[#title_feedzy_rewrite]

The emergence of fixed interest rates and bond-like instruments in Decentralized Finance (DeFi) is not a novel invention. Instead, it’s a sophisticated re-engineering. It draws from established financial engineering principles of traditional finance (TradFi). This adaptation aims to give inherently volatile crypto markets predictability. It also seeks risk management capabilities. These have long been linked to conventional fixed-income securities.

Conceptual Origins: From Traditional Finance to Blockchain

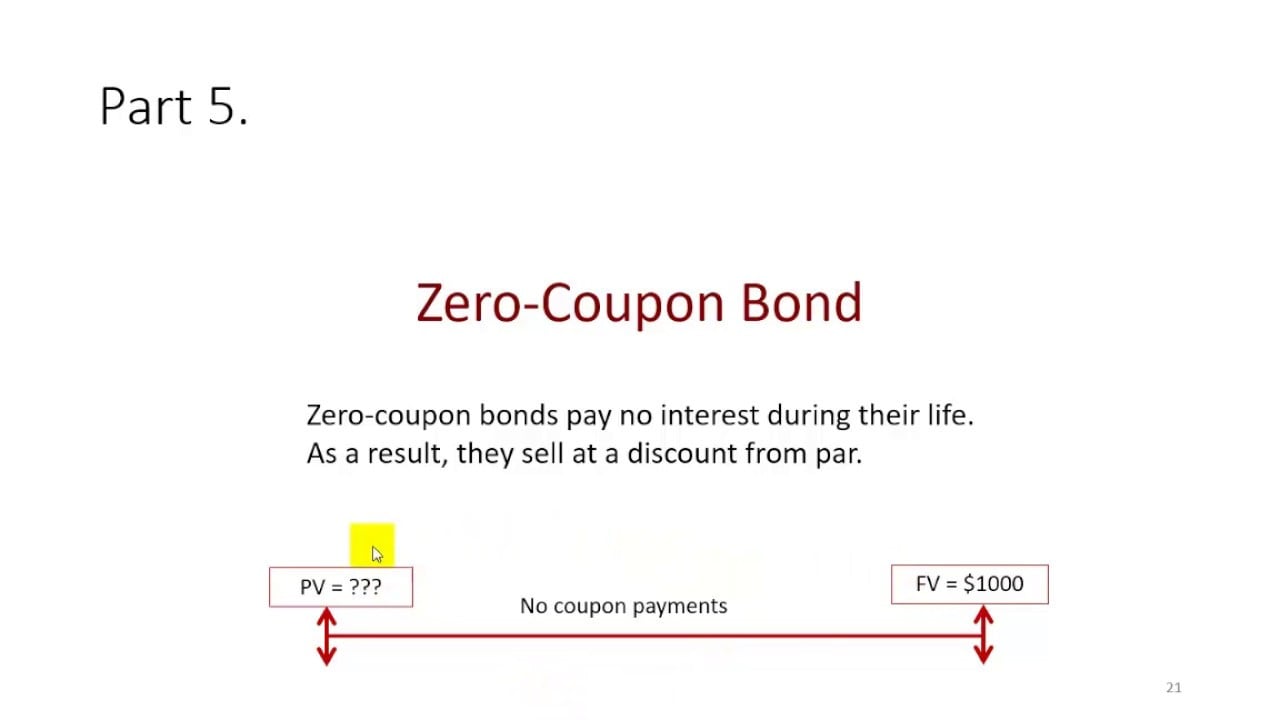

Foundations in Traditional Fixed Income: Zero-Coupon Bonds and Yield Tokenization

In traditional finance, instruments like zero-coupon bonds (ZCBs) have been instrumental. They provide predictable returns. ZCBs repay their face value at maturity. They do not have periodic interest payments. They gained popularity in the 1980s. The financial practice of “stripping” further enhanced this. It separated a bond’s principal from its interest payments. This created new zero-coupon bonds.

