[#title_feedzy_rewrite]

This report examines Ripple Labs, the XRP Ledger (XRPL), and XRP token, detailing their historical development, technical underpinnings, economic model, and primary use cases. It further analyzes the complex regulatory landscape, particularly the long-running SEC lawsuit, and explores Ripple’s ambitious future roadmap aimed at cementing its role as a foundational layer for institutional decentralized finance (DeFi).

The analysis reveals Ripple’s deliberate approach to regulatory compliance and its strategic positioning to integrate seamlessly with existing financial systems, distinguishing its path from many purely decentralized blockchain projects.

What is XRP & Ripple: Company, XRP Ledger, and RLUSD Stablecoin

The XRP & Ripple Ecosystem Defined

The Ripple ecosystem is built upon three core components: Ripple Labs, the XRP Ledger (XRPL), and the digital asset XRP.

- Ripple Labs, established in 2012 and headquartered in San Francisco, is a technology company focused on developing enterprise blockchain solutions.

- The XRP Ledger, an open-source platform initiated in 2011, is designed to facilitate rapid and low-cost transactions.

- XRP, the native cryptocurrency of the XRPL, serves as a crucial bridge currency for instant exchanges between different fiat currencies and is used to cover network transaction fees.

Ripple’s journey has been marked by significant growth, supported by substantial funding rounds from prominent investors such as Google Ventures and Andreessen Horowitz.

The company has forged key partnerships with global financial institutions like Santander and SBI, integrating its payment technology into existing systems. Strategic acquisitions, such as that of Metaco, and active political engagement further underscore Ripple’s ambition to become a regulated and influential player within the global financial infrastructure.

Source: Ripple

XRP Ledger’s Technology and Compliance Focus

The XRP Ledger operates on the Ripple Protocol Consensus Algorithm (RPCA), a unique consensus mechanism that enables impressive transaction finality of 3-5 seconds and a throughput of 1,500 transactions per second (TPS). This system, which relies on a Unique Node List (UNL) of independent validators, offers superior speed and energy efficiency compared to Proof-of-Work or Proof-of-Stake systems, while maintaining robust fault tolerance.

While this “trust-based validation” model has led to discussions about centralization, Ripple intentionally prioritizes regulatory compliance, aiming to provide a “permissioned decentralized finance” solution that resonates with traditional financial institutions seeking predictability and adherence to regulations.

The Introduction of RLUSD Stablecoin

In a significant strategic move, Ripple launched its own institutional-grade stablecoin, RLUSD, on December 17, 2024. RLUSD is a US dollar-pegged stablecoin, fully backed 1:1 by cash and equivalent reserves. Its approval by the New York Department of Financial Services (NYDFS) highlights Ripple’s commitment to regulatory adherence.

RLUSD is available on both the XRP Ledger and Ethereum networks, demonstrating Ripple’s focus on compliance and interoperability. This stablecoin is poised to enhance the utility of the XRP Ledger by providing a stable medium for transactions and expanding possibilities for institutional DeFi and the tokenization of real-world assets.

For more: Fixed Yield DeFi vs. Traditional Fixed Income in Yield Farming Rewards

Ripple Press Release

Ripple Fundraising Rounds

Ripple has secured substantial funding through several rounds, underscoring investor confidence in its vision and technology.

A summary of its funding rounds is provided below:

| Date | Funding Type | Investor | Amount (million $) |

| April 2013 | Angel | Andreessen Horowitz, FF Angel LLC, Lightspeed Venture Partners, Pantera Capital, Vast Ventures, Bitcoin Opportunity Fund | 2.5 |

| May 2013 | Angel | Google Ventures, IDG Capital Partners | 3.0 |

| November 2013 | Seed | Core Innovation Capital, Venture51, Camp One Ventures, IDG Capital Partners | 3.5 |

| May 2015 | Series A | IDG Capital Partners, China Growth Capital, Seagate Technology, Vast Ventures, AME Cloud Ventures, Bitcoin Opportunity Corp, ChinaRock Capital Management, Core Innovation Capital, Wicklow Capital, Route 66 Ventures, RRE Ventures, Venture 51 | 28 |

