[#title_feedzy_rewrite]

While Bitcoin holds steady within a key range, altcoins are showing mixed signals, some rebounding off support, others struggling near resistance. This report revisits our previous technical outlooks and updates each with the latest price action

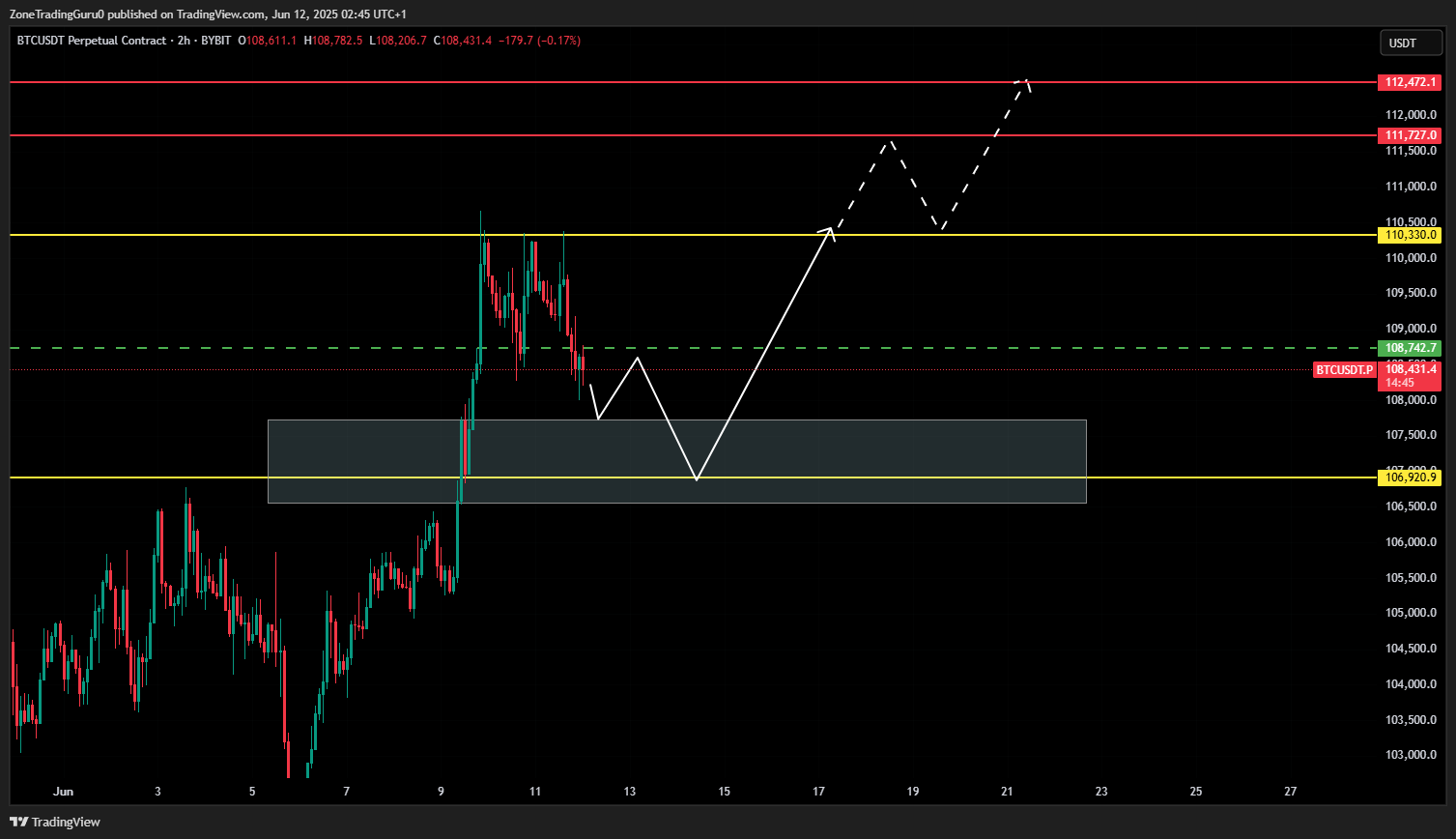

BTC Price Prediction

Bitcoin (BTC) continues to follow the anticipated trajectory outlined last week. After dipping to the support zone at $108,750, the BTC price rebounded and tested the resistance level at $110,330. However, without a clear breakout above this key level, BTC remains in a consolidation phase, trading within the range of $106,920 to $110,330.