Zero Coupon Bond

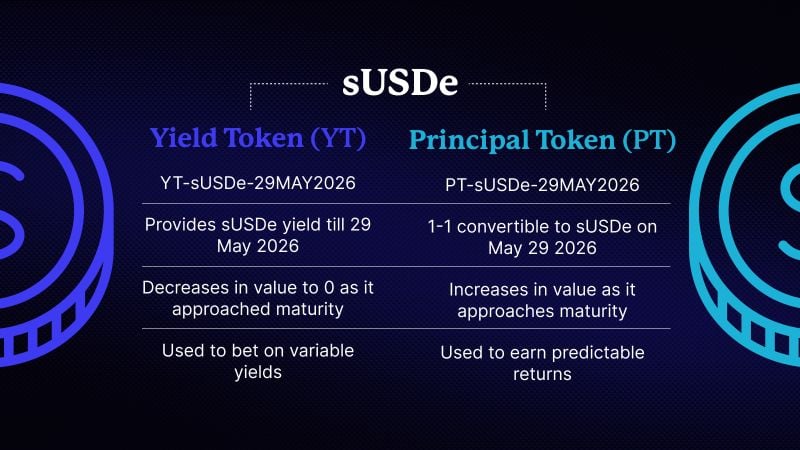

This concept has a direct parallel in Pendle’s yield tokenization. Here, yield-bearing assets decompose into Principal Tokens (PT) and Yield Tokens (YT). This foundational borrowing from traditional finance is significant. It suggests DeFi fixed income evolution will likely mirror TradFi fixed income markets. This implies increasing sophistication and market segmentation over decades. Ultimately, DeFi could offer a more complex array of structured products and derivatives. This will attract a wider range of investors accustomed to such instruments.

For more: Fixed Yield DeFi vs. Traditional Fixed Income in Yield Farming Rewards

sUSDe with YT and PT

Advanced Debt Structures and Hedging from TradFi

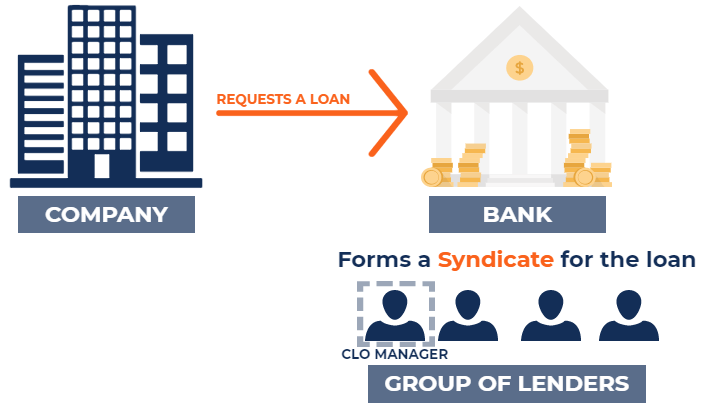

Beyond simple bonds, TradFi also developed complex debt securities. These include Collateralized Mortgage Obligations (CMOs). These instruments pool mortgages. They divide them into tranches. Each has distinct risk-return profiles. Junior tranches absorb losses first. Senior tranches are designed to be safer. They typically receive lower, but more stable, rates.

This tiered risk structure has been adopted by DeFi protocols. Examples include Waterfall DeFi and Centrifuge. They offer “junior” and “senior” tranches. This customizes investor risk-return profiles. Senior tranches often provide fixed returns. Furthermore, the concept of interest rate swaps is relevant. These are agreements between two parties. They exchange future interest payments. This provides a mechanism in TradFi to hedge against interest rate volatility. The DeFi ecosystem has actively sought to reinvent these products. This aims to offer certainty in returns within the blockchain environment.

Collateralized Mortgage Obligations (CMOs)

DeFi’s Maturation and Institutional Appeal

The drive towards fixed-rate products signifies a truly crucial step; indeed, it marks DeFi’s ongoing maturation. This transition moves DeFi away from purely speculative “yield farming,” ultimately guiding it towards more predictable and thus institutionally friendly financial instruments.

Furthermore, this shift is absolutely indispensable, as it serves to attract a broader, inherently more risk-averse investor base. Significantly, this includes traditional financial institutions, which fundamentally require certainty for their balance sheets and portfolio management. Consequently, this growing demand for stability emerges as a direct response to, and effectively addresses, the inherent interest rate volatility that was so prevalent in early DeFi markets.

