[#title_feedzy_rewrite]

The landscape of digital assets is constantly evolving, with stablecoins emerging as a foundational pillar of the Web3 economy. Far from being a monolithic entity, the stablecoin ecosystem is increasingly specializing, giving rise to two distinct yet interconnected categories: payment stablecoins and yield-bearing stablecoins.

This comprehensive analysis will delve into the intricacies of each, exploring their mechanisms, market impact, advantages, risks, and their collective role in shaping the future of global finance.

Payment Stablecoins: The Digital Cash of the Internet

Payment stablecoins are designed primarily to function as a stable medium of exchange. Their core utility lies in facilitating seamless, low-cost, and near-instant transactions across various blockchain networks. They aim to replicate the stability of fiat currencies (most commonly the US dollar) in a decentralized, digital format, avoiding the volatility inherent in traditional cryptocurrencies like Bitcoin or Ethereum.

For more: The Rise of Stablecoins: 2025 Market Update and Key Statistics

How payment stablecoins work:

The vast majority of payment stablecoins are fiat-backed. This means that for every digital token issued, an equivalent amount of fiat currency (or highly liquid, low-risk assets like cash equivalents and short-term government bonds) is held in reserves by the issuer. This 1:1 backing is crucial for maintaining their peg to the underlying fiat currency. Regular attestations and audits are essential to ensure the transparency and integrity of these reserves, building trust among users.

Market Dominance and Impact

The two titans of the payment stablecoin world are Tether (USDT) and Circle (USDC). Together, they command over 86% of the total stablecoin market capitalization, which stands at approximately $250.3 billion as of early June 2025. Their transactional prowess is undeniable:

- USDT remains the largest by market cap, hovering around $153-154 billion in June 2025, driven by its extensive liquidity and widespread acceptance across exchanges and emerging markets.

- USDC has shown remarkable recovery and growth, with its market cap climbing to approximately $61.05-61.5 billion as of June 5, 2025. Its emphasis on regulatory compliance and transparency has propelled its adoption, particularly in jurisdictions with clearer legal frameworks.

- Unprecedented Transaction Volumes: A significant milestone occurred in 2024 when total stablecoin transfer volume reached an astonishing $27.6 trillion. This figure surpassed the combined transaction volumes of Visa and Mastercard. This trend has continued into 2025, with reports indicating that stablecoin transaction volume narrowly outpaced Visa payments in Q1 2025. This underscores their growing importance in global commerce and remittances.

- Network Shifts: While Ethereum and Tron remain dominant hosts for stablecoins, other networks like Base, Solana, Arbitrum, and Aptos are gaining traction due to lower fees and higher throughput.

Source: thepaymentassociation

Advantages of Payment Stablecoins

- Price Stability: Their direct peg minimizes price volatility, making them suitable for transactions, savings, and accounting.

- Speed and Efficiency: Transactions settle in minutes, sometimes seconds, on blockchain networks, a stark contrast to traditional banking systems that can take days, especially for cross-border payments.

- Lower Costs: Transaction fees are significantly lower than traditional credit card processing fees or international wire transfers.

- Global Accessibility: They enable seamless cross-border payments and financial inclusion for the unbanked, transcending traditional banking hours and geographic limitations.

- Programmability: As digital assets, they can be integrated into smart contracts for automated payments, escrow services, and other innovative DeFi applications.

Risks of Payment Stablecoins

- Centralization Risk: Many are issued by centralized entities, requiring trust in the issuer’s reserve management and commitment to transparency. Lack of regular, comprehensive audits can be a concern.

- Regulatory Uncertainty: While frameworks are emerging, unforeseen stringent regulations or classifications could impact their operations and usability.

- Illicit Finance Risk: The speed and pseudo-anonymity of some stablecoin transactions pose challenges for Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) efforts, leading to increased scrutiny.

Yield-Bearing Stablecoins: The Productive Digital Dollar

Yield-bearing stablecoins represent the next frontier in stablecoin utility. They are designed not just to maintain a stable value, but also to generate passive income for their holders. They transform static digital assets into dynamic, interest-earning instruments, bridging the gap between traditional interest-bearing accounts and the efficiency of blockchain.

How Yield-Bearing Stablecoins Work

The yield generated by these stablecoins stems from various sources, moving beyond simple fiat backing:

- DeFi Lending & Yield Farming: Users deposit stablecoins into decentralized lending protocols (e.g., Aave, Compound) or participate in yield farming strategies. The interest earned from these activities is then passed back to the stablecoin holders.

