[#title_feedzy_rewrite]

Sui (SUI) has emerged as a closely watched altcoin as we enter June 2025. Investors are evaluating whether SUI can sustain its recovery and potentially rally further this month amid a mix of positive project developments and macroeconomic uncertainty.

In this report, we examine Sui’s fundamental strengths to forecast SUI’s price trajectory for June 2025.

Sui’s Fundamental Strengths and Recent Developments

Recent Development

In August 2024, the network achieved a major technical milestone by deploying its new Mysticeti consensus protocol on mainnet, cutting transaction finality to an astonishing 390 milliseconds. This upgrade – an 80% latency reduction over Sui’s original consensus – established Sui as one of the fastest blockchains in the industry.

In early 2025, Sui rolled out Mysticeti v2, further refining its parallelized consensus to speed up transaction confirmation times for DeFi, gaming, and other high-throughput use cases. . These advancements underscore Sui’s core value proposition: industry-leading speed and scalability as a foundation for a Web3 ecosystem.

Beyond raw performance, Sui is positioning itself as a comprehensive platform with out-of-the-box infrastructure for developers. Recent protocol upgrades highlight this modular approach:

- DeepBook 3.1: Sui’s native on-chain order book and shared liquidity engine – was upgraded to provide permissionless liquidity pools, lower fees, and flexible fee payment, so decentralized apps can tap into readily available liquidity instead of bootstrapping from scratch.

- SCION: A next-generation networking protocol – is in progress to enhance Sui’s resilience. It ensures validators can communicate securely even under DDoS attacks or internet outages, helping keep the chain online during critical periods.

- Walrus: A blockchain-based storage solution – launched its mainnet in late March 2025, rapidly onboarding data. Within weeks, 17.5% of Walrus’s 4 petabyte capacity (725 TB) was filled as external projects integrated it.

Meanwhile, Sui’s core software continues to improve for developers and users: Move VM 2.0 (Sui’s smart contract engine) boosted execution speed by 30–65% under load, Remora lets validators scale across machines for growth, Pilotfish enhanced parallel transaction processing by 10× through better validator economics, and a Move Registry (MVR) now allows simple contract naming for easier interoperability.

Fundamental Strengths

These technical updates reflect a fast-evolving platform that is addressing prior limitations (throughput, storage, privacy, usability) in an integrated fashion.

No discussion of fundamentals is complete without noting challenges. In May 2025, Sui faced a significant security incident: a hacker exploited a vulnerability in Cetus Protocol, Sui’s top decentralized exchange, draining over $220 million from its liquidity pools.

Source: TradingView

The attack on May 22 disrupted SUI’s bullish price momentum and caused a sharp dip. However, the community and Sui Foundation responded swiftly. The network froze the attacker’s wallet with ~$160M of stolen assets and organized a compensation plan.

Despite this temporary setback, SUI’s price rebounded after the hack as confidence gradually returned. The incident underscores that while Sui’s technology is cutting-edge, maintaining security in DeFi remains an ongoing concern. Investors are watching how Sui learns from this exploit to strengthen its smart contract auditing and risk controls going forward.

Ecosystem and Adoption

A cryptocurrency’s price is heavily influenced by the health and growth of its ecosystem. In Sui’s case, 2024 and early 2025 have seen an explosion of activity on the network, positioning Sui as a rising DeFi and Web3 hub.

Sui’s decentralized finance ecosystem has grown from virtually nothing at launch (May 2023) into a multi-billion dollar DeFi arena. The total value locked (TVL) in Sui’s DeFi protocols hit an all-time high of over $2.08 billion in early January 2025.