Early Crypto Bonds and Recent Digital Bond Issuances

Early conceptualizations of crypto bonds significantly laid the groundwork for today’s digital assets. Foundational ideas, for instance, explored digital money and innovative methods of value storage, notably predating even Bitcoin. Pioneering projects like DigiCash (1989), which investigated anonymous digital payments, and E-Gold (1996), which focused on gold-backed digital value, exemplify these nascent efforts.

More recently, the landscape has seen substantial progress. The world’s first cryptocurrency-denominated, blockchain-settled bond, for example, was issued by LuxDeco in collaboration with Nivaura. This significant event showcased the tangible potential for faster settlement and automated smart contract payments.

Furthermore, in March 2025, the Inter-American Development Bank (IDB) notably issued its first digital bond in pound sterling—a 15-month, £5 million, fixed-rate bond managed by HSBC and NatWest on HSBC Orion, a blockchain-based platform. Adding to this momentum, the World Bank’s “bond-i” in 2018 had already provided compelling evidence of Distributed Ledger Technology’s (DLT’s) utility for public bonds.

Early Fixed-Yield Protocols in DeFi

Following the pivotal “DeFi Summer” of 2020 (spanning June to August), a distinct wave of protocols indeed emerged. These new entrants had an explicit goal: to introduce fixed-rate lending and borrowing into the burgeoning decentralized ecosystem.

Consequently, these early innovators diligently experimented with various mechanisms; ultimately, their primary aim was to provide much-needed yield certainty in a volatile market. In doing so, they collectively laid the crucial conceptual and technical groundwork for more advanced solutions that would follow, such as Pendle.

Key Early Fixed-Yield Protocols

Several protocols launched during this period:

- Notional Finance: Founded in 2019, it launched in early 2020. It pioneered fixed-rate, fixed-term borrowing and lending on Ethereum. It used its novel “fCash” instrument.

