[#title_feedzy_rewrite]

The Decentralized Finance (DeFi) landscape constantly evolves, and at its forefront, Pendle Protocol drives a significant shift: the maturation of fixed-yield markets. This deep dive explores how Pendle fundamentally re-engineers TradFi (Traditional Finance) principles like zero-coupon bonds and tranches, introducing much-needed predictability into inherently volatile crypto assets.

Pendle Yield Tokenization: Principal Tokens (PT) and Yield Tokens (YT)

Pendle Finance’s foundational innovation lies in its yield tokenization mechanism, a process that fundamentally redefines how users interact with yield-bearing assets in DeFi. It ingeniously separates the future yield stream from the underlying principal asset, creating two distinct, independently tradable tokens.

Pendle protocol takes any yield-bearing asset, such as staked Ethereum (stETH), Compound’s cUSDT, or Yearn Finance’s yvUSDC, and splits it into two unique components: a Principal Token (PT) and a Yield Token (YT).

Source: Pendle Finance

Pendle Yield Tokenization: Principal Tokens (PT)

Before this splitting, Pendle protocol wraps the underlying yield-bearing tokens into a Standardized Yield token (SY), which then serves as the base from which PT and YT are minted. A crucial aspect of this design is that users can combine 1 PT and 1 YT at any time before maturity to reconstruct and redeem the original underlying asset.

The PT represents the underlying asset’s principal amount. It is designed to be redeemable 1:1 for the deposited asset at its maturity date. PTs are typically acquired at a discount to the underlying asset’s current price, meaning that holding a PT until maturity guarantees a fixed yield.

Functionally, PTs are analogous to zero-coupon bonds in traditional finance. Their volatility naturally decreases as they approach maturity, making them attractive for conservative yield strategies and highly suitable as collateral in DeFi lending protocols.

For more: A Comprehensive Analysis of Yield and Payment Stablecoins

Source: Pendle Finance

Pendle Yield Tokenization: Yield Tokens (YT)

Conversely, the YT embodies the yield generated by the underlying asset. Holders of YT tokens are entitled to claim periodic yield (interest) and can effectively “long the yield,” speculating on its future increase or fluctuation. YTs thus enable direct speculation on future interest rate movements. This innovative mechanism unlocks a diverse array of financial strategies.

Users can sell their future yield (YT) in advance to gain immediate liquidity, purchase PTs at a discount to lock in a fixed return, or actively trade YTs to profit from anticipated changes in Annual Percentage Yields (APYs). This process significantly enhances liquidity for yield-generating assets and boosts overall capital efficiency within DeFi.

Source: Pendle Finance

This transformation of passive yield into active, tradable financial primitives marks a significant leap in DeFi’s financial engineering capabilities. Traditional yield farming often involves simply locking assets to earn passive rewards, which can reduce liquidity and limit strategic flexibility.

By disaggregating the principal and yield, Pendle changes a static, passive position into two dynamic, tradable components, allowing users to “time-travel” their earnings by selling future yield upfront or to express granular views on interest rate movements through speculation. This level of granularity and control is crucial for attracting more professional and institutional participants, who require precise tools for risk management, hedging, and alpha generation.

The composability of PTs and YTs

The simultaneous existence and tradability of PTs (fixed yield) and YTs (variable yield speculation) within Pendle’s market creates a dynamic interplay. The market-determined prices of these tokens inherently reflect the “implied rate” for the underlying asset. This mechanism allows for organic interest rate price discovery, a crucial element often lacking in earlier fixed-rate DeFi protocols.

Importantly, this price discovery is achieved without relying on external oracles or manual adjustments , embedding the rate determination within the protocol’s own market dynamics. This architectural choice enhances the protocol’s overall security and trustworthiness, reducing reliance on external, potentially manipulable, data feeds. This contributes to the long-term stability and reliability of the decentralized financial system.

