[#title_feedzy_rewrite]

The HOME token – native to the “DeFi App” ecosystem – has quickly captured trader attention after a high-profile launch yesterday.

DeFi App touts itself as crypto’s first true super app, blending the user-friendly feel of centralized exchanges with the self-custody and composability of decentralized finance. We will examine how HOME’s unique value proposition and recent listing hype could influence its price over the next month.

Project Overview: DeFi App and HOME Token

DeFi App is an all-in-one, chain-agnostic platform designed to make decentralized finance accessible to everyone. Notably, the platform has eliminated gas fees and manual bridging for users – any transaction’s gas cost is sponsored by the protocol, and cross-chain swaps happen in one click.

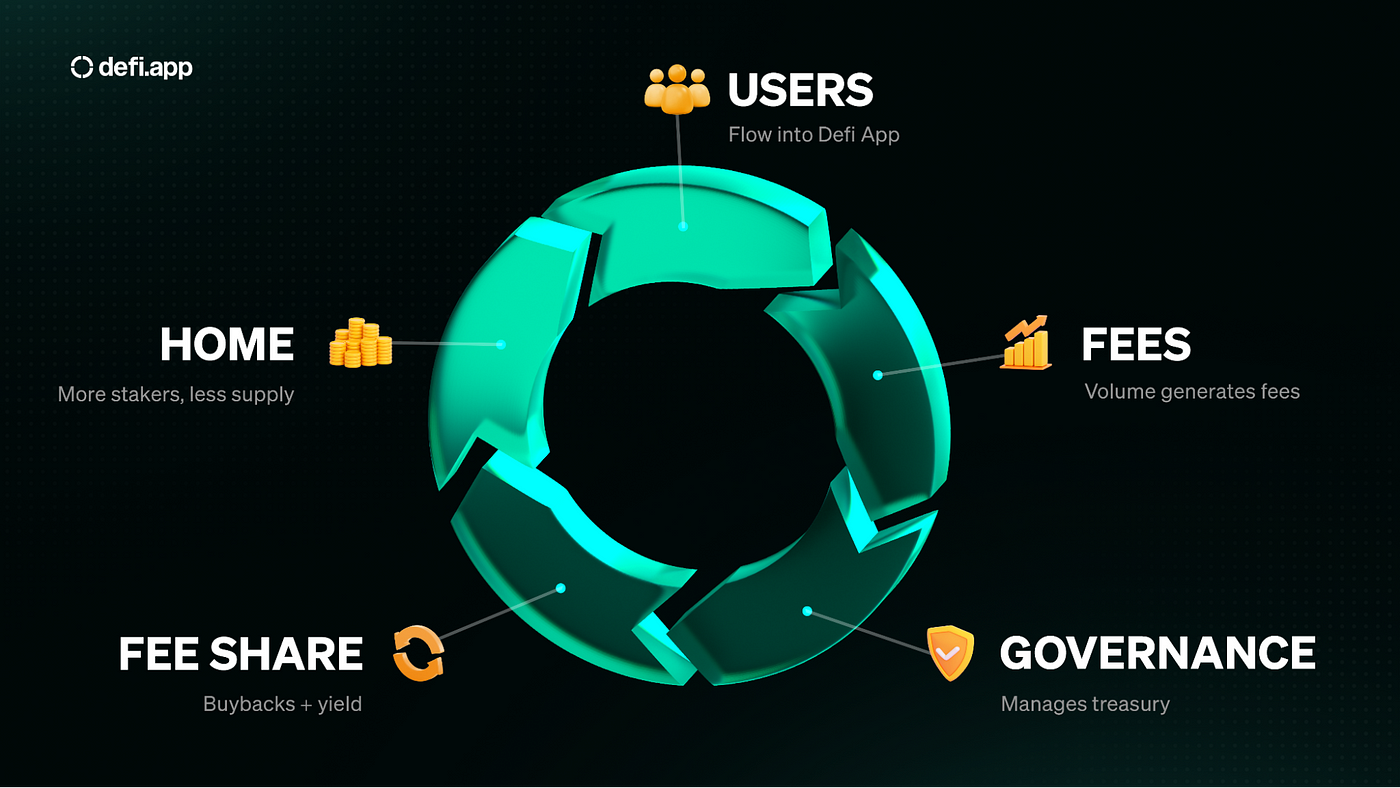

The HOME token powers this ecosystem as both a governance token and utility token. Unlike many governance tokens that languish without real use, HOME is actively woven into the platform’s operations. It lets holders propose and vote on important decisions – from platform features and fee models to treasury usage.