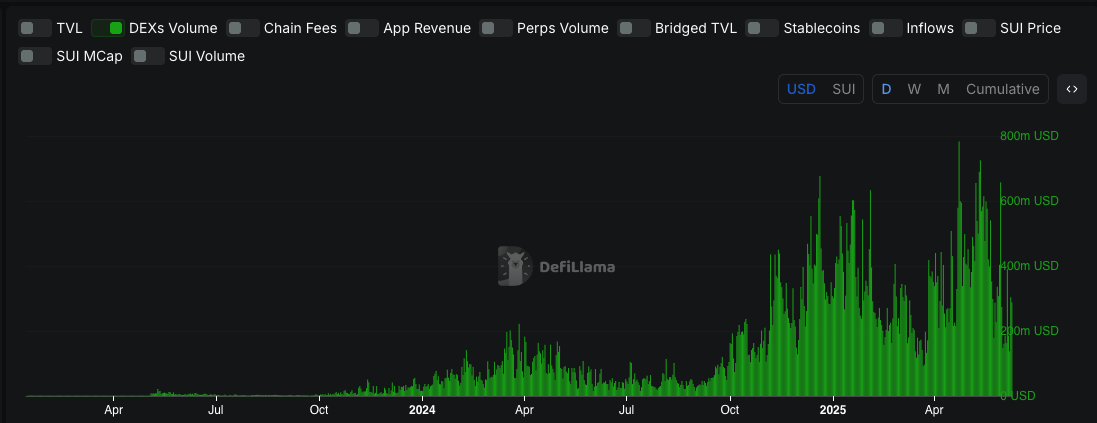

Source: DeFiLlama

Decentralized exchange activity on Sui has similarly surged. Sui’s average daily DEX trading volume reached $304.3 million in Q1 2025, a 14.6% increase quarter-over-quarter. This was a new record for on-chain activity and signals a maturing DeFi ecosystem on Sui.

Two trading platforms dominate Sui’s volumes: Cetus, an automated market maker and aggregator, and Bluefin, a decentralized perpetual futures exchange. Together they contributed roughly $239.5 million of the daily volume. The takeaway is clear: trading activity on Sui is robust and growing, which bodes well for SUI’s utility (as gas and fees) and visibility in the DeFi sector.