| October 2015 | Series A | Santander InnoVentures | 4 |

| September 2016 | Series B | Standard Chartered, Accenture, SCB Digital Ventures, SBI Holdings, Santander InnoVentures, CME Group, Seagate Technology | 55 |

| December 2019 | Series C | Tetragon, SBI Holdings, Route 66 Ventures | 200 |

XRP Tokenomics

XRP Tokenomics and Supply Management

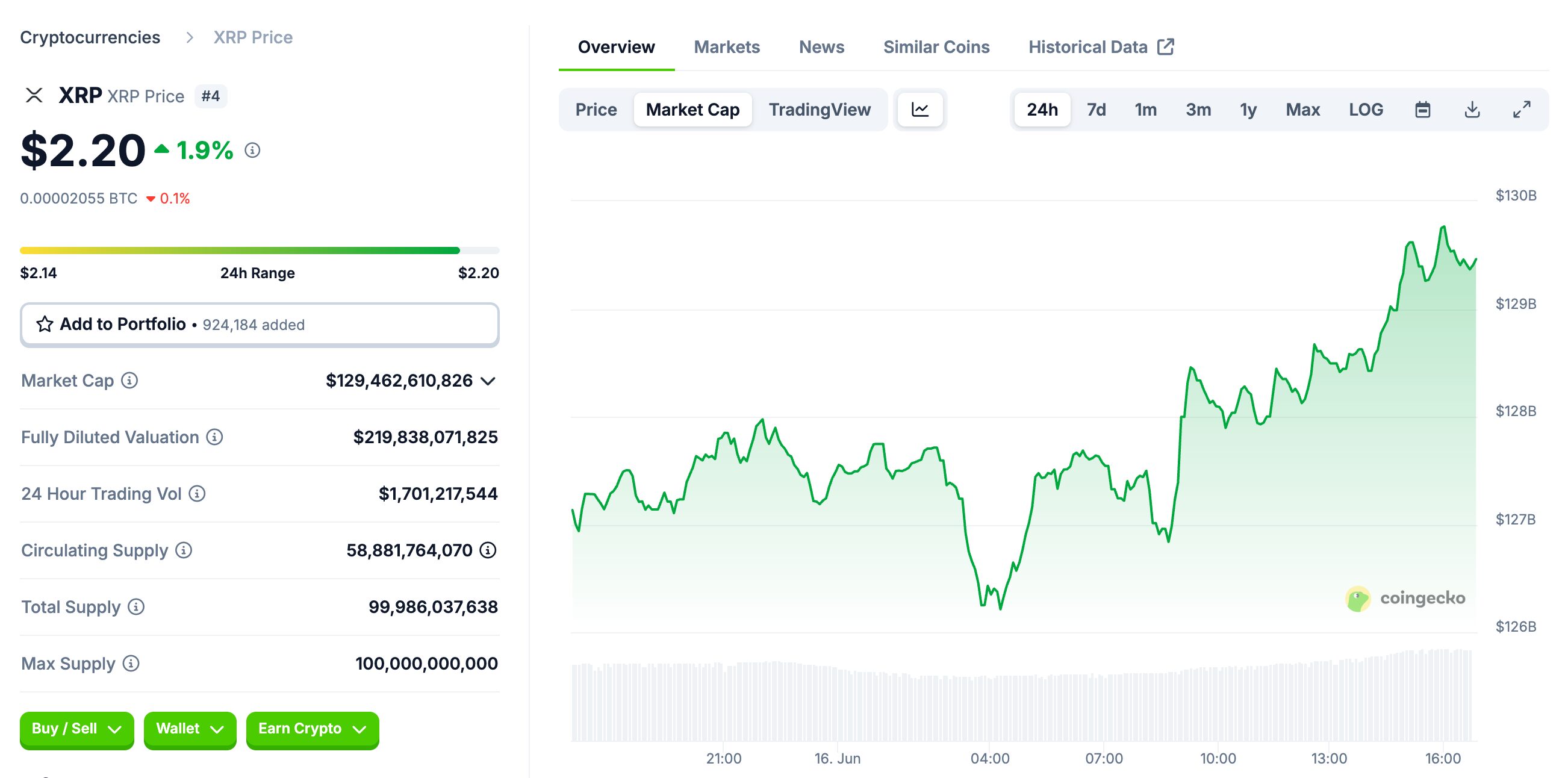

XRP’s economic model is characterized by its pre-mined nature, with all 100 billion tokens created at inception to prevent inflation. Ripple Labs initially received 80 billion XRP from the founders. As of June 15, 2025, the circulating supply stands at approximately 58.88 billion tokens.

A substantial 55 billion XRP is held in secure escrow contracts, programmed to release up to 1 billion XRP monthly over 55 months. Crucially, any unused XRP from the monthly release is returned to escrow, ensuring a tightly controlled supply aligned with demand.

This mechanism addresses centralization criticisms by providing transparency and predictability to market participants, acting as responsible stewardship rather than monopolistic control. As of Q3 2024, Ripple directly held 4.4 billion XRP, with 38.9 billion remaining in escrow.

Source: Coingecko

Transaction Fees and Network Incentives