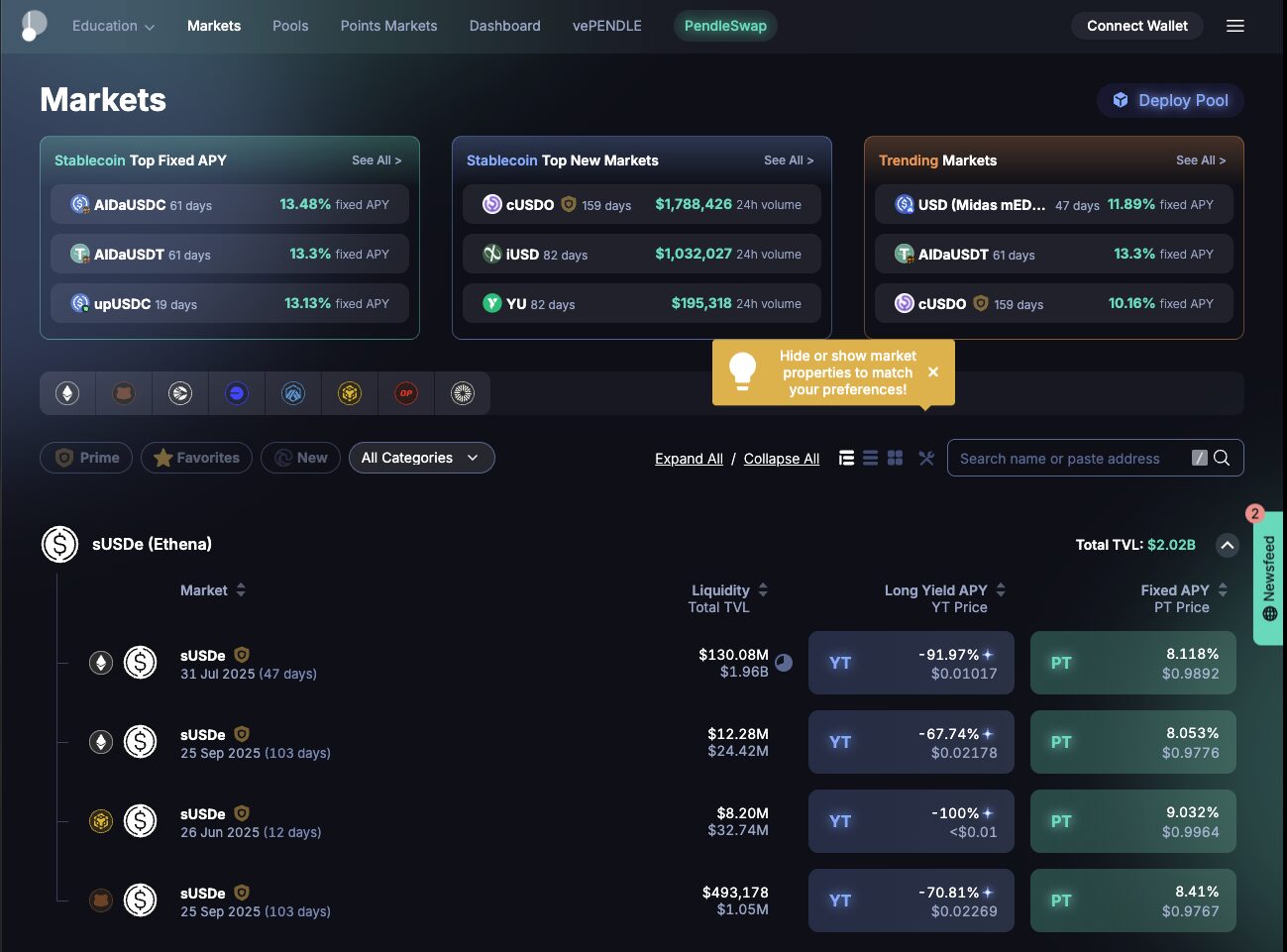

The Pendle AMM: Enabling Efficient Yield Trading

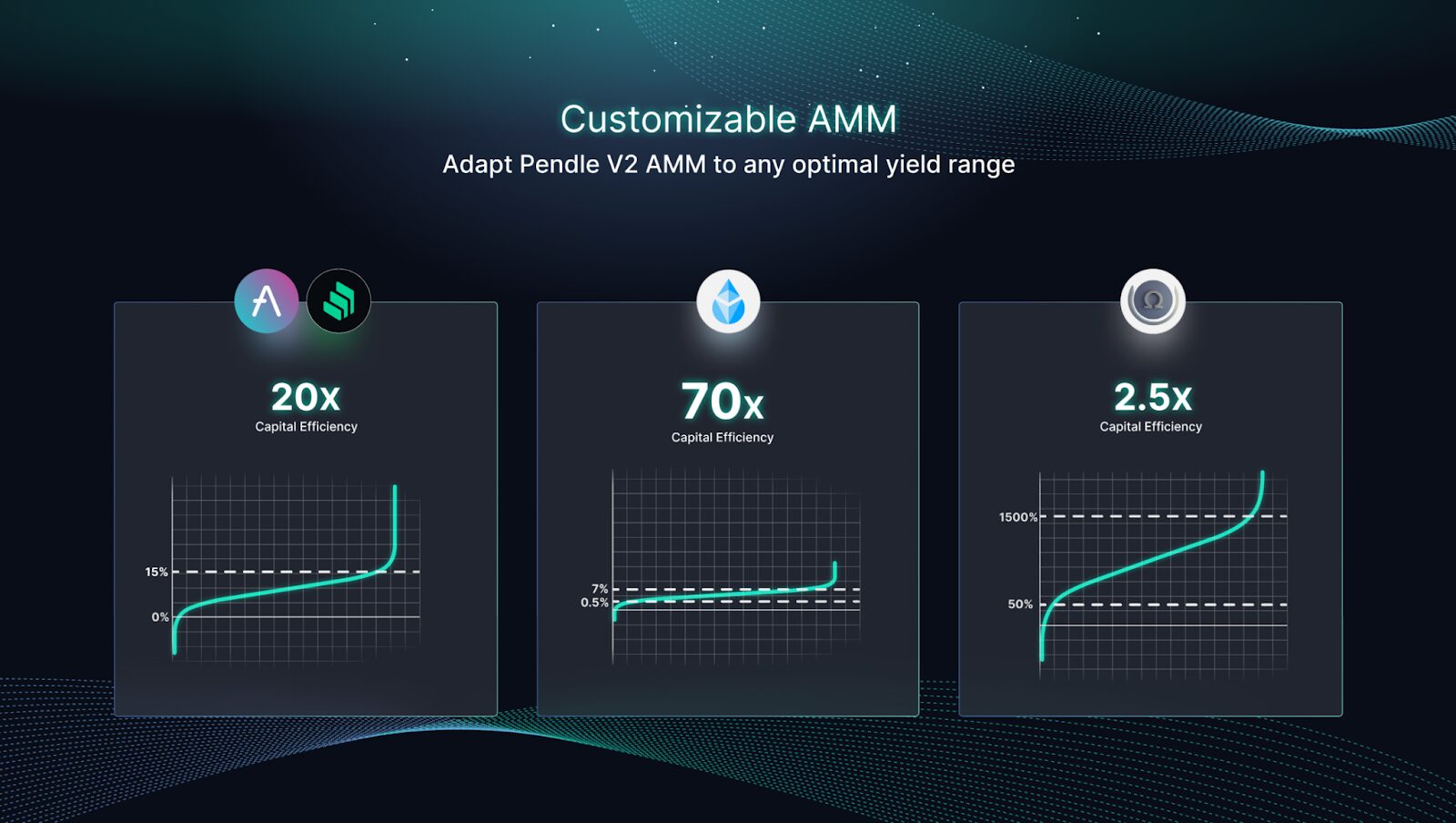

The Automated Market Maker (AMM) is the central engine of Pendle’s operations, specifically designed to facilitate the efficient trading of PT and YT tokens. Its unique design is optimized for the nuances of yield trading, incorporating features that significantly enhance capital efficiency and liquidity while mitigating common AMM-related risks.