A key part of HOME’s appeal is that it governs a platform with proven traction, not just a speculative idea. As of its launch, DeFi App had already processed over $11 billion in cumulative trading volume and attracted 350,000+ users, including around 30,000 daily active users.

Such metrics indicate genuine product-market fit – a strong sign that the platform addresses real user needs in DeFi. This adoption gives HOME a solid fundamental base: holders are governing a live platform with revenue and growth, rather than a theoretical future network.

Fundamental Analysis of HOME

Tokenomics

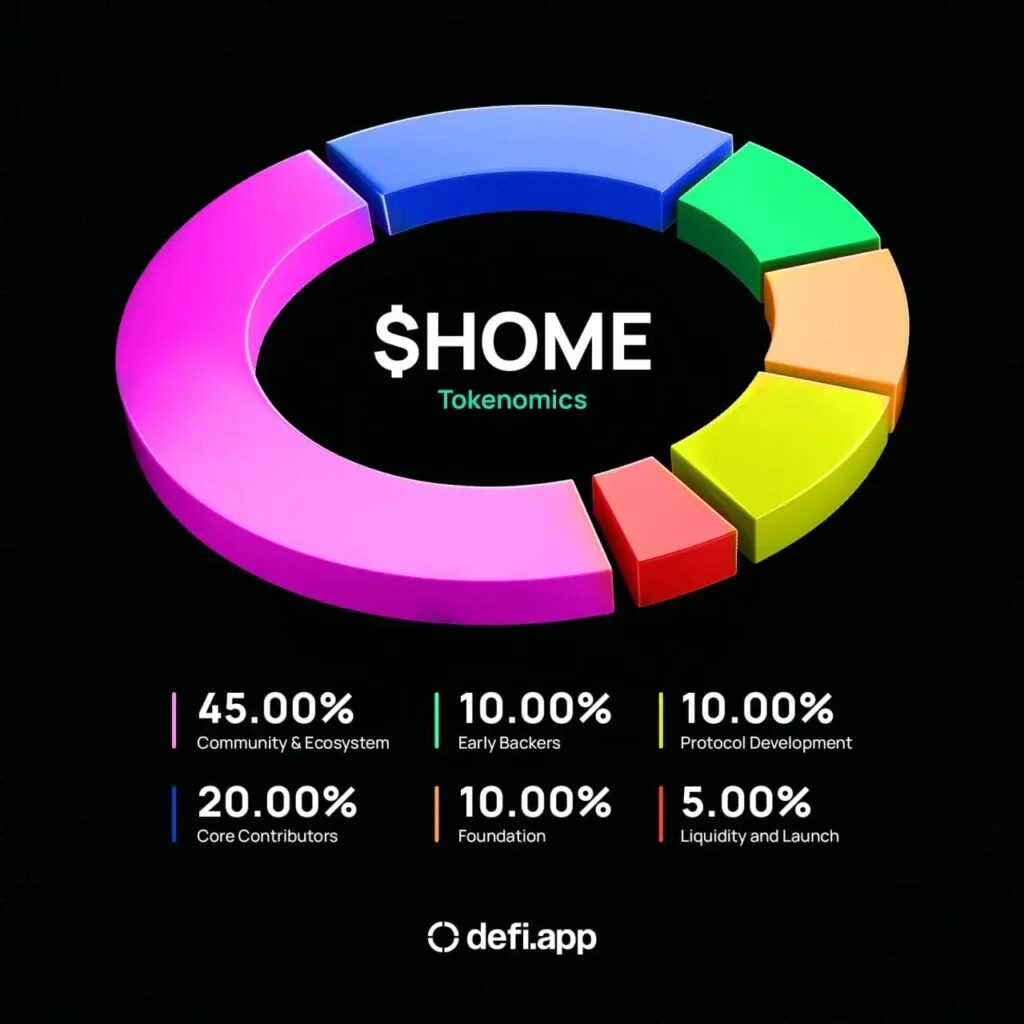

The total supply of HOME is 10 billion tokens. According to official tokenomics, 45% of the supply is earmarked for Community & Ecosystem purposes. Another 20% is allocated to Core Contributors (the team), and 10% to Early Backers (investors).