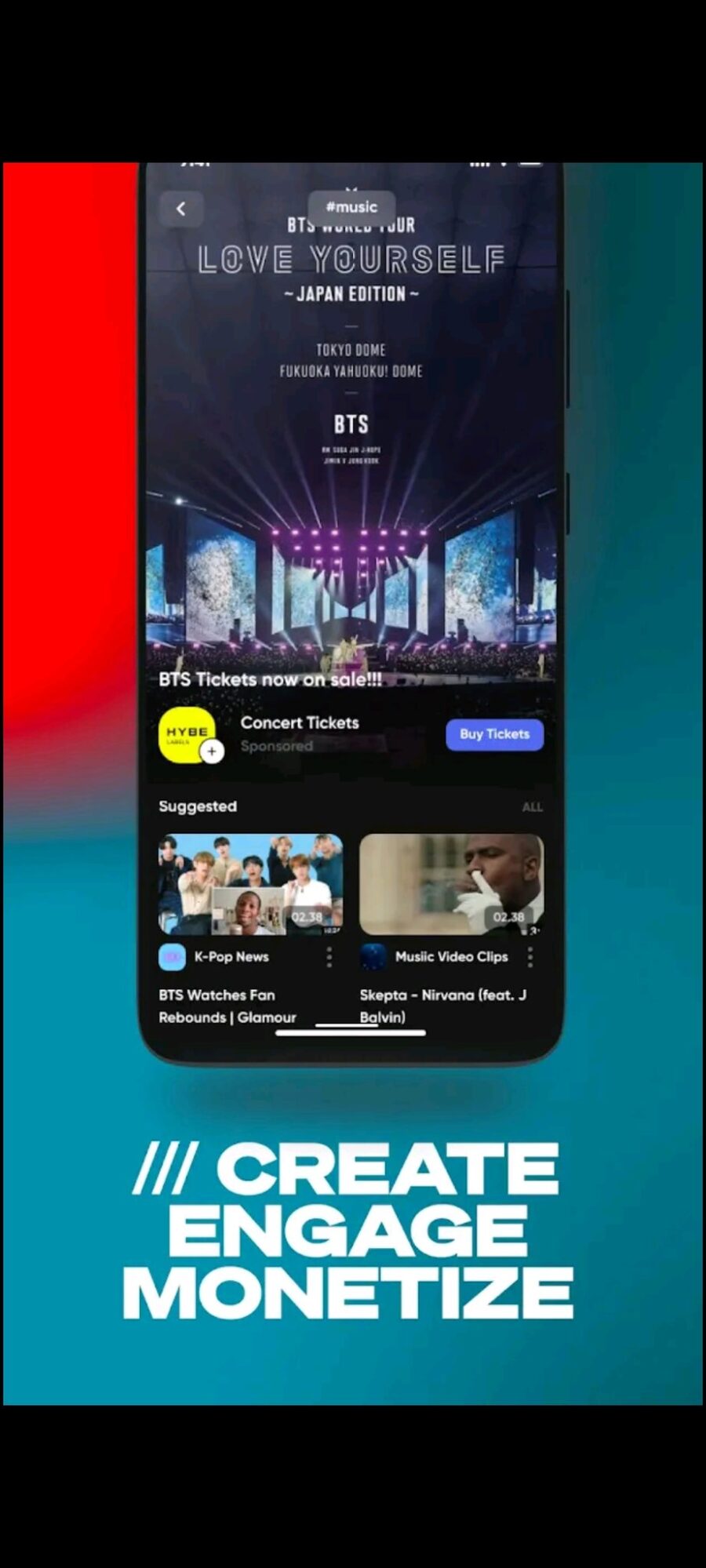

The biggest growth story comes from SocialFi and gaming. Remarkably, Sui’s top application by usage in early 2025 is RECRD, a short-form video content platform (like a decentralized TikTok) that monetizes creators.

RECRD has attracted around 1 million daily active users, generating over 100 million on-chain transactions in the past three months – a staggering level of activity.

Another social dApp, FanTV, brings AI-driven content creation is seeing 128,000 daily active addresses.

Indeed, the Sui Foundation noted that daily active users on Sui doubled in the first quarter of 2025, with new wallets being the majority – evidence that fresh users (likely drawn by these new apps) are powering the growth.

