[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/image-114-1024x574-Ma68ux.jpg)

Elon Musk xAI loans have become a major talking point right now as the AI company aims at…

Elon Musk xAI loans have become a major talking point right now as the AI company aims at securing $5 billion in debt financing through Morgan Stanley, and this comes despite ongoing Trump feud impact that’s been affecting market confidence. The Morgan Stanley loans structure also reflects growing regulatory uncertainty in today’s volatile business environment.

Also Read: Elon Musk’s XChat Encryption Slammed Amid $300M XAI Stock Sale

Elon Musk’s xAI Raises $5B Loans Amid Regulatory Risks and Market Volatility

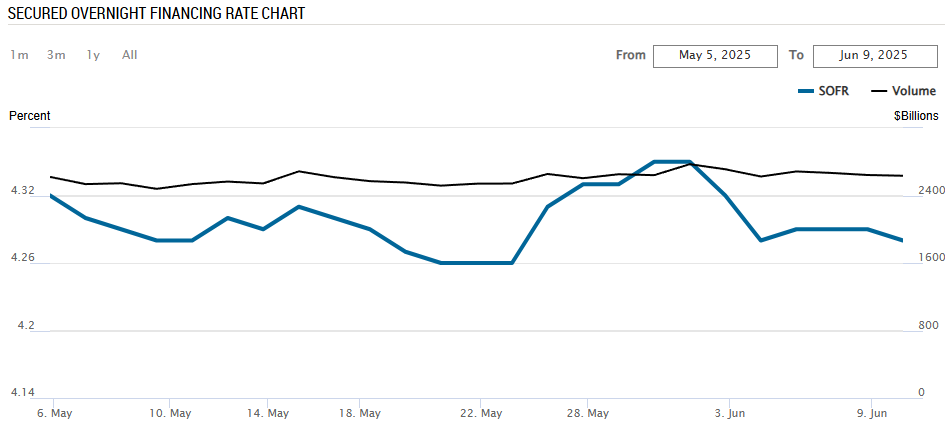

The Elon Musk xAI loans package includes a floating-rate term loan B that’s been priced at 97 cents on the dollar with a 700 basis point spread over SOFR, and there’s also an alternative option available. Morgan Stanley loans are being structured as a “best efforts” deal, with an alternative hybrid option that’s offering a 12% fixed coupon rate.

One insider had this to say:

“What has shifted in just a few months is Musk’s political leverage.”

Political Tensions Shape Financing Strategy

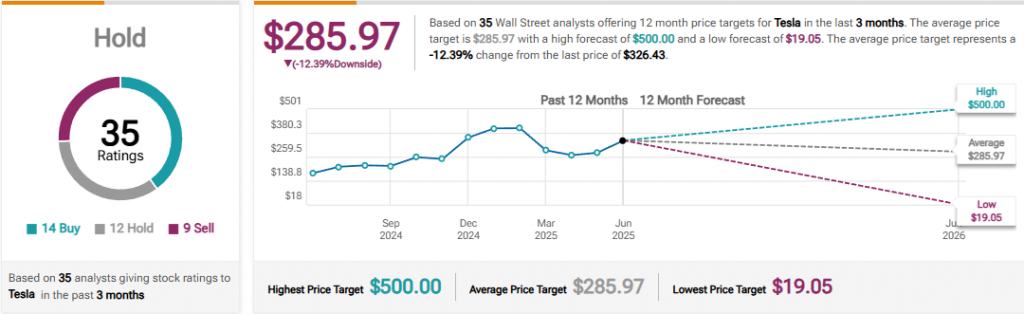

The Trump feud impact has created substantial market volatility, and Tesla shares fell 17% during peak tensions. Regulatory uncertainty is influencing how Morgan Stanley is approaching loans right now, with the bank avoiding full underwriting commitments.

The Elon Musk xAI loans come as the billionaire faces potential federal pushbacks, including contract cancellations and also funding cutbacks. Cryptocurrency market volatility adds another layer of complexity to the financing efforts at the time of writing.

Double Fundraising Strategy

Beyond the Morgan Stanley loans, xAI is simultaneously pursuing $20 billion in equity financing with valuations ranging from $120 billion to $200 billion as I write this piece. The Trump feud impact hasn’t deterred these ambitious funding goals, though regulatory uncertainty remains a concern.

Tesla’s market value recently returned above $1 trillion following conciliatory social media posts, and this demonstrates how cryptocurrency market volatility and political tensions continue affecting Musk-related ventures.

Also Read: Nvidia Tops Microsoft, NVDA Eyes $210 (+48.5%) on AI Demand

The Elon Musk xAI loans are a maneuver in a difficult situation, and the reserved position of Morgan Stanley indicates the anxiety of the entire market, which is associated not only with regulatory uncertainty but also with current political dynamics.