Crucially, most of these tokens are locked and vest over time to prevent sudden supply shocks. For example, team and early investor tokens have a 12-month lock-up post-TGE. Community tokens, while partly used in the initial airdrop, also mostly vest over 3 years after an initial unlock.

Read more: Trading with Free Crypto Signals in Evening Trader Channel

Source: DeFi App

At the TGE, an estimated ~2.7 billion HOME (around 27% of total supply) entered circulation – including the 5% launch allocation and an initial portion of community tokens. Such a moderate initial float, combined with vesting, helps mitigate extreme sell pressure in the first month.

Utility and Roadmap

Firstly, it acts as a medium for gas fees across all chains. If a user holds only HOME and initiates a transaction, the DeFi App treasury will automatically swap a bit of the user’s HOME and pay the gas on Ethereum, Solana, etc.

This gas abstraction feature not only makes the user experience seamless, but also creates constant buying demand for HOME.

Secondly, HOME is required for staking and governance participation. Users can stake HOME to gain voting rights over platform upgrades, fee parameters, and treasury usage (even decisions like whether to use revenue for token buybacks or yield distribution). Stakers form the community “steering committee” guiding the DeFi App’s evolution. Staking also unlocks platform benefits – for example, stakers get access to special reward boosts.

In fact, by locking HOME for set durations, users can earn up to a 3× multiplier on their experience points (XP) gained through using the app. This incentivizes power users to hold and lock HOME, since higher XP may translate to larger airdrops or fee rebates in future seasons.

Overall, HOME’s utility design – gas, governance, rewards, and partner staking – creates a flywheel where more usage of the app can translate into more demand for the token.

The team built the app on smart account abstraction (ERC-4337), meaning users interact via a smart contract wallet that the platform can programmatically manage to bundle transactions across chains.

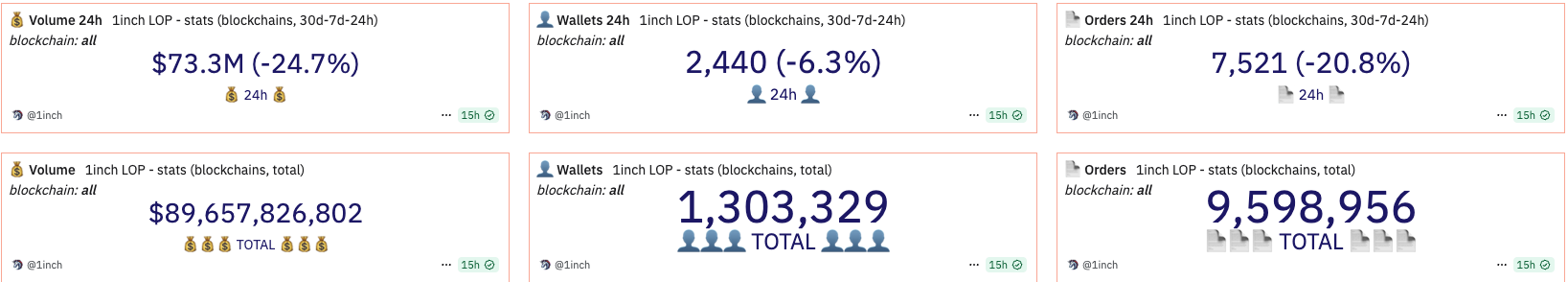

They also use intent-based execution, where a user simply specifies a desired outcome and the system finds the optimal cross-chain route automatically. Under the hood, DeFi App aggregates liquidity from top DEX aggregators like 1inch (for Ethereum) and Jupiter (for Solana) to ensure trades get the best rates across networks.