Tokenomics and Supply Dynamics

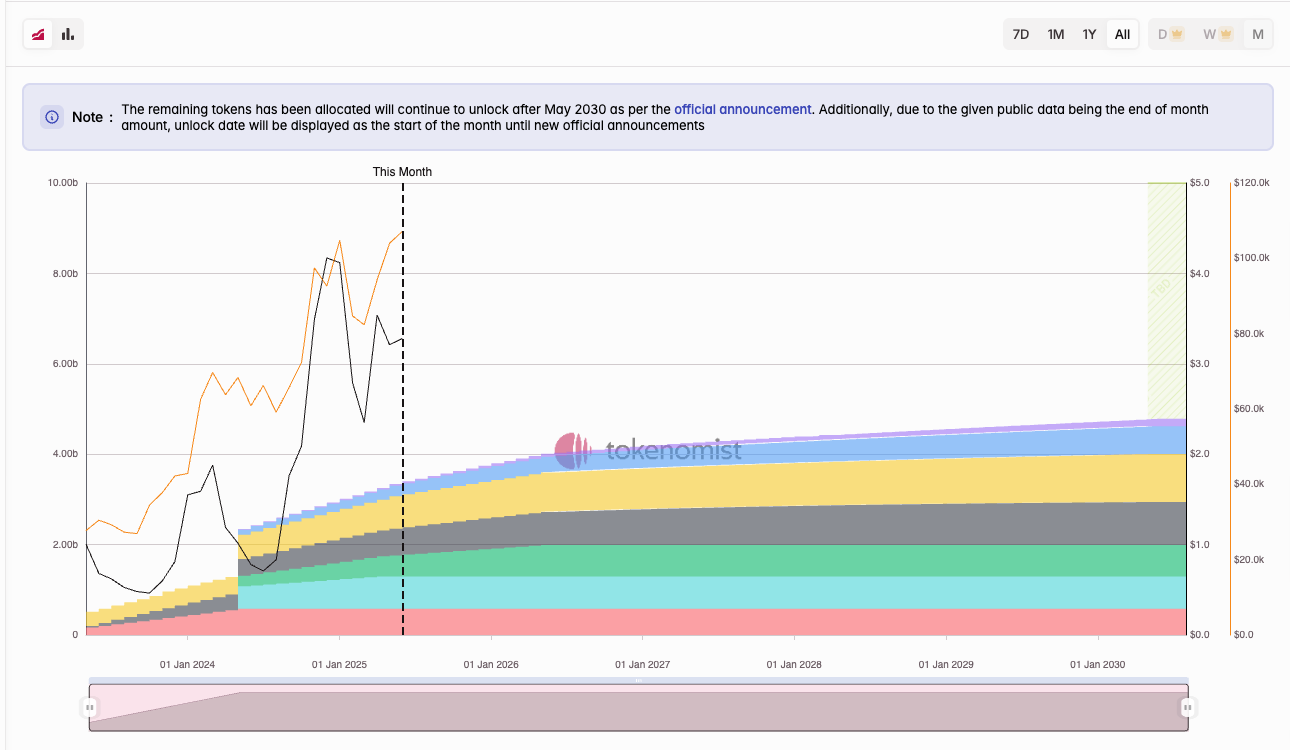

As of Q2 2025, around 3.25 billion SUI (≈32.5% of total supply) are in circulation. On June 1, 2025, another 44 million SUI unlocked, equivalent to 1.3% of circulating supply.

These monthly or periodic unlocks distribute tokens to early contributors, the Sui Foundation, or other stakeholders per the initial token allocation. Such events can create short-term sell pressure if recipients decide to take profits, which is why traders closely watch unlock schedules.

Source: Token Unlocks

Crucially, Sui’s team has communicated and managed these unlocks transparently, and even built mechanisms to mitigate their market impact. The tokenomics are “carefully calibrated” – Sui’s unlock mechanism is gradual, providing steady liquidity while aiming to maintain market balance.

Rather than dumping a large supply at once, the releases are spread out, a strategy meant to prevent sudden supply shocks that could destabilize SUI’s price.

It’s also worth noting the market capitalization aspect. While SUI’s price per token can be affected by unlocks, the overall network value accounts for all tokens (circulating or not). During Q1 2025, SUI’s circulating market cap actually fell significantly (by 40.3% to $7.2 billion) due to price decline, even as more tokens entered circulation.

Source: Messari

The key point is that supply increases are not inherently bearish if met with proportional demand. Sui’s ecosystem growth and investor interest have so far grown in tandem with its supply, which is a healthy dynamic.

Looking ahead, tokenomics will continue to play a role in SUI’s price. Such influxes will require the ecosystem’s growth to keep pace. The Sui Foundation’s stewardship in balancing these releases and the community’s response.

Industry Sentiment on SUI

As June 2025 begins, sentiment in the crypto industry toward SUI is largely optimistic yet tempered with some caution. Here we compile a range of recent expert views.

Messari’s “State of Sui Q1 2025” report confirmed many of the growth metrics we’ve covered (record DEX volumes, etc.) and also highlighted that SUI’s token underperformed in early 2025, indicating it may have been oversold relative to its fundamental growth.

Messari observed that while network activity was strong, SUI’s market cap declined more than the average crypto in Q1, implying potential value if the fundamentals continue to improve.

TokenInsight analysts also questioned whether SUI remains undervalued. They noted that the circulating supply stood at around 27–32% and could rise to approximately 36% by October 2025, raising questions about whether ecosystem growth can keep pace.

Galaxy Digital, the crypto investment firm led by Mike Novogratz, reportedly accumulated a substantial position in SUI.

ARK Invest – led by Cathie Wood – signaled optimism for next-gen blockchains by creating funds like a Solana ETF; ARK’s interest in layer-1 ecosystems suggests Sui could also be on their radar, at least indirectly.