As of today, there is a significant support area forming between $107,700 and $106,600, which could act as a potential target for a short-term pullback in the BTC price. Traders should closely monitor this zone. A decisive break below $106,600 may trigger a deeper correction toward the $101,000 region, which served as a prior demand zone.

Meanwhile, Bitcoin Dominance (BTC.D) is showing a short-term downtrend. The metric may retest the 64.46% area before continuing its decline. If this scenario plays out, it could provide an opportunity to long select altcoins, especially if price action aligns with BTC finding support.

Source: TradingView

XRP Price Prediction

XRP had staged an explosive rally from $0.52 to $3.40, delivering an impressive 550% gain. At the time, we noted that this surge lacked a proper corrective wave—a red flag for sustainable growth. We also highlighted the key resistance at $2.95, and emphasized the importance of the $1.61 support as a level to watch for any potential breakdowns.

However, since that rally, XRP price action has remained largely stagnant. The market has failed to build on the momentum, with price moving sideways and showing no clear directional conviction.

Despite the earlier breakout, the XRP price is still struggling to establish a clean trend and continues to trade within a wide, indecisive range.

Technical indicators remain mixed. RSI across higher timeframes (D1, W, 2W) still doesn’t support a strong bullish continuation, and the price has yet to retest key levels like $1.61 or push meaningfully toward resistance zones such as $2.95.

At this stage, our previous view remains valid: a pullback toward the $1.8954–$1.61 support zone is still on the table, and a daily close below $1.61 could confirm a deeper correction in the XRP price toward $1.323, $1.1655, or even $0.755 in an extended sell-off.

In short, XRP continues to move sluggishly, offering little in terms of tradable clarity for now. Until price action becomes more decisive, especially around critical support/resistance zones, it may be best to stay cautious and avoid forced entries.

SHIB Price Prediction

SHIB is currently trading sideways within a narrow range between 0.00001478 and 0.00001384, with a descending trendline formed from two prior swing highs adding downward pressure. The Shiba Inu price has been consolidating near these levels, lacking the momentum needed for a decisive breakout.

If SHIB breaks below the lower boundary of this range (0.00001384), the Shiba Inu price could drop toward the key support zone at 0.00001267. This level is considered strong support and could trigger a sharp rebound toward the resistance area near the recent high of 0.00001708.

However, a daily candle (D1) closing below 0.00001267 would invalidate the support and likely lead to a deeper correction toward the previous bottom at 0.00001054.

On the other hand, if SHIB breaks above the upper boundary of the range (0.00001478), it could rally toward 0.00001585, potentially followed by a pullback to retest the breakout level before making another move toward 0.00001708. A daily close above 0.00001708 would be a bullish breakout confirmation, potentially triggering a larger rally in Shiba Inu price toward the 0.00002222–0.00002280 resistance zone.

This is a key inflection area, and traders should monitor for volume and candle closures around these breakout levels for confirmation.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