This sophisticated backend suggests a strong developer team with multi-chain expertise. Indeed, the core team includes seasoned crypto engineers and growth experts. The project’s public roadmap indicates upcoming launches that could further boost HOME’s utility and demand. In the short term, a mobile app release is planned, which should broaden access and usage.

No major exploits have been reported to date, but as with any DeFi platform, smart contract risk remains – a point the team acknowledges in risk disclosures.

Funding & Partnerships

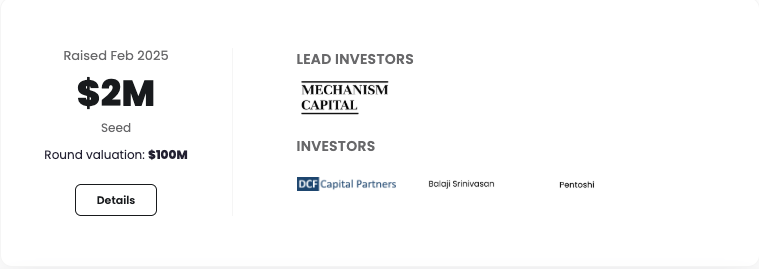

The venture backing behind DeFi App is another positive fundamental factor. The project completed several funding rounds in late 2024 and early 2025, raising at least $6 million in total at a ~$100 million valuation. Notably, these rounds included well-known crypto investors: Mechanism Capital and personalities like Balaji Srinivasan.

Having such backers not only provided capital but also is a vote of confidence in the product’s potential. We’ve also seen exchange support as a form of partnership: Binance’s early listing of HOME.

Furthermore, the platform’s integration with aggregators (1inch, Jupiter, Odos, etc.) and service providers (like a built-in Jarvis AI trading assistant, fiat on-ramps, social login services) suggests a broad network of partnerships in the DeFi space.

These partnerships and funding ties strengthen the fundamental outlook for HOME by expanding its reach and resources.

HOME’s fundamentals are strong for a newly launched token. It has a large and engaged user base, a well-designed token model with real utility, a capable team shipping innovative features, and significant backing. These factors form the baseline for evaluating its market performance.

Current Market Conditions

Zooming out, the macro crypto environment in mid-2025 provides an important context for HOME’s short-term prospects. May 2025, Bitcoin reached a new all-time high around $111,000 illustrating the strong bullish momentum in the market.

In fact, the DeFi sector outpaced Bitcoin in recent gains – in May, DeFi-related tokens gained roughly 19% as a basket, versus Bitcoin’s 11% rise. his indicates a renewed investor appetite for DeFi, likely driven by the search for yield and protocol revenues during the bull run. On-chain activity mirrors this enthusiasm. Total Value Locked (TVL) in DeFi protocols jumped ~21% in May 2025 compared to the prior month.

For a cross-chain platform like DeFi App, these trends are encouraging – rising TVL on Ethereum and Layer-2s could translate into more trading volume and users to aggregate. The broader crypto rally also extends to smart contract platforms.

A bullish macro backdrop tends to lift newer projects like HOME by increasing overall liquidity and risk appetite in the market.

Another element of June 2025’s environment is the improving regulatory outlook for DeFi and crypto. There have been hints of more constructive approaches, such as discussions about DeFi innovation “safe harbors” in certain jurisdictions.

Meanwhile, traditional finance players are increasingly embracing crypto, which contributes to positive sentiment. While regulatory headlines can swing markets, at present there’s a sense that DeFi is becoming too significant to ignore, and regulators may seek to integrate rather than ban – easing one overhang on DeFi tokens.

However, markets never go up in a straight line. Even within a bullish trend, short-term volatility remains. Highlighting geopolitical news injecting volatility into markets.

Comparison with Similar DeFi Projects

HOME and DeFi App occupy a competitive arena of platforms aiming to simplify DeFi. It’s important to compare how HOME stacks up against both direct rivals.