Transaction fees on the XRP Ledger are remarkably low, starting at 0.000001 XRP. A unique deflationary aspect is that a portion of each transaction fee is permanently “burned,” reducing the total supply over time. Additionally, the required account reserve on the XRPL was recently reduced from 10 XRP to 1 XRP in December 2024, significantly lowering onboarding costs and potentially increasing network activity.

These economic incentives—minimal fees and burning—are strategically aligned with Ripple’s enterprise focus, encouraging efficient, large-scale network usage and supporting its objective of high-volume, low-cost cross-border payments.

Market Dynamics and Utility

As of June 15, 2025, XRP’s market capitalization reached approximately $127.82 billion, positioning it as a top-tier cryptocurrency with a trading price around $2.17. Its primary utility lies in facilitating cross-border payments and currency exchange within the Ripple network, serving as an intermediary bridge. The market dynamics are heavily influenced by the controlled supply release, regulatory developments, and Ripple’s strategic business partnerships.

The protracted SEC lawsuit, for instance, has demonstrated how regulatory uncertainty can introduce volatility, while positive legal outcomes can restore market confidence. Ripple’s “institutional-first” market positioning aims to cultivate demand driven by real-world utility and enterprise adoption, fostering more stable and sustainable growth linked to transactional volume rather than purely speculative trading.

Primary Use Cases and Solutions

Cross-Border Payments and On-Demand Liquidity (ODL)