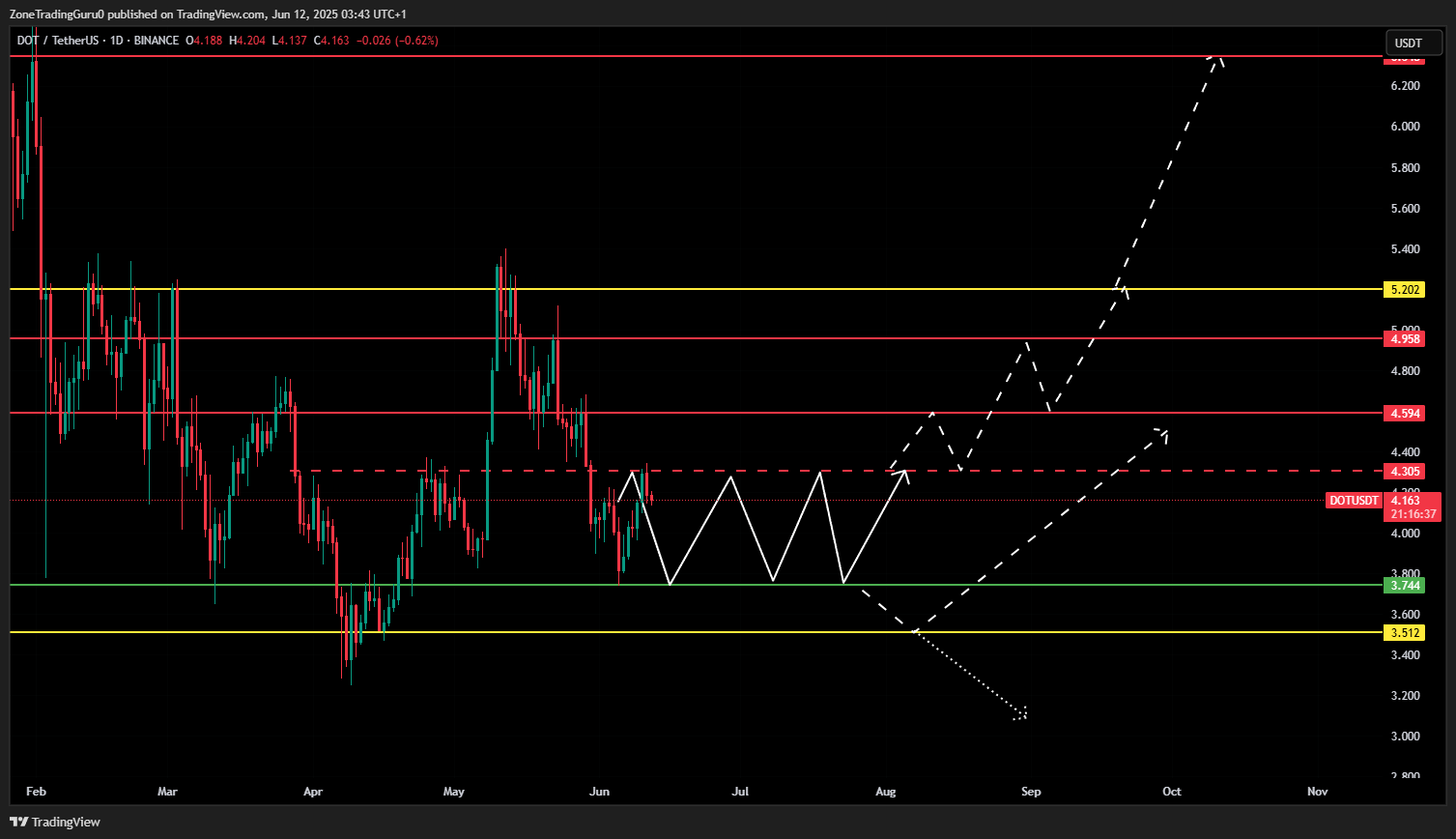

Polkadot Price Prediction

DOT was consolidating within a key range, bounded by resistance at $4.305 and support at $3.744. That view remains unchanged: the DOT price continues to move sideways within this range, with no confirmed breakout in either direction.

A breakout above $4.305 would open the door for a move toward higher resistance levels at $4.594, $4.958, and potentially $5.202—the most significant resistance in this structure. A weekly candle (W1) close above $5.202 would signal a strong bullish shift and could set the stage for a move toward the next major level at $6.348.

On the flip side, if the DOT price breaks below the $3.744 support, the next key level to watch is $3.512. A 3-day candle (3D) closing below $3.512 would invalidate the current range and could lead to new lows for DOT.

As of now, the DOT price remains directionless, trading within the established boundaries. A clear breakout beyond either range limit will provide the next directional cue.