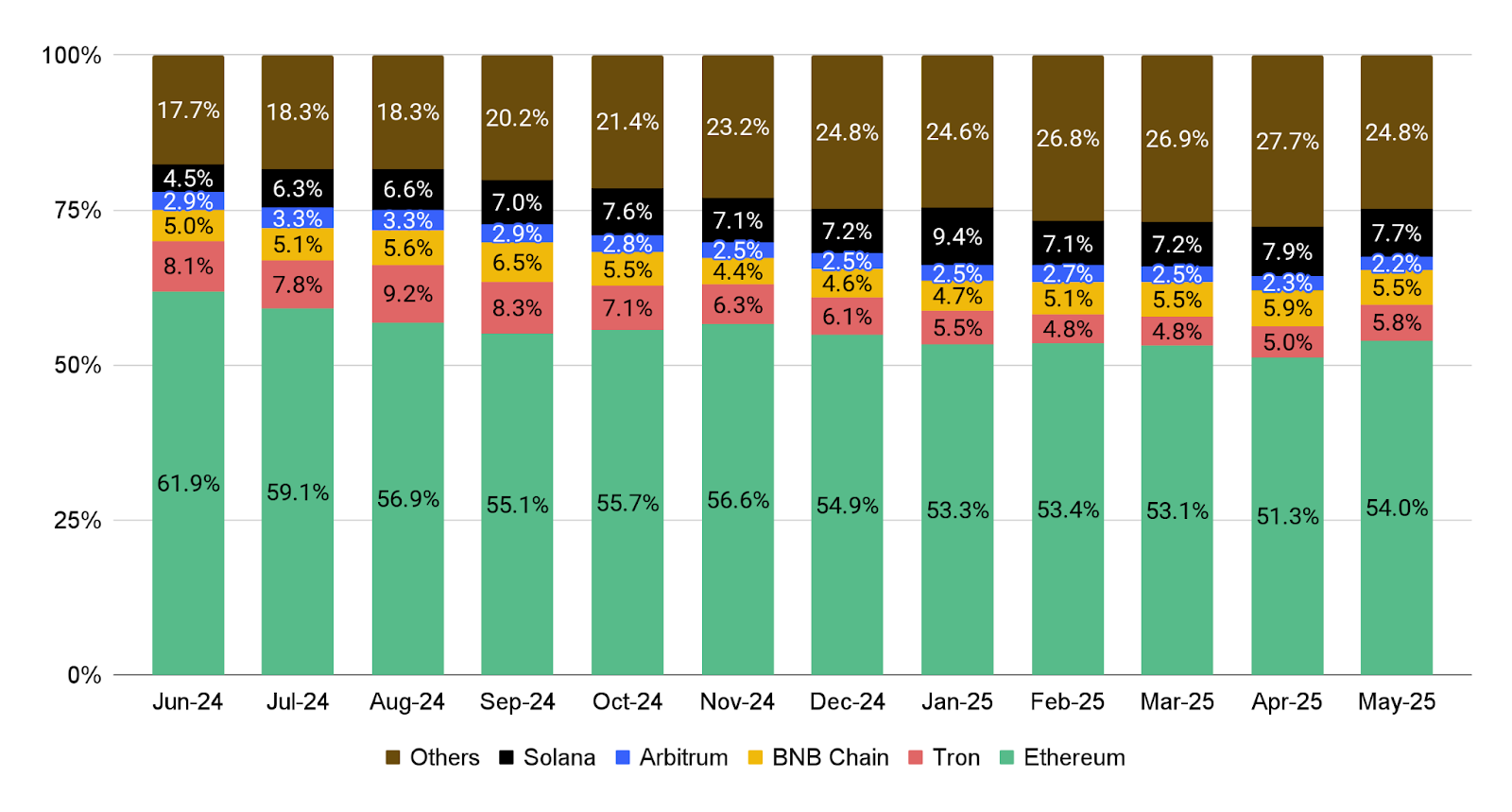

DeFi App vs 1Inch

Competing interfaces include popular DEX aggregators such as 1inch, which likewise find the best trade routes across decentralized exchanges. Those platforms have their own tokens that provide governance and sometimes gas cost benefits.

However, their focus is narrower – primarily on single-chain trade aggregation and they don’t eliminate gas or support non-EVM chains in one interface.

In contrast, DeFi App spans multiple ecosystems (even Solana) and abstracts gas entirely. Another set of competitors are emerging “super apps” within certain ecosystems – for example, some Solana-based mobile wallets or cross-chain bridges with integrated swap UIs.

