[#title_feedzy_rewrite]

![[#title_feedzy_rewrite]](https://postcryptocoins.com/wp-content/uploads/2025/06/Screenshot-2025-05-16-at-12.16.42E280AFPM-1024x577-X3ebJ8.jpg)

VanEck’s proposed spot Solana (SOL) ETF has been registered with the Depository Trust & Clearing Corporation (DTCC). The…

VanEck’s proposed spot Solana (SOL) ETF has been registered with the Depository Trust & Clearing Corporation (DTCC). The financial institution will use the label VANECK SOLANA TR COM SHS BEN INT, with the ticker VSOL. There are several spot SOL ETF applications currently awaiting approval from the SEC. The applicants include VanEck, Fidelity Investments, Franklin Templeton, 21Shares, Canary Capital, and Bitwise.

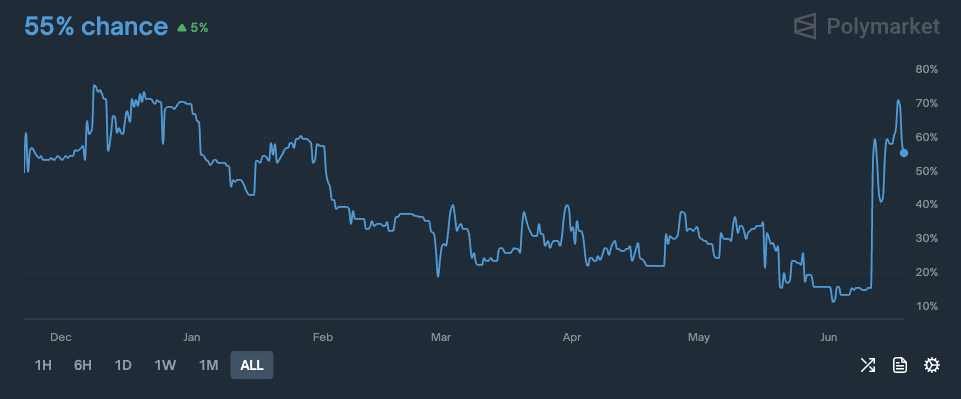

Solana ETF Approval Odds

According to Polymarket’s estimates, there is a 55% chance of a spot SOL ETF approval by July 31. The odds of approval went up to more than 71% on June 17. The figures have since fallen dramatically.

Bloomberg ETF analyst James Seyffart is quite bullish on a Solana (SOL) ETF. Seyffart’s estimates put a 90% chance of an SOL ETF being approved by the SEC. Seyffart highlights that the 19b-4 filings of the applicants have been acknowledged. The analyst also says that the SEC most likely views SOL as a commodity.

Also Read: Solana Spot ETF: CoinShares Seeks SEC Nod for Launch

Fellow Bloomberg analyst Eric Balchunas also recently shed light on the surge of ETF launches in 2025. According to a graph shared by Balchunas, there have been more than 800 ETF launches this year. The figures give hope to Solana (SOL) fans and investors.

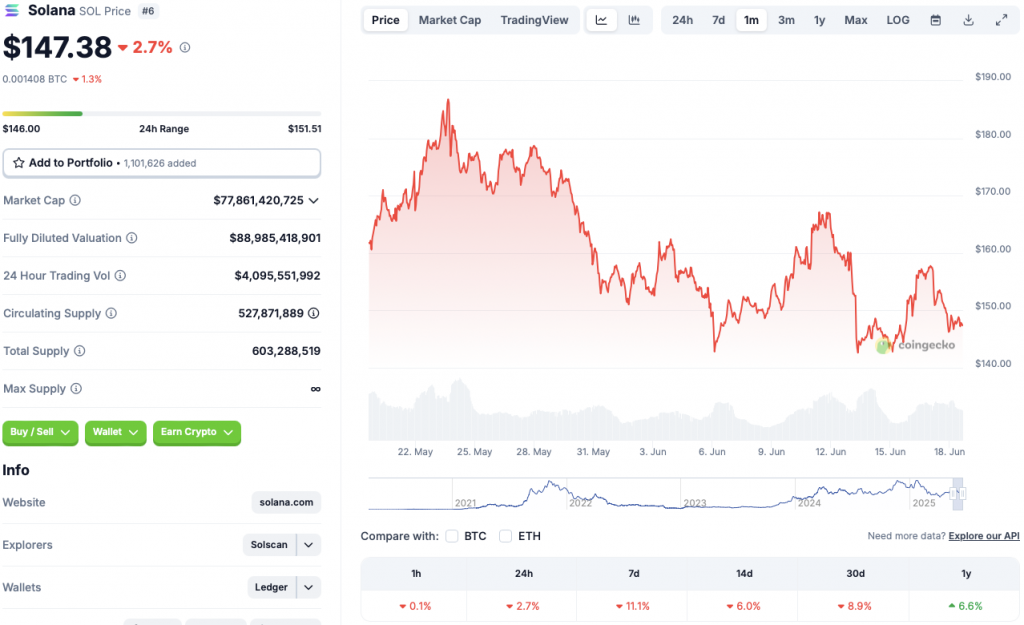

Underlying Asset Continues To Bleed

While the possibility of an ETF launch is high, SOL’s price has continued to dip over the last few weeks. The asset’s price has fallen 2.7% in the daily charts, 11.1% in the weekly charts, 6% in the 14-day charts, and 8.9% over the previous month. SOL has maintained some gains over the last year, rallying 6.6% in the yearly charts.

Solana’s (SOL) lackluster performance is likely due to a market-wide correction. Geopolitical tensions and trade wars have likely led market participants to become cautious. The upcoming FOMC meeting may have also led investors to take a back seat.