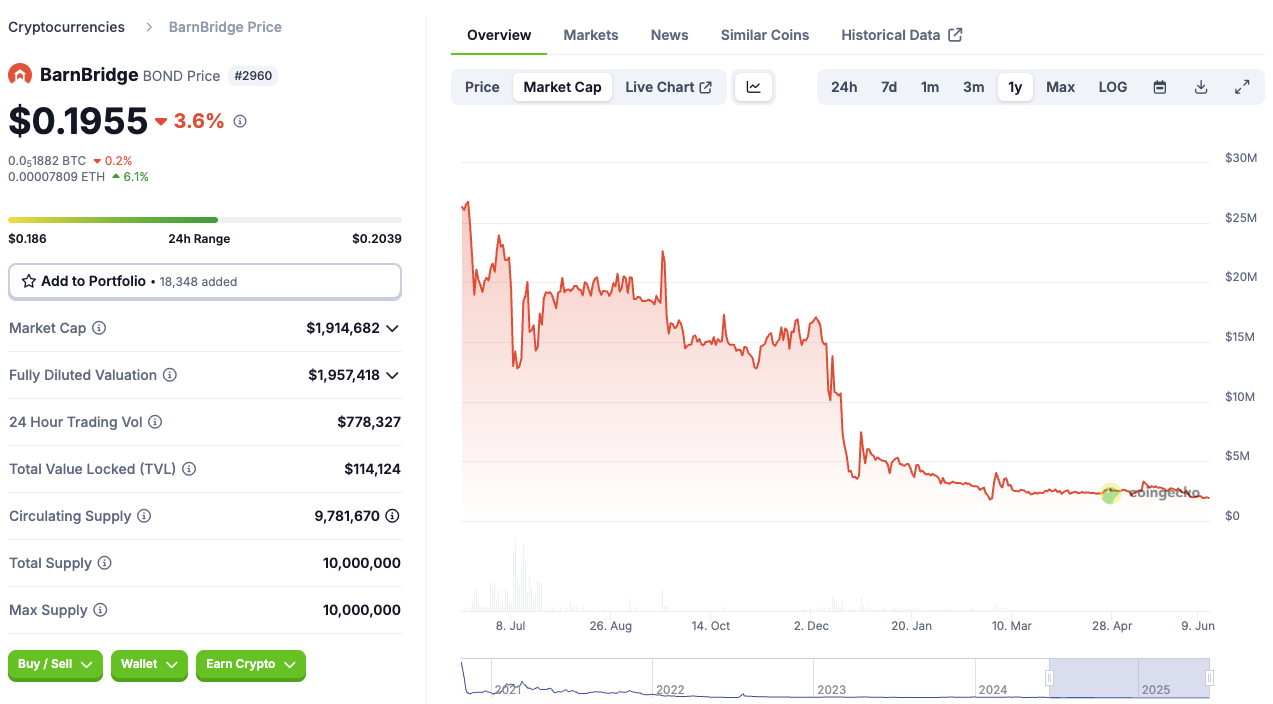

- BarnBridge: Founded in 2019, it launched in September/October 2020. Its SMART Yield product arrived in March 2021. It offered users either fixed or leveraged variable yields. The protocol aimed to tokenize risk into tranches. This provided different risk profiles for investors.

- 88mph: Its initial version (v0) launched in April 2020. The current iteration was released in late November 2020. It enabled users to lend crypto assets at fixed interest rates. Or, they could purchase floating-rate bonds.

- Saffron Finance: Price history data indicates activity from 2021. It focused on tokenizing on-chain collateral. It also offered customized risk/return profiles through its A, AA, and S tranches.

- Yield Protocol: Launched in 2021, it introduced fixed-rate, fixed-term borrowing and lending. It used “fyTokens” (fixed yield tokens). These tokens function similarly to zero-coupon bonds. They are redeemable at a fixed value at maturity.

- Element Finance: It raised seed funding in March 2021. An “imminent” official release was planned. It aimed to provide fixed-rate yields. It allowed users to purchase assets at a discount. This was without locking into fixed terms.

Challenges and Limitations of the “First Wave”

The early fixed-rate protocols broadly fit into two distinct categories. First, some leveraged DeFi’s composable nature, thereby bringing fixed rates to existing yield opportunities; notable examples include BarnBridge, 88mph, and Saffron Finance. In contrast, others aimed to establish their own lending markets with fixed rates, such as Notional and Yield Protocol.

However, despite these innovations, this “first wave” largely struggled to gain significant traction and liquidity. This lack of adoption often stemmed from the relatively low yields offered to depositors. Although composable fixed-rate protocols did experience moderate success, Barnbridge (BOND), for instance, achieved the highest TVL at $79 million and a market capitalization of $125 million. Nevertheless, the “first wave” of fixed-rate protocols as a whole ultimately failed to secure widespread traction in the DeFi market, and consequently, their various governance tokens broadly underperformed.

This outcome clearly demonstrated that merely offering fixed rates was insufficient. The underlying issues likely revolved around liquidity fragmentation, inefficient price discovery, or a general lack of compelling value propositions. Consequently, these protocols simply could not compete with the high, albeit variable, yields offered by more established DeFi protocols. This challenging landscape, therefore, effectively set the stage for Pendle’s subsequent and impactful emergence.

BarnBridge token. Source: Coingecko

The Fundamental Tension and Pendle’s Response

The early fixed-rate protocols in DeFi faced a core problem: they struggled to attract enough liquidity. This was primarily because the yields they offered depositors were simply too low. During those early, often speculative, phases of DeFi, users consistently prioritized maximizing their returns, even if those yields were highly variable. Consequently, fixed-rate offerings found themselves at a significant competitive disadvantage if their yields weren’t appealing enough.

This situation highlights a fundamental and ongoing challenge for any fixed-yield protocol: how can it provide stability without sacrificing competitiveness? Pendle’s unique approach directly tackles this very tension. Through its innovative “yield tokenization,” Pendle effectively creates a dynamic new market. Here, users gain the flexibility to either lock in predictable fixed returns using Principal Tokens (PTs), or, conversely, they can speculate on fluctuating yields with Yield Tokens (YTs). This dual approach caters to a much broader spectrum of risk appetites, thereby potentially overcoming the limitations that plagued its predecessors.

For more: The Rise of Yield-Bearing Stablecoins: Earning Passive Income

The post The Evolution of Fixed-Yield DeFi: A Historical Context appeared first on NFT Evening.