- Real-World Asset (RWA) Tokenization: A rapidly expanding model involves backing stablecoins with tokenized traditional assets, such as U.S. Treasury bills. The interest derived from these highly liquid, secure financial instruments is then distributed to the stablecoin holders. This offers a compelling blend of blockchain efficiency and traditional financial yields.

- Derivative-Based Strategies: Some protocols, like Ethena, employ complex strategies involving perpetual futures and other derivatives to generate yield from funding rates and market inefficiencies.

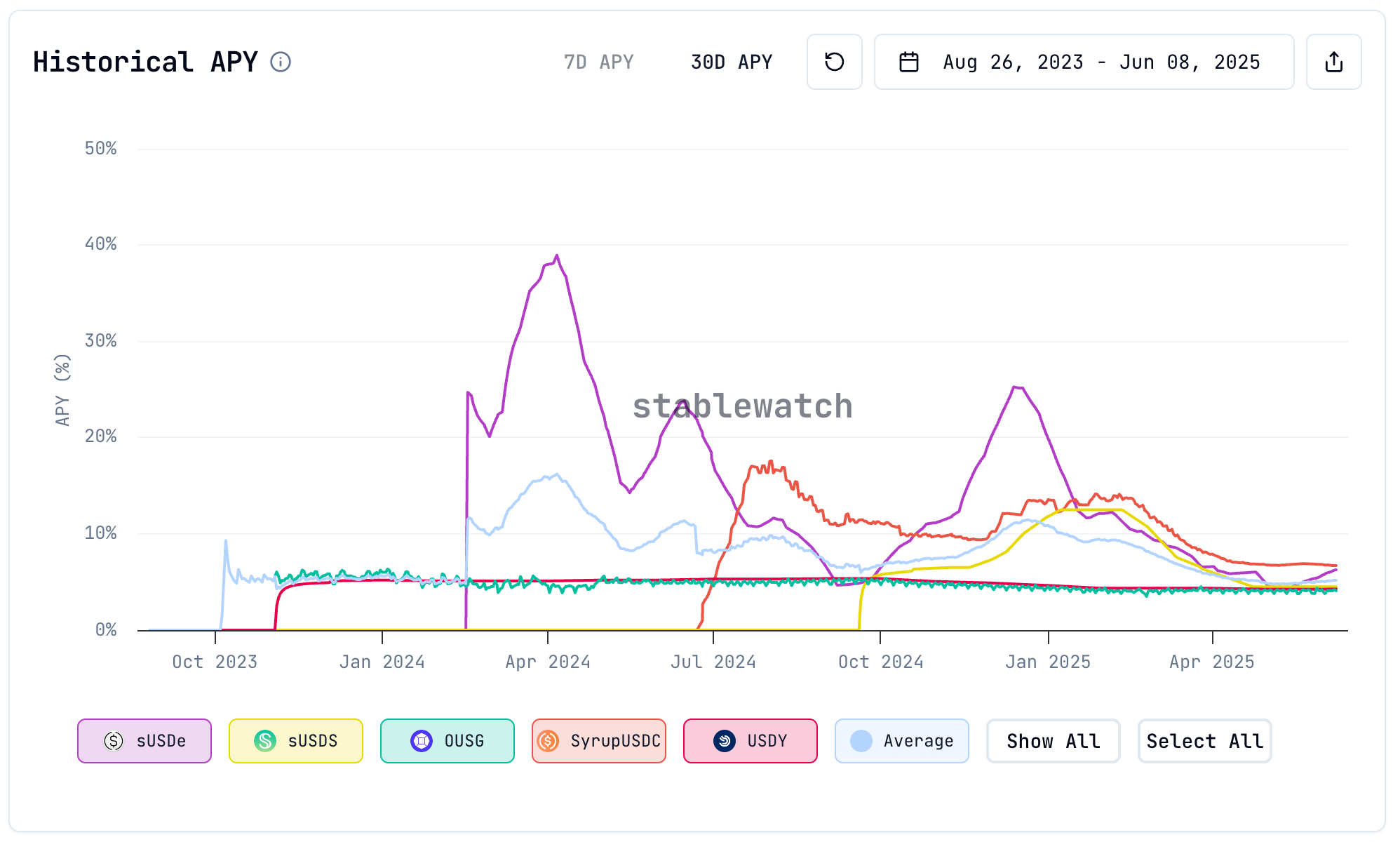

Source: stablewatch

Explosive Growth and Market Impact

The growth of yield-bearing stablecoins has been phenomenal:

- Market Cap Surge: By May 2025, the aggregated market capitalization of yield-bearing stablecoins soared to over $11 billion. This marks a substantial increase from just $1.5 billion at the beginning of 2024.