These tend to offer one or two features, whereas DeFi App delivers a “complete package” of cross-chain swaps, yield, and even perps trading in one place.

A key metric underscoring this is DeFi App’s 350k user count and $11B volume, which many DeFi interfaces have not achieved. By achieving product-market fit early, HOME’s platform is ahead of most newer aggregator projects still trying to attract users.

One project mentioned is Kamino (focused on Solana liquidity management), which at last check had a market cap around $140M. DeFi App, with a similar community-centric ethos but a cross-chain reach, appears to have leapfrogged such single-ecosystem tools in both usage and valuation.

DeFi App vs Uniswap

Beyond aggregators, HOME also inevitably draws comparisons to giants like Uniswap. Uniswap is a decentralized exchange protocol rather than an aggregator, but it’s often the baseline for DeFi trading. Uniswap’s UNI token (market cap ~$5 billion) dwarfs HOME’s current ~$70–80 million cap, reflecting its blue-chip status.

While Uniswap is non-custodial and highly liquid, it only operates on certain chains and requires users to manage gas and bridging on their own. DeFi App’s strategy can be seen as complementary to Uniswap – in fact it taps into Uniswap’s liquidity via aggregation – but by providing a smoother experience.

In a way, HOME’s success doesn’t require displacing Uniswap; instead it could ride on Uniswap’s deep liquidity while offering a friendlier front-end governed by HOME holders.

For now, HOME is at an “early valuation phase” relative to these established projects – meaning there is room for growth if it can execute and capture even a fraction of their market share.

Note that given DeFi App’s already working product and user base, a repricing could occur to close the gap with incumbents if the platform continues to expand.

To summarize, HOME’s strengths relative to others include comprehensiveness, cross-chain capability, and a proven community. It isn’t just a DEX or just a bridge – it’s combining many DeFi actions under one roof. Its cross-chain nature (EVM + Solana) is fairly unique – many rivals do EVM-only or Solana-only. By abstracting away complexity, it dramatically lowers the barrier for new users, which is something even top DeFi dapps hadn’t solved.

Also, while being cross-chain is a selling point, it exposes the project to broader attack surface and dependencies. Another consideration is token dilution: HOME’s fully diluted valuation is roughly $250–300 million at current prices.and as more tokens vest and enter circulation over the next months and years, the market must absorb them.

This contrasts with some competitor tokens that have smaller inflation. Yet, with strong usage growth, demand could keep up with new supply – especially since early users opted to lock airdrops for 12 months to get bonus HOME, which shows confidence from the community.

Home Price Prediction: Short-term Outlook

formulate a short-term price prediction for HOME based on the above analysis. At the time of writing, HOME is trading around $0.025 per token with a circulating market cap near $68 million. Its 24-hour trading volumes have been extraordinarily high.

This combination of a relatively modest market cap, high trading activity, and strong fundamentals sets the stage for potentially large moves in the near term.

There are several reasons to be optimistic about HOME’s price over the next month. First, the general market trend is bullish – capital flowing into crypto and specifically into DeFi protocols could lift HOME alongside its peers. With DeFi tokens outperforming recently, investor sentiment favors projects like HOME that represent the “next generation” of DeFi apps.

HOME hit roughly $0.038 – $0.04 at peak before some profit-taking occurred. A reasonable bullish target for one month out would be a break above those highs if momentum continues.

At $0.06, HOME’s circulating market cap would be about $160 million – still below many DeFi tokens like 1INCH, and only about 3% of Uniswap’s market cap. In a scenario where DeFi App announces a major user growth milestone or a new partnership, speculative enthusiasm could even push HOME higher.

This bullish scenario assumes Bitcoin and Ethereum remain in at least a sideways or upward trend in the coming month, and no adverse events hit the DeFi sector.

During this month, keep an eye on HOME’s daily trading volume and liquidity on exchanges. Sustained high volume would indicate continued trader interest and make a large price rise more feasible, as liquidity begets participation.

Read more: Resolv Price Prediction: Post-TGE

The post DeFi App Price Prediction: HOME Price Forecast appeared first on NFT Evening.