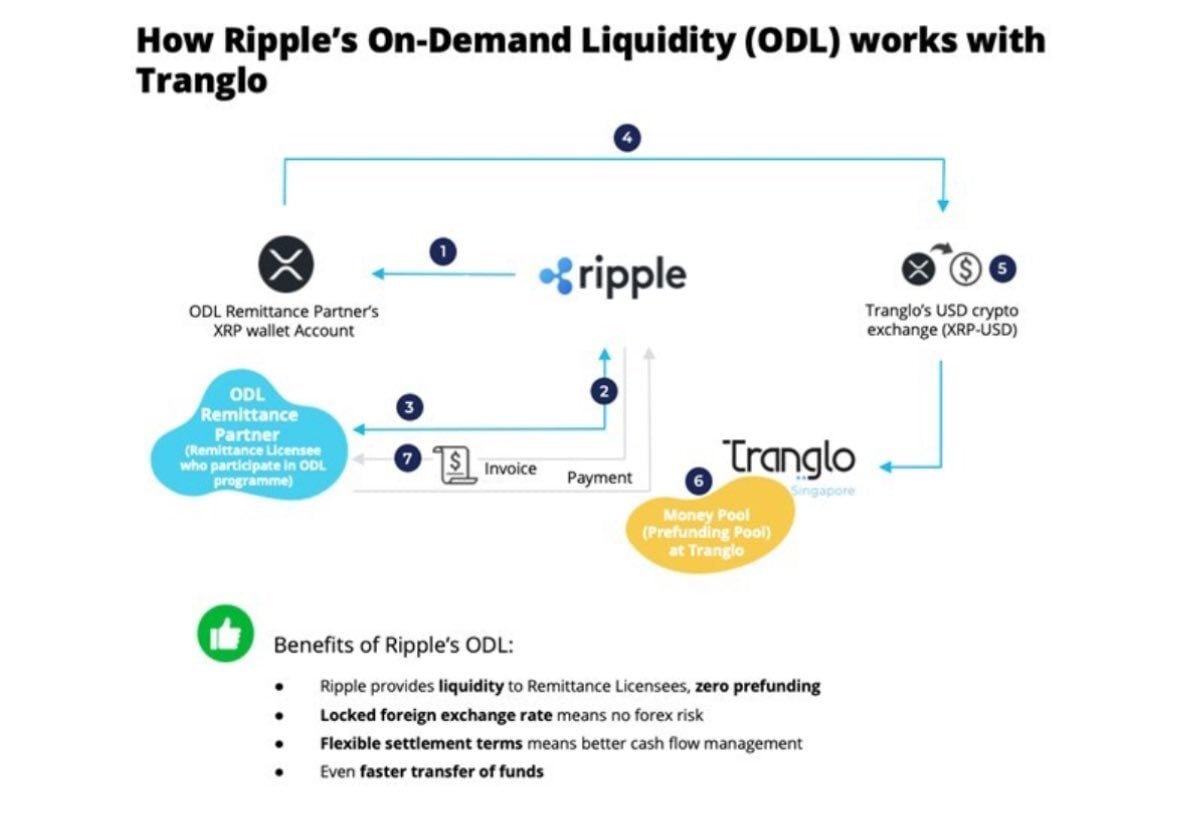

Ripple’s core mission centers on revolutionizing global payments and liquidity using the XRP Ledger and XRP. Traditional cross-border transactions are burdened by high fees, delays, and outdated infrastructure. Ripple’s solutions aim for immediate, low-cost, and secure global settlements, bypassing intermediaries and completing transfers in seconds.

XRP acts as a vital bridge currency, facilitating instant fiat exchanges and significantly reducing the need for banks to pre-fund foreign accounts, potentially cutting costs by up to 80%. CEO Brad Garlinghouse projects XRP could handle 14% of SWIFT’s cross-border volume within five years, a transformative vision for global finance.

Source: Ripple

Ripple’s flagship On-Demand Liquidity (ODL), now known as Ripple Payments, eliminates the need for financial institutions to pre-fund nostro accounts, freeing up substantial capital. ODL leverages XRP as a real-time bridge asset for swift, low-fee fund transfers.

Ripple Payments operates in over 55 countries, with notable partners including Santander, Bank of America, and Standard Chartered. Tranglo, a key partner, saw its ODL usage skyrocket from $53 million in 2021 to $2 billion in the first half of 2023. By 2024, Ripple Payments achieved near-global reach, processing over $50 billion in transaction volume, prioritizing capital-efficient liquidity over mere messaging.

Expanding Enterprise Solutions

Beyond its foundational payment solutions, Ripple is actively expanding its enterprise offerings. Its digital asset custody solutions, bolstered by the 2023 acquisition of Metaco, provide bank-grade security and flexible deployment for institutions.

The XRP Ledger is also emerging as a robust hub for fiat-backed stablecoins like USDC, XSGD, EURØP, and Ripple’s own RLUSD, leveraging its “compliance-first architecture.” XRP supports these stablecoin use cases by enabling efficient liquidity and powering fast settlement on the XRPL’s built-in decentralized exchange (DEX).

Furthermore, Ripple is actively exploring the tokenization of real-world assets (RWAs) and broader digital asset management, with its 2025 roadmap including Multi-Purpose Tokens (MPTs) for bonds, RWAs, and structured financial products. Partnerships with firms like Archax and Meld Gold are enabling tokenized assets such as gold and Treasury bills on the XRPL, accelerating institutional DeFi and aiming to position the XRP Ledger as a comprehensive platform for digital finance.