- Significant Market Share: This segment now commands a notable 4.5% of the total stablecoin market, a testament to its rapid adoption and the demand for capital-efficient crypto assets.

- Ethena’s Influence: Ethena’s synthetic dollar, USDe, has been a major catalyst, with its market cap reaching approximately $5.46 – $5.88 billion as of early June 2025. It exemplifies the potential for innovative yield generation within the stablecoin space.

- RWA Fueling Growth: The rise of yield-bearing stablecoins has directly fueled the expansion of the tokenized treasury bond market, which surged over 260% in 2025, reaching over $23 billion. This highlights the increasing convergence of traditional finance and DeFi.

Source: stablewatch

Advantages of Yield-Bearing Stablecoins

- Passive Income: They offer a straightforward way to earn returns on digital assets without active trading or complex management.

- Capital Efficiency: Users can earn yield while retaining exposure to a stable asset, improving capital utilization.

- Inflation Hedge (indirectly): By earning interest, users can potentially offset the erosive effects of inflation on their digital dollar holdings.

- Bridging TradFi & DeFi: RWAs allow users to access traditional finance yields through the transparency and efficiency of blockchain.

Risks of Yield-Bearing Stablecoins

- Smart Contract Risk: Reliance on DeFi protocols exposes them to vulnerabilities in code, which could lead to loss of funds.

- Counterparty Risk: Especially with more complex or centralized yield strategies, the solvency and integrity of underlying entities are critical.

- De-pegging Risk: While less common for RWA-backed variants, some models, particularly algorithmic or derivative-heavy ones, face a higher risk of losing their 1:1 peg.

- Yield Volatility and Sustainability: The yields are not always fixed and can fluctuate. High yields might indicate higher underlying risk or unsustainable models.

- Regulatory Scrutiny: Many yield-bearing stablecoins may be classified as securities, subjecting them to stricter regulatory oversight, which could impact their availability or operational models.

The Interplay and Future of Stablecoins

While distinct, yield-bearing and payment stablecoins are intrinsically linked. Payment stablecoins often serve as the foundational assets deposited into protocols to become yield-bearing. The continued growth and specialization of both categories signal a maturing digital financial system.

Regulatory Environment (June 2025): The global regulatory landscape is rapidly adapting to the rise of stablecoins:

- MiCA in EU: The EU’s Markets in Crypto-Assets (MiCA) framework became fully applicable for stablecoins (asset-referenced tokens and e-money tokens) on June 30, 2024. This has provided significant clarity, encouraging issuers like Circle to seek licenses.

- US Legislation: In the U.S., proposed legislation like the GENIUS Act and the STABLE Act continue to advance in Congress. These bills aim to establish comprehensive federal regulatory frameworks for stablecoins, focusing on reserve requirements, supervision, and consumer protection. Their passage is anticipated to unlock further institutional adoption.

- Global Adoption: Beyond the EU and US, jurisdictions like Hong Kong are also implementing dedicated stablecoin ordinances (effective August 1, 2025), creating clear legal guidelines.

This evolving regulatory landscape is paramount. It is enhancing stablecoin legitimacy, crucial for broader institutional adoption, and fostering trust among traditional financial entities and governments. Analysts predict significant future growth, with some even forecasting that overall stablecoin issuance could double to $500 billion in the next 18-24 months, with yield-bearing assets potentially capturing a substantial portion of this market.

The stablecoin market is no longer a niche corner of crypto. It is a dynamic and increasingly sophisticated sector, bifurcating into specialized functionalities. Payment stablecoins are transforming global transactions with their speed and efficiency, challenging traditional payment rails. Simultaneously, yield-bearing stablecoins are democratizing access to passive income, leveraging the power of DeFi and tokenized RWAs to generate returns previously exclusive to traditional finance.

The post A Comprehensive Analysis of Yield and Payment Stablecoins appeared first on NFT Evening.