[#title_feedzy_rewrite]

Over the past week, global markets have been gripped by uncertainty, reflected in the rollercoaster ride of Bitcoin (BTC). After a sharp drop below $80,000 late last week, the cryptocurrency showed signs of recovery at the start of this week. However, with macroeconomic pressures, geopolitical tensions, and shifting investor sentiment at play, BTC’s price remains far from stable.

Recent Bitcoin Price Update: A Weekend Crash and a Tentative Recovery

Bitcoin’s price BTC took a significant hit over the weekend, plummeting from a high of $88,500 to below $80,000 by late Sunday, April 6. This drop, marked by a steep candle down to $82,320 on April 2, followed by further declines, erased much of the gains from its earlier rally toward $90,000.

Source: CoinMarketCap

Analysts attributed the sell-off to a combination of profit-taking and broader market fears tied to looming U.S. tariff policies. By Monday, April 7, however, BTC BTC began to rebound, climbing back toward $85,000 as dip-buyers stepped in and short-term sentiment shifted. Despite this uptick, the market remains anxious, with traders eyeing key support levels at $75,000-$80,000 and resistance near $88,000-$90,000.

The question now is whether this recovery can hold or if more turbulence lies ahead.

Read more: Crypto Volatiles Intensely following Trump’s Tariff Announcement

Factors Expected to Drive Volatility

Several interconnected factors are poised to keep Bitcoin’s price swinging in the coming days:

Unresolved Tariffs and Trade War Risks

The Trump administration’s tariff policies, set to take effect as early as April 9, remain a wildcard. A comprehensive and reciprocal tariff was set in several countries, and an unexpectedly high tariff level was imposed. This caused turbulence among countries and investors, as the worry of inflation and trade war.

Negotiations with major economies like China and the European Union (EU) remain ongoing, with no final tariff rates confirmed as of April 8, 2025. China has already confirmed retaliatory measures, imposing a 34% tariff on U.S. goods effective April 10, heightening fears of a full-blown trade war.

Such escalation could strengthen the U.S. dollar, exerting downward pressure on risk assets like Bitcoin and potentially triggering a sell-off—evidenced by BTC’s drop from $88,500 to $82,320 following the tariff announcement on April 2.

Conversely, if the U.S. and EU strike a deal to ease tariffs and non-tariff barriers, it could foster a “risk-on” environment, channeling capital back into crypto markets. The inherent uncertainty significantly contributes to market volatility, keeping investors apprehensive as they anticipate the potential economic consequences of a trade war or the possibility of a stabilizing agreement, leaving the price of Bitcoin in limbo until further clarity is obtained.

Fed Pressure and Interest Rate Speculation

President Trump’s persistent calls for lower interest rates and pressure from the market have put the Federal Reserve (Fed) under scrutiny. In his March statement, Chairman Jerome Powell quietly dropped two key phrases that ruled out rate hikes, signaling that further tightening could still be on the table if consumer prices don’t come down significantly.

Following a closed-board meeting on the morning of April 7 (U.S. time), market expectations are leaning toward a potential rate cut in the near future. Lower rates could weaken the dollar and make borrowing cheaper, fueling investment in speculative assets like BTC. However, if the Fed resists Trump’s pressure and adopts a hawkish stance to combat tariff-induced inflation, Bitcoin could face downward pressure. Every word from the Fed’s upcoming minutes will be dissected for clues.

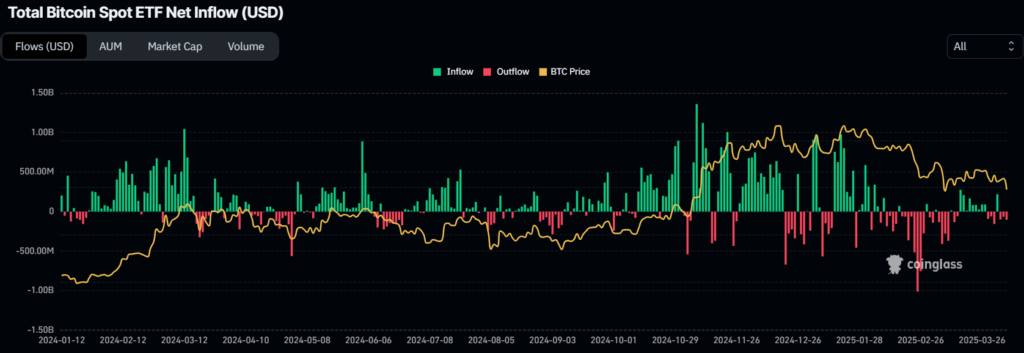

Bitcoin ETF Outflows and Institutional Hesitation

Institutional investors have been pulling back, with Bitcoin ETF outflows totaling $157.8 million on April 1 alone. This trend reflects growing caution among big players amid macroeconomic uncertainty.

Source: Coinglass

Reduced institutional buying power has left BTC vulnerable to sharp drops, as seen in last week’s crash. Yet, some firms, like Japan’s Metaplanet, which added 160 BTC to its holdings on April 1, continue to accumulate, offering a counterbalance. The conflict between outflows and selective buying is likely to intensify price fluctuations.

Microeconomic Uncertainty

Macroeconomic factors will significantly influence Bitcoin’s price in the week ahead. The FOMC minutes and the U.S. JOLTS report, due this week, will shed light on labor market conditions. A stronger-than-expected JOLTS report, showing robust job openings, could bolster the U.S. dollar, pressuring BTC downward as a risk asset.

Conversely, weaker data might fuel expectations of Fed monetary easing, potentially weakening the dollar and lifting Bitcoin’s price. Additionally, the market’s “fearful” sentiment, reflected in a low Fear and Greed Index, could amplify volatility. As of April 8, 2025, these dynamics—combined with tariff uncertainty—may trigger sharp price swings, depending on how the data unfolds.

Strategies for Crypto Investors

Given the current volatility, crypto investors need to tread carefully. Here are four practical strategies to help you navigate through the current volatility:

Avoid Overleveraging and Aggressive Dip-Buying

With BTC’s price prone to sudden shifts, large leveraged positions or overzealous “buy the dip” moves could lead to significant losses. The market’s unpredictability—exemplified by last week’s rapid $6,000 drop—suggests caution. Until clearer trends emerge, scaling back leverage and sizing positions conservatively is prudent.

Monitor FED Signals Closely

The