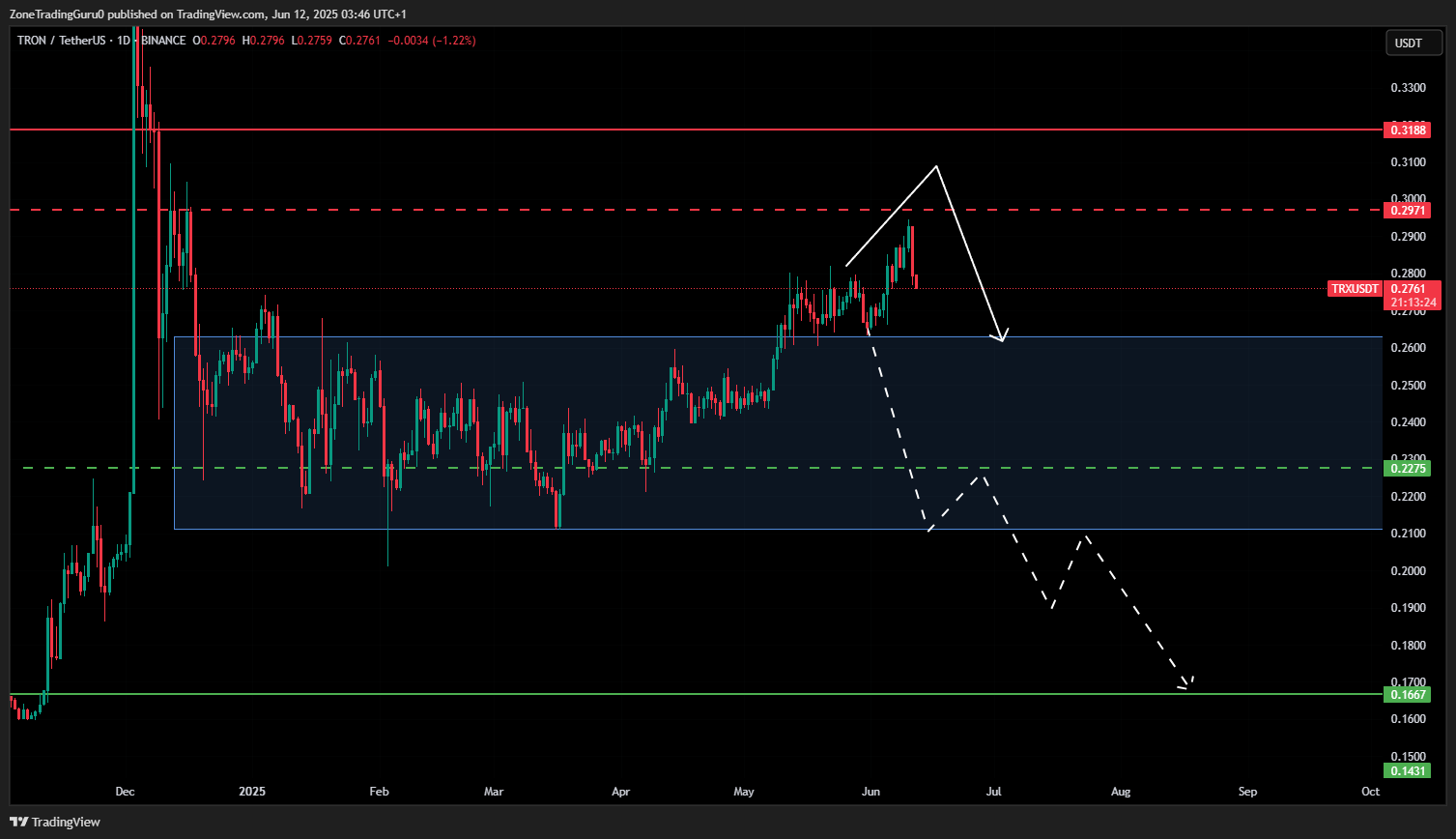

TRX Price Prediction

TRX’s strong rally toward the $0.45 zone suggested that any further significant upside would be difficult to sustain. At the time, the Tron price had already broken out of its 140-day consolidation range between $0.2103 and $0.2611, successfully backtested the upper boundary, and appeared poised to continue higher toward the $0.2971 resistance, with a possible wick extension toward $0.3188 before a larger correction.

Since then, TRX has followed that trajectory but fell short of fully reaching the resistance. The Tron price approached the $0.2971 zone but faced rejection just before touching it, resulting in a noticeable pullback – marking the first leg of rejection.

At this stage, the Tron price appears to be forming a second leg as it moves back toward support near $0.263, which could act as a short-term base. If this level holds, a bounce toward the previously mentioned resistance levels remains on the table.