Pendle Finance deploys a dedicated AMM for each Standardized Yield (SY) instance, enabling the trading of its corresponding PT and YT tokens from the moment they are minted. This AMM is explicitly “designed for yield trading with concentrated liquidity, dual fee-structure, and negligible IL concerns”.

Source: Pendle Finance

Pendle’s AMM employs a concentrated liquidity model. This lets liquidity providers (LPs) strategically allocate capital within specific price ranges. This targeted approach maximizes capital efficiency and minimizes impermanent loss (IL).

A unique feature is its time-decaying model, governed by functions like _getRateScalar(). This function’s value increases as the underlying asset’s maturity date nears. This design ensures smaller price impacts early on, allowing larger PT transactions. As maturity approaches, price sensitivity naturally increases. This incentivizes market makers to rebalance positions closer to fair redemption value. This mechanism ensures PT prices converge to their redemption value at expiry. It requires no external oracles or manual interventions.

Developing an AMM “designed for yield trading” is a crucial step in DeFi evolution. Most DeFi protocols use generic AMMs. Pendle’s specialization, with concentrated liquidity and its time-decaying model, addresses the unique traits of yield-bearing assets. These inherently converge to a fixed value at maturity.

Source: Pendle Finance

This move toward highly specialized financial primitives indicates a maturing DeFi infrastructure. Such specialization boosts efficiency and accuracy in price discovery. It also reduces specific risks, like impermanent loss, for niche asset classes. This makes DeFi more competitive with traditional financial markets.

The inherent time-decaying mechanism is a critical security choice. It ensures PT prices align with redemption value without relying on external oracles. Oracle manipulation is a costly DeFi vulnerability. By embedding this price convergence logic directly into the AMM, Pendle significantly reduces its attack surface. This enhances protocol security and trustworthiness. This is key for institutional adoption. It signals more robust, self-contained DeFi primitives that minimize external dependencies, contributing to decentralized financial system stability.