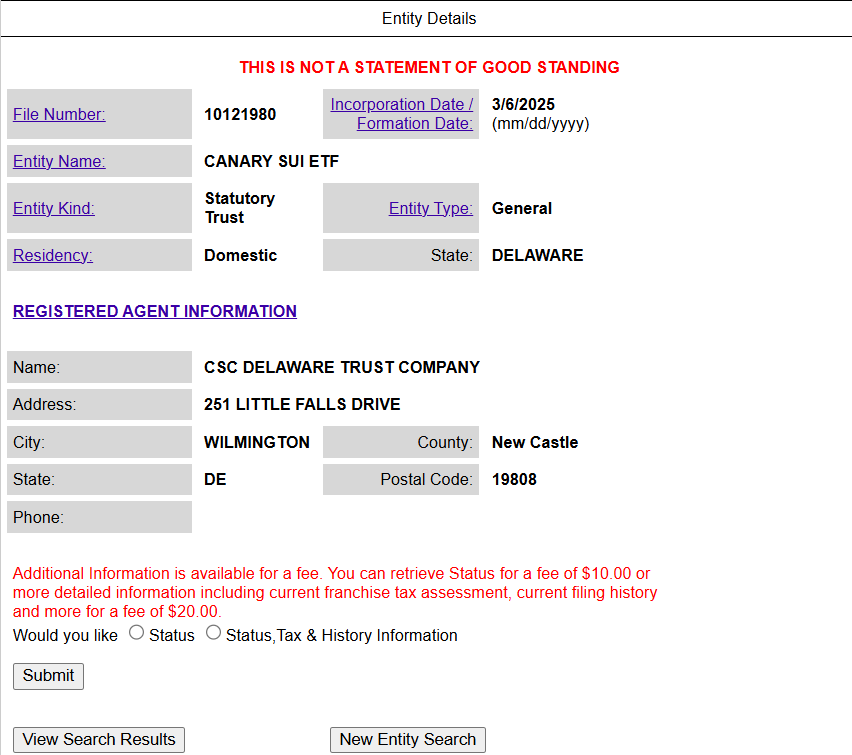

Canary Capital, by filing for a SUI ETF, is effectively betting that investor demand for Sui will grow and that regulators will be comfortable with it.

In aggregate, expert opinion leans bullish on Sui’s price outlook, highlighting fundamentals like ecosystem growth, partnerships, and institutional interest as reasons SUI could rise.

SUI Technical Outlook

SUI is currently facing significant resistance at the $4.117 level. For the price to break out and form a new all-time high (ATH), it must first close a daily (D1) candle decisively above this resistance zone. As of now, that has not occurred — suggesting the market may pull back to retest lower support levels.

The $3.2644 level serves as a minor support, but it looks weak since price has tested it multiple times with long candle wicks. A more reliable support area lies between $2.7822 and $2.3664, which aligns with a 3D Fair Value Gap (FVG). This gap indicates strong historical buying pressure, and it’s likely that price could return to this area to rebalance buy/sell liquidity in the market.

As such, the $2.7822–$2.3664 zone presents a high-probability support area for scalp trades or spot entries, especially for traders looking to capitalize on potential bounce setups in a strong demand zone.

SUI Price Prediction in June 2025

A plausible forecast is SUI ending June higher than its start, potentially in the high-$3 to $4+ range, with an upside toward $5 if momentum builds. This represents a cautiously bullish outlook, acknowledging that volatility is inherent and downside to ~$3 remains a possibility if the market turns risk-averse.

Investors and observers should continue monitoring key indicators: user activity on Sui, TVL and volume trends, upcoming product launches, and macro signals like central bank communications.

The expert consensus is “cautiously optimistic” – Sui has proven its fundamentals, and now the market is looking for confirmation in the form of price performance.

Ultimately, while the path to $5 remains within reach under favorable conditions, investors should remain pragmatic, focusing on trend confirmation rather than speculation. SUI’s trajectory in June may well serve as a litmus test for broader Layer 1 confidence in the current market cycle.

Read more: Top 5 Best Airdrop Projects on SUI

The post SUI Price Prediction in June 2025 appeared first on NFT Evening.