However, if selling pressure intensifies and TRX closes back inside the old range (below $0.2611), then a deeper retracement toward $0.2103 becomes likely. Should the Tron price close below $0.2103, this would invalidate the breakout structure entirely and may open the path toward lower support zones at $0.1667 and $0.1431.

In that scenario, a swing short setup targeting those lower levels would be a valid consideration.

For now, TRX is still respecting the breakout structure, but price action has turned more cautious. Watch closely how the Tron price behaves around $0.263, as it may determine whether this correction is a healthy retest or the start of a deeper reversal.

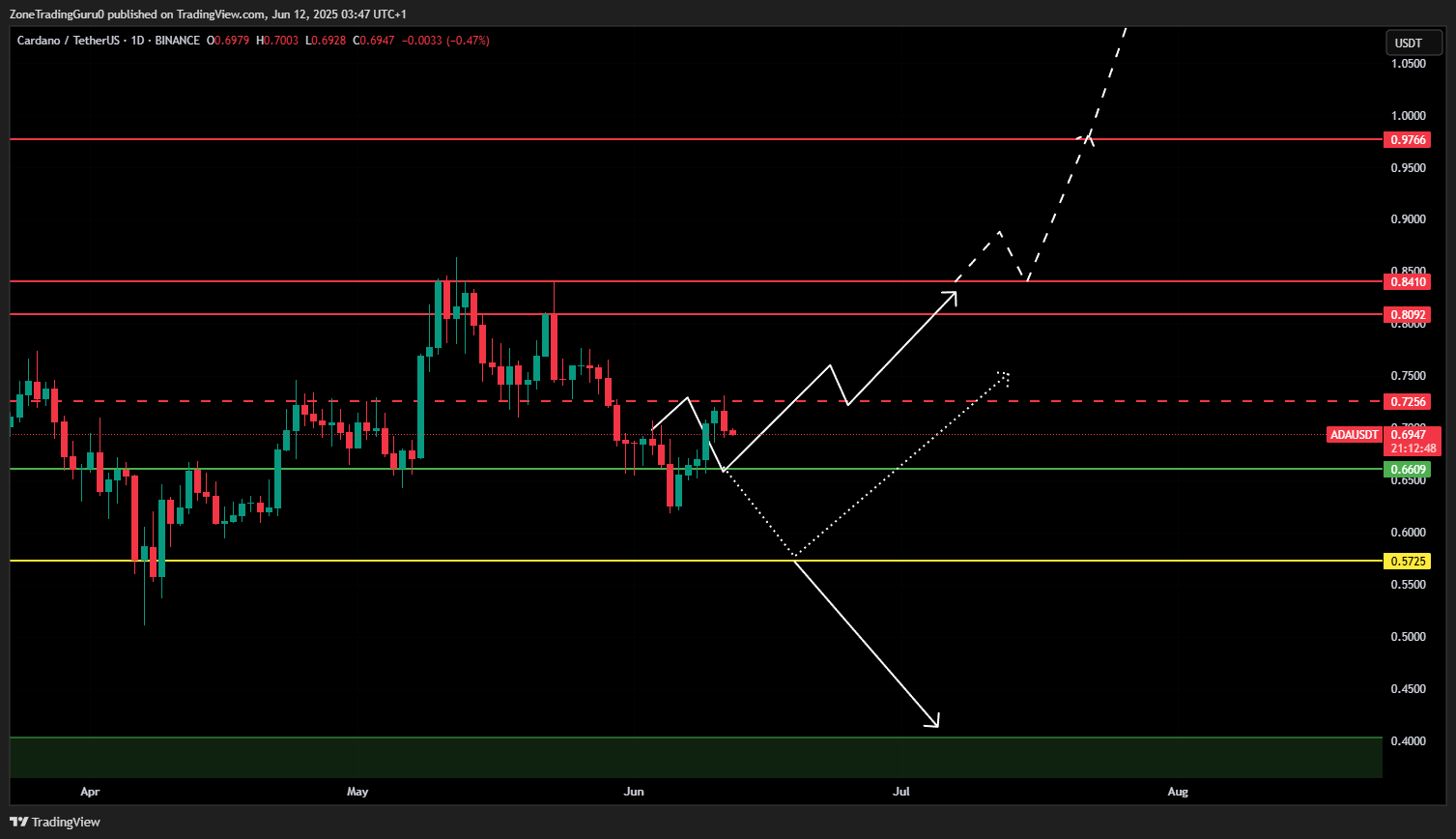

Cardano Price Prediction

Noted that ADA was trading within a tight range, caught between resistance at $0.7256 and support at $0.6609, and was likely to move sideways until a breakout from either boundary occurred.