For more: Fixed Yield DeFi vs. Traditional Fixed Income in Yield Farming Rewards

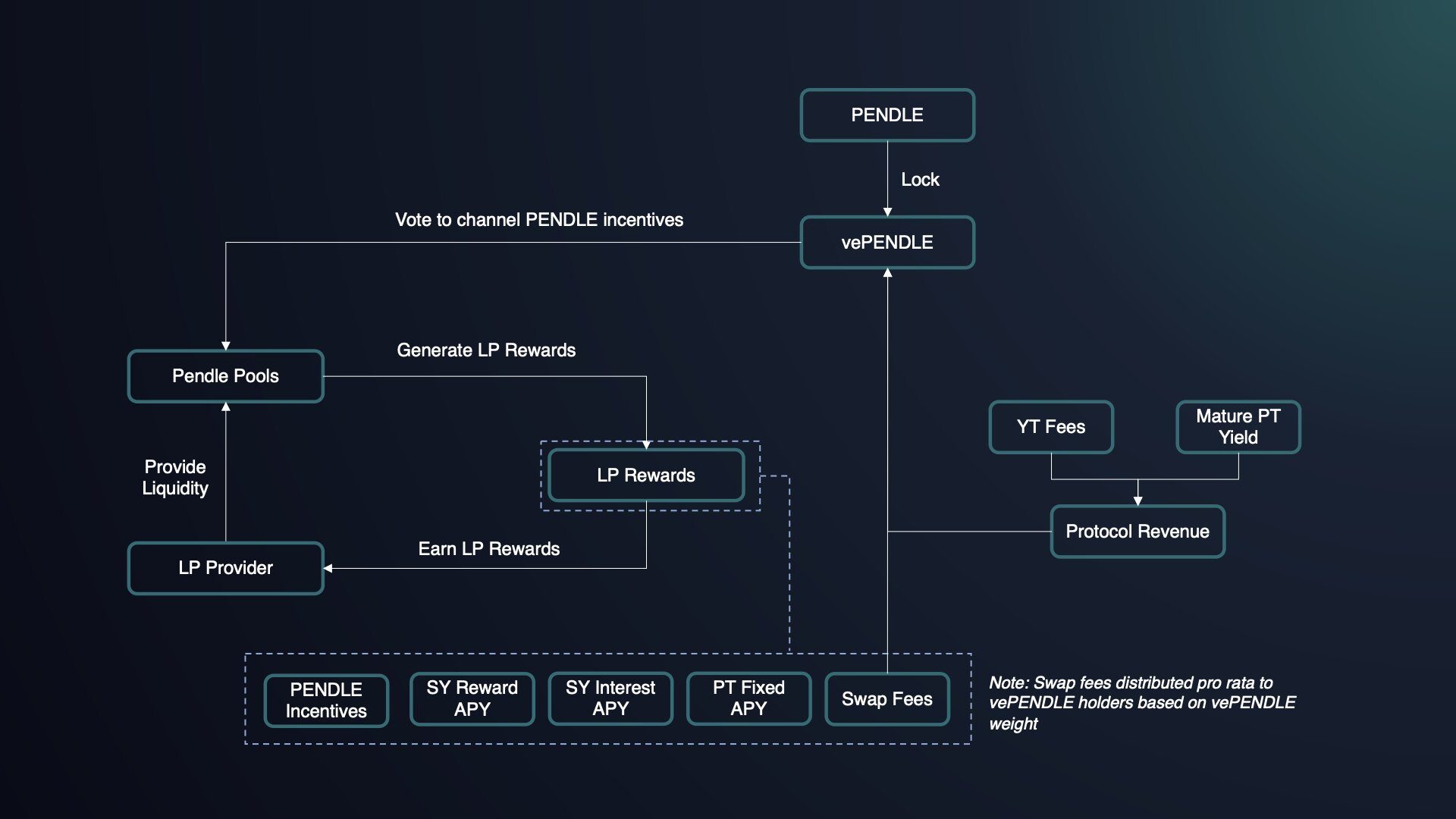

vePENDLE: Governance and Protocol Alignment

The vePENDLE token mechanism drives Pendle’s strategic approach. It significantly boosts decentralized governance and, furthermore, encourages robust long-term community engagement. This innovative model, in fact, draws clear inspiration from successful vote-escrowed token designs that other prominent DeFi protocols successfully employ.

Specifically, PENDLE token holders actively lock their tokens for varying periods; consequently, this action earns them vePENDLE. In return, vePENDLE grants them not only enhanced voting rights on crucial protocol decisions but also the ability to boost their rewards from the platform. This widely adopted design, therefore, inherently strengthens community engagement and, crucially, aligns token holder interests directly with the protocol’s long-term success, consciously mirroring effective strategies from protocols like Curve.

Source: Pendle Finance

Pendle’s governance structure has matured. Over 60% of token holders actively vote. Specialized governance committees now focus on risk management, development, and treasury management. On-chain governance ensures transparency and immutability of decisions.

This design is key for Pendle’s fixed-yield offerings to be sustainable and reliable. The vePENDLE model tackles “mercenary capital” by requiring token locking. This turns short-term yield farmers into long-term stakeholders. It builds a loyal community, making the ecosystem more resilient and stable. This is vital for attracting and keeping sophisticated capital.

