5 billion by February 2025, and as of early June 2025, USDe’s market capitalization stands approximately between $5.46 and $5.88 billion. This positions Ethena as a dominant force in the yield-bearing stablecoin arena. Their innovative approach, primarily relying on delta-neutral perpetual futures strategies, has captured significant attention due to its attractive yields.

- Tokenized Real-World Assets (RWAs): The proliferation of yield-bearing stablecoins has directly fueled a substantial increase in the market capitalization of tokenized treasury bonds. This specific RWA market segment surged over 260% in 2025, reaching over $23 billion. Notable examples include BlackRock’s BUIDL tokenized Treasury fund, which itself grew from $649 million to $2.9 billion. This trend vividly illustrates the growing interest in bridging traditional finance yields with the efficiency, transparency, and accessibility offered by DeFi on blockchain.

- Broadening Investor Demand: Both retail and institutional investors are increasingly seeking stable yet rewarding options within the volatile crypto space. The appeal of earning a consistent yield on stable digital assets is strong. Even traditional payment giants like PayPal are showing interest, with offerings like 3.7% interest on PayPal USD (PYUSD) balances, signaling growing mainstream interest and confidence in stablecoin-related products.

Navigating the Landscape: Inherent Risks and Essential Considerations

While the promise of attractive returns from yield-bearing stablecoins is compelling, it is crucial for investors to understand the inherent risks involved. No investment, especially in the nascent Web3 space, is without its challenges:

- Smart Contract Risk: The underlying DeFi protocols that enable yield generation rely on smart contracts. These are susceptible to bugs, exploits, or unforeseen vulnerabilities, which could lead to significant financial losses if not robustly audited and secured.

- Counterparty Risk: For protocols that rely on centralized entities for custody or complex hedging strategies, counterparty risk becomes a concern. The solvency and trustworthiness of these entities are paramount.

- De-peg Risk: While designed for stability, some yield-bearing stablecoin models, particularly those with algorithmic or complex backing mechanisms, have historically faced de-pegging events. This means the stablecoin temporarily or permanently loses its intended 1:1 peg to the underlying fiat currency.

- Yield Sustainability: The attractive yields offered by some protocols may not always be sustainable in the long term. Yields can fluctuate based on market demand, funding rates, and the performance of underlying strategies. Investors must scrutinize the yield generation mechanism to assess its robustness.

- Regulatory Risk: The evolving regulatory landscape for stablecoins could impact the operations and legality of certain yield-bearing models, especially if new classifications or restrictions are introduced.

Source: stablewatch

The Future Outlook: Regulatory Catalysts and Mainstream Integration

The future of yield-bearing stablecoins appears exceptionally promising. Analysts anticipate sustained expansion and deeper integration into the global financial system.

For instance, JPMorgan analysts project significant growth for these assets. They could capture as much as 50% of the total stablecoin market cap. They also foresee overall stablecoin issuance doubling to $500 billion within the next 18-24 months.

Yield-bearing assets might comprise a substantial $75 billion of this burgeoning market. This growth is powerfully catalyzed by increasing regulatory clarity globally. The EU’s Markets in Crypto-Assets (MiCA) framework became fully operational for stablecoins on June 30, 2024. This has already led to new licenses for prominent issuers.

Simultaneously, in the US, proposed legislation like the GENIUS Act and the STABLE Act aim to establish a comprehensive federal framework. Hong Kong’s Stablecoin Ordinance is also set to commence on August 1, 2025, providing clear legal guidelines.

This global regulatory progress significantly enhances stablecoin legitimacy. It effectively paves the way for wider institutional adoption and fosters greater trust among financial entities and governments. Deloitte has even aptly termed 2025 “The year of the payment stablecoin.” This sentiment fundamentally supports the growing acceptance of all stablecoin variants, including those that offer yield.

Indeed, yield-bearing stablecoins are rapidly transforming the stablecoin market. They offer a compelling blend of stability and attractive passive income opportunities for Web3 investors. Their explosive growth, driven by innovative protocols and increasing tokenization of real-world assets, signals a new era for digital finance.

The post The Rise of Yield-Bearing Stablecoins: Earning Passive Income appeared first on NFT Evening.