Since then, the ADA price has followed that expected path, completing two distinct legs—first, a move down to retest the $0.6609 support, followed by a bounce up toward resistance at $0.7256. At the time of writing, ADA is reacting to this resistance zone, but has yet to break through it decisively.

A clean breakout above $0.7256 could pave the way for a retest of the short-term highs at $0.8092–$0.841. If a daily candle (D1) closes above $0.841, it would confirm bullish continuation and open up potential upside in ADA price toward the $0.9766 resistance and possibly even the previous cycle high around $1.1362.

On the downside, if ADA fails to break through resistance and instead closes below $0.6609, the ADA price could revisit the $0.5725 support zone. This is a key weekly level (W1) and may act as a strong springboard for a bullish reversal.

However, a weekly candle closing below $0.5725 would invalidate that support and likely send the ADA price toward the $0.4xxx range, revisiting its previous bottom structure.

For now, ADA remains range-bound, with traders watching closely to see if this current resistance test will lead to a breakout or another rejection.

Sui Price Prediction

Identified $4.117 as a major resistance level for SUI. At the time, we noted that for the SUI price to establish a new all-time high (ATH), it needed a daily candle (D1) to close decisively above $4.117. Since the price failed to break through that resistance, the expectation was for a retracement toward lower support zones.

We also highlighted a minor support around $3.2644, but noted that this level appeared weak due to multiple candle wicks testing and rejecting it. Instead, we pointed to $2.7822 and $2.3664 as stronger, more reliable support zones, backed by the presence of a Fair Value Gap (FVG) on the 3-day chart—indicating previous strong buying pressure at those levels.

Our view at the time was that if the SUI price returned to this $2.7822–$2.3664 range, it would present a high-probability opportunity for spot accumulation or short-term scalp entries, as the market could seek to fill the FVG and rebalance buy-sell pressure.

This setup provided a clear roadmap for both downside protection and upside continuation, pending a confirmed breakout through the $4.117 resistance.