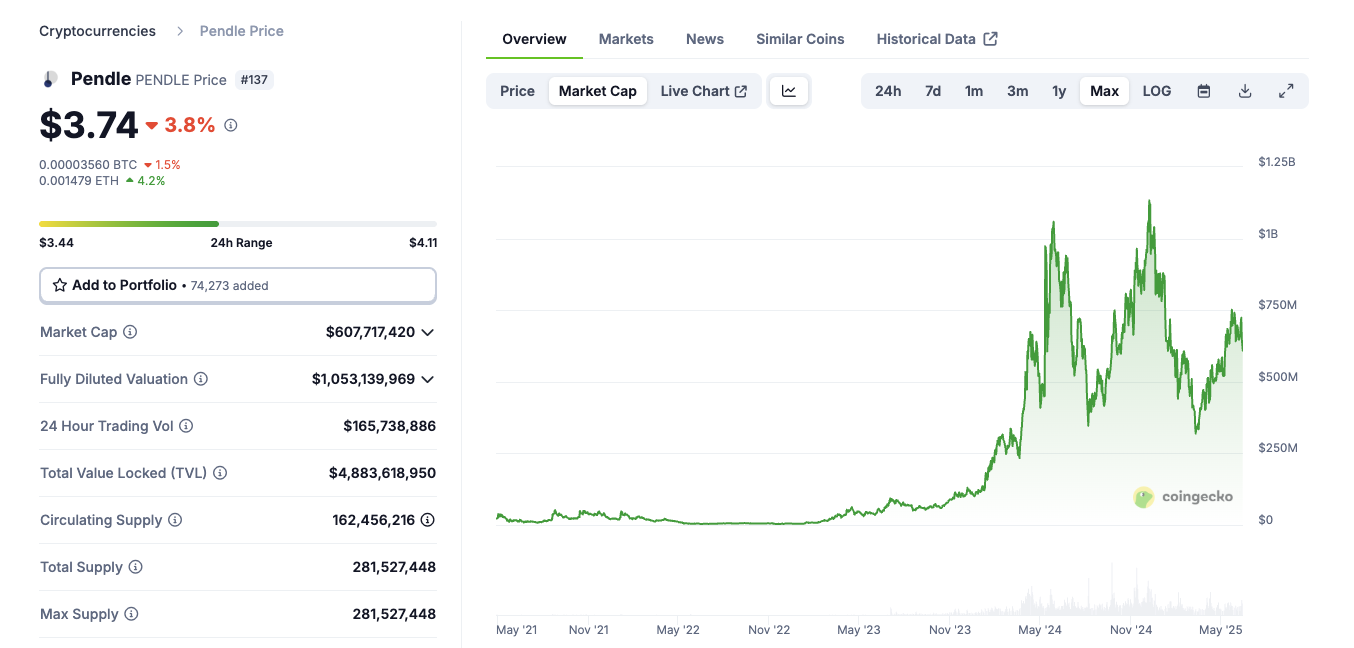

Understanding the PENDLE Token

The PENDLE token acts as the native utility and governance token for the Pendle protocol, which primarily operates across Ethereum and a growing number of Layer 2 solutions. Fundamentally, its purpose is to empower holders by leveraging the vePENDLE mechanism, thereby allowing them to actively participate in the protocol’s decentralized governance. Consequently, this involvement includes voting on crucial parameters such as upgrades, fee structures, market incentives, and even the specific yield pools that are launched.

Currently, the total supply of PENDLE tokens is capped at approximately 281 million, with the circulating supply naturally varying based on recent market data. By staking PENDLE to acquire vePENDLE, holders gain significant benefits. These include not only enhanced voting power but also boosted rewards, directly aligning token holder incentives with the protocol’s long-term success and overall sustainability.

Source: Coingecko

Pendle Protocol Risks and Challenges

Smart Contract Vulnerabilities and Exploits

The DeFi ecosystem carries inherent risks, with smart contract vulnerabilities being a primary concern. While Pendle implements robust security measures, the broader landscape shows a persistent threat of exploits. DeFi smart contracts can contain bugs leading to significant financial losses; flash loan attacks are a common method.

Pendle Finance Auditors.

Pendle addresses this with comprehensive security practices. Its smart contracts are open source and have undergone numerous audits by reputable firms. However, even extensive audits don’t guarantee full safety.

