[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/opera_bE1MSwPdMR-1024x500-oLCPob.png)

Solana Spot ETF applications are intensifying right now as CoinShares has officially filed with the SEC approval process…

Solana Spot ETF applications are intensifying right now as CoinShares has officially filed with the SEC approval process for cryptocurrency investments. The company submitted a Form S-1 registration statement, and also joined seven other firms seeking to launch Solana news-worthy investment products in the rapidly evolving cryptocurrency market.

Also Read: XRP ETF Approved for Toronto Stock Exchange Launch

CoinShares Pushes for Solana ETF as SEC Scrutiny Heats Up

CoinShares has become the eighth firm to file for a Solana Spot ETF, and this marks a significant milestone in institutional cryptocurrency adoption. The filing includes Coinbase Custody and BitGo Trust as custodians, providing institutional-grade security for potential investors at the time of writing.

Eric Balchunas said:

“CoinShares has just become the eighth firm to file for a spot Solana ETF, further intensifying the race. Tons of engagement with the SEC, issuers are quickly updating/redrafting S-1s. Momentum is notably higher compared to pre-ETH ETF days.”

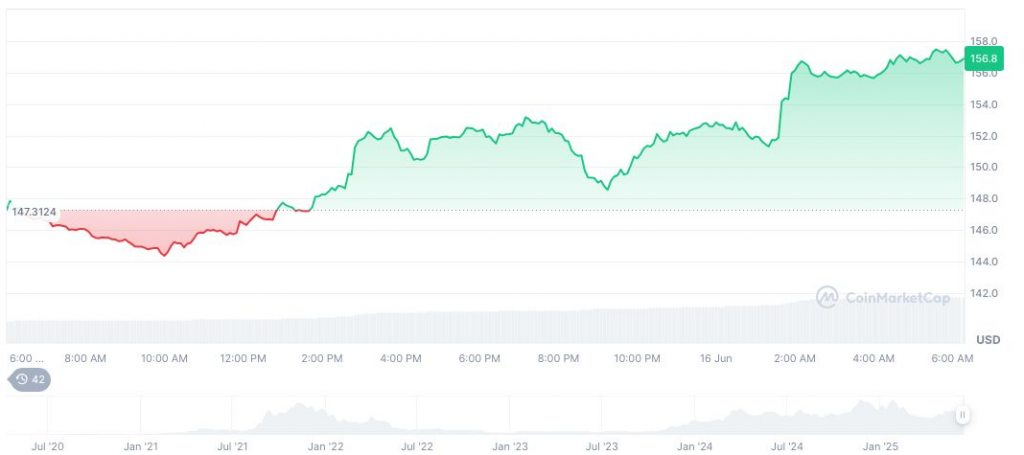

Market Response to Solana Spot ETF Filing

The Solana Spot ETF application has generated positive market sentiment, and also Solana is trading at $157.18 while maintaining a market cap of $82.95 billion. Industry analysts estimate a 70-90% chance of SEC approval due to growing regulatory openness toward cryptocurrency products right now.

Institutional Interest and Market Impact

CoinShares’ Solana Spot ETF would provide direct price exposure to SOL, including staking rewards, and this makes it attractive for institutional investors. The filing demonstrates heightened institutional enthusiasm compared to previous Bitcoin and Ethereum ETF proceedings, and also shows how the market is evolving.

The Total Value Locked in Solana’s network has reached 8.7 billion, and this underscores strong fundamentals that support the cryptocurrency investment case. This growth in network activity signals positive sentiment among developers and users alike at the time of writing.

Also Read: JPMorgan Files Trademark “JPMD” for Crypto Trading Services

The Solana news continues to drive institutional interest, and CoinShares is positioning itself strategically in the competitive SEC approval landscape right now. As the regulatory environment evolves, these Solana Spot ETF applications represent a crucial step toward mainstream cryptocurrency adoption through traditional investment vehicles.