Litecoin Price Prediction

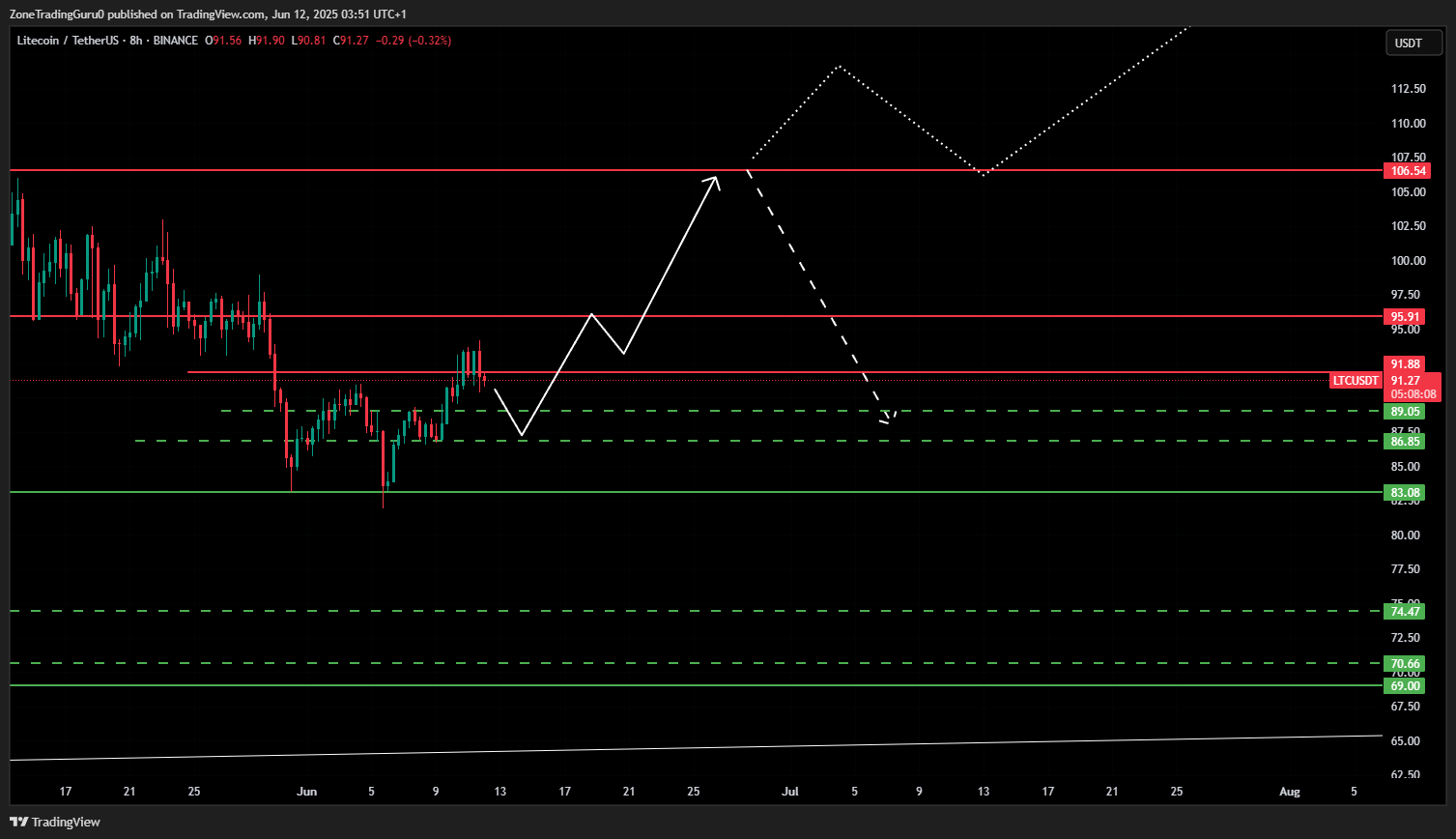

Litecoin (LTC) was moving within a consolidation range, with resistance between $91.88 and $95.91, and a key support level at $83.08. We also highlighted the potential for the LTC price to move up toward the strong resistance at $106.54, or break down below $83.08 to revisit deeper support zones near $74.47, $70.66, and $69.00, where a major ascending trendline also aligned—making it a likely bounce zone.

Since then, the LTC price has respected the $83.08 support, bouncing strongly off that level and rallying back up toward the $91.2–$95.91 resistance zone, just as anticipated.

Currently, the LTC price is facing resistance in that upper range, and while the bullish reaction from support is encouraging, momentum appears to be slowing near this zone.

We’ve also identified two intermediate support levels at $89.05 and $86.85, which could act as short-term demand zones. If the LTC price pulls back to test either of these levels, it may present a renewed opportunity to re-enter for a move toward $106.54.

A confirmed 3-day candle close above $106.54 would signal a strong breakout, with the next major target near the previous cycle high at $128.15. Conversely, if the LTC price unexpectedly breaks below $83.08 with a daily close, it could invalidate the recent bounce and open the path toward lower supports at $74.47, $70.66, and ultimately $69.00, where another potential reversal may occur.

For now, the LTC price remains range-bound but reactive, and short-term price action will hinge on how it behaves around $89–$86.8 and whether it can break cleanly above the resistance zone ahead.

Conclusion

Several altcoins like TRX, LTC, and ADA have respected prior support zones and are now testing upper boundaries, yet face clear resistance caps that have yet to be breached. XRP and SHIB remain directionless, with price action losing momentum after previous rallies.

Meanwhile, SUI and DOT are still range-bound, awaiting confirmation moves to define their next leg. Notably, LTC and TRX have followed expected structures closely, giving more confidence to technical setups.

The post Crypto Price Prediction 6/13: BTC, SHIB, DOT, TRX, ADA, SUI, XRP, LTC appeared first on NFT Evening.