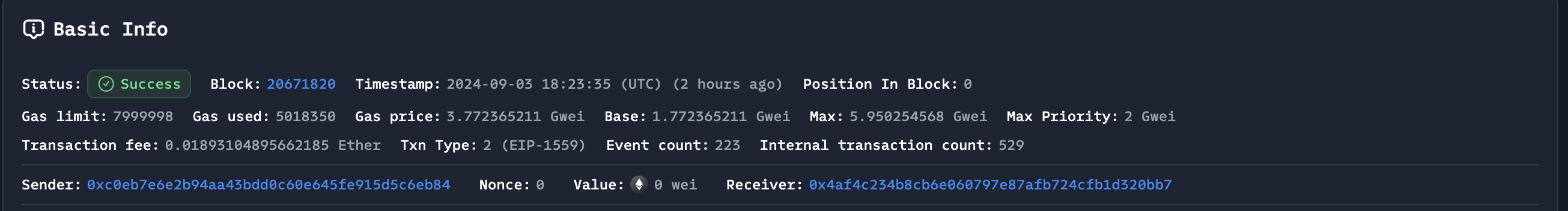

A notable incident involved Penpie, a yield farming protocol hosted on Pendle Finance, which suffered a $27 million exploit in September 2024. This hack leveraged a reentrancy vulnerability, highlighting that audits are necessary but insufficient. Continuous vigilance and robust incident response are equally vital.

Source: BlockSec

This event, along with issues identified by an audit of Jigsaw Finance’s Pendle strategies, underscores the systemic risk in DeFi’s composable “money legos” architecture. A flaw in one integrated protocol can cascade, even if the core protocol itself is secure. This demands a holistic risk assessment beyond individual smart contracts.

Liquidity and Price Discovery Challenges

Maintaining deep liquidity and ensuring accurate price discovery are ongoing challenges in fixed-yield DeFi markets. Indeed, this challenge intensifies significantly due to the inherent complexities of yield-bearing assets.

Earlier fixed-yield models, like those based on zero-coupon bonds, often caused liquidity fragmentation across different maturities. This made establishing robust markets difficult. Furthermore, DeFi commonly relies on external price oracles. These can be vulnerable to manipulation, risking significant financial losses.

Regulatory Uncertainty and Institutional Adoption Barriers

The evolving regulatory landscape undeniably casts a significant shadow, directly impacting institutional engagement with DeFi. Consequently, a persistent lack of clear frameworks can deter broader adoption, even amidst growing institutional interest. Indeed, the DeFi sector operates within a rapidly changing environment, where governments and regulators are still meticulously defining appropriate oversight. This inherent uncertainty, therefore, consistently creates formidable challenges for attracting large-scale institutional investment and, furthermore, for expanding into crucial new markets.

However, Pendle is proactively addressing these formidable barriers. For instance, its 2025 roadmap notably includes “Citadels.” Indeed, these are no ordinary tools; rather, such specialized infrastructure is precisely designed to provide compliant DeFi services specifically tailored for institutional users. Consequently, this effectively bridges the critical gap between traditional finance and decentralized markets.

Moreover, Pendle’s partnership with Ethena’s new Converge blockchain offers native KYC capabilities, thereby enabling compliant access for institutions to Pendle’s yield products. Beyond this, Pendle’s strategic focus on Real World Assets (RWAs) also serves as a critical bridge between TradFi and DeFi, effectively tokenizing familiar traditional assets directly onto the blockchain.

Ultimately, this strategic emphasis on KYC-compliant products and RWAs is absolutely crucial. By doing so, it directly attracts the vast pools of institutional capital that inherently demand regulatory certainty before engaging deeply. Therefore, by tokenizing TradFi assets and fostering key partnerships like Ethena’s iUSDe, the Pendle protocol directly meets institutional demand for alternative yields, simultaneously unlocking substantial new liquidity and accelerating broader DeFi adoption.

The post Pendle Deep Dive: Tokenized Yield and Fixed Yield in DeFi appeared first on NFT Evening.