[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/opera_DoLCpUOSTQ-1024x500-a5pSpb.png)

The GENIUS Act stablecoin legislation passed the Senate with overwhelming bipartisan support in a 68-30 vote, and it…

The GENIUS Act stablecoin legislation passed the Senate with overwhelming bipartisan support in a 68-30 vote, and it establishes the first federal crypto regulation framework for digital dollar tokens. This milestone coincided with JPMorgan’s strategic SEC meetings about onchain markets migration, which marks a pivotal moment for federal crypto regulation and also blockchain adoption right now.

Also Read: JPMorgan Chase: AI Predicts Price After the JPMD Stablecoin Launch

How JPMorgan and the SEC Shape Stablecoin Security

GENIUS Act Stablecoin Framework Passes Senate

The GENIUS Act stablecoin bill received decisive approval as eighteen Democrats joined Republicans in supporting federal crypto regulation. The legislation creates the first comprehensive framework for stablecoin issuers, and it allows private companies to create digital dollars backed by traditional assets right now.

Senator Elizabeth Warren said:

“It would make Trump the regulator of his own financial company and, importantly, the regulator of his competitors.”

Warren voted against the final GENIUS Act stablecoin version, citing inadequate regulatory safeguards despite bipartisan momentum for federal crypto regulation at the time of writing.

JPMorgan Drives Onchain Markets Discussion

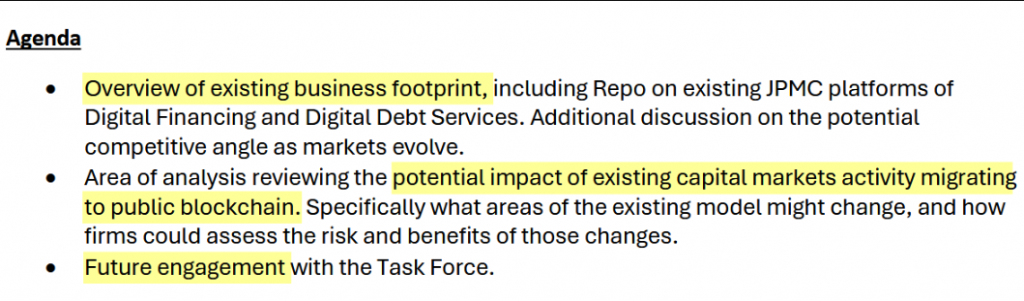

JPMorgan executives Scott Lucas, Justin Cohen, and also Aaron Iovine met with the SEC’s Crypto Task Force to discuss capital markets migrating to blockchain infrastructure. The discussions focused on assessing risks and benefits as financial institutions pursue onchain markets for faster transactions and also tokenized revenue streams.

The bank’s existing digital platform handles repurchase agreements under “Digital Financing” services, and it demonstrates JPMorgan’s established presence in cryptocurrency markets. These onchain markets discussions align with the GENIUS Act stablecoin framework’s broader federal crypto regulation objectives right now.

Political Momentum for Federal Crypto Regulation

Seth Hertline is actually convinced about the fact that:

“If the GENIUS Act derails, everything behind it derails.”

The crypto industry invested over $131 million in political campaigns, driving support for the GENIUS Act stablecoin legislation and also broader federal crypto regulation initiatives. The bill now advances to the House, which is working on companion STABLE Act legislation for comprehensive onchain markets oversight at the time of writing.

Also Read: Amazon & Walmart Explore Launching Their Own Stablecoins