Regulatory Landscape and Criticisms

SEC Lawsuit and Regulatory Implications

Ripple’s journey has been significantly shaped by the SEC lawsuit, filed in December 2020, which alleged unregistered securities offerings through institutional XRP sales. A pivotal July 2023 ruling by Judge Analisa Torres provided significant clarity, distinguishing programmatic XRP sales to retail buyers as non-securities, while institutional sales were deemed securities. This partial victory offered a crucial legal framework for digital asset classification.

On June 12, 2025, Ripple and the SEC jointly moved to settle the lawsuit, proposing a split civil penalty ($50M to SEC, $75M returned to Ripple) and dissolution of the injunction. This outcome is expected to establish a de facto regulatory precedent, enhancing clarity for financial institutions considering crypto integration.

Source: XRP Governor

Centralization Concerns

Despite its claims of decentralization, Ripple faces persistent criticisms regarding the perceived centralization of the XRP Ledger. These concerns primarily stem from Ripple Labs’ substantial XRP holdings and the curated nature of the XRPL’s Unique Node List (UNL).

Critics argue that Ripple’s significant influence over XRP’s supply and the UNL constitutes centralization, with some even labeling XRP a “centralized controlled security.” However, Ripple maintains its network is neutral and decentralized, viewing this “permissioned decentralization” as an advantage for attracting regulated financial institutions that prioritize predictability and accountability.

Environmental Impact

The XRP Ledger boasts significant environmental advantages. This is especially true compared to many Proof-of-Work blockchain networks. The XRPL consumes substantially less electricity than Bitcoin, with its energy footprint comparable to that of an email server. This efficiency stems from its unique consensus mechanism, which does not involve energy-intensive mining.

Furthermore, Ripple actively advocates for greener energy practices within the broader cryptocurrency space. Its chairman, Chris Larsen, personally funds initiatives. For example, “Change the Code, Not the Climate” is one such initiative. This proactive stance aligns Ripple with growing Environmental, Social, and Governance (ESG) concerns, appealing to institutions prioritizing sustainability.

Adoption, Future Roadmap, and Competitive Landscape

Ripple is deeply embedded in institutional adoption. Its RippleNet connects banks and payment providers globally, facilitating real-time, low-cost cross-border payments. Prominent partners include Santander, Bank of America, Standard Chartered, and CIBC. Consequently, this signals increasing institutional interest in XRP’s utility. Furthermore, beyond banks, enterprises like Trident Digital Tech Holdings and Weebus plan significant XRP reserves. Thus, this positions XRP as a top choice for corporate treasuries.

Ripple Partner

Ripple’s 2025 roadmap focuses on building an institutional decentralized finance ecosystem on the XRP Ledger. Key initiatives involve integrating compliance checks via decentralized identifiers. Institutional lending with undercollateralized options will be offered by Q3 2025. Furthermore, an Ethereum Virtual Machine (EVM) Sidechain arrives by Q2 2025. This enhances programmability significantly.

Moreover, tokenization of Real-World Assets (RWAs) using Multi-Purpose Tokens (MPTs) is planned. Integrated liquidity pools are also a feature. A “clawback” option for asset recovery is likewise included. These efforts aim to position XRPL as a regulatory-friendly platform, driving institutional adoption and long-term XRP demand.

However, the competitive landscape is diverse. It includes incumbent innovations like SWIFT GPI and real-time payment rails. Moreover, emerging Central Bank Digital Currencies (CBDCs) like mBridge also pose competition. Rival cryptocurrencies such as Stellar (XLM), Solana (SOL), and Tether (USDT) also compete in fast, low-cost international transactions. Crucially, Ripple’s differentiator is its “compliance-first architecture.” Also, it strategically focuses on integrating with existing financial infrastructure. This makes it an attractive, regulated solution for traditional financial institutions.

For more: Pendle Deep Dive: Tokenized Yield and Fixed Yield in DeFi

The post XRP Deep Dive: A Comprehensive Analysis of Ripple Effect appeared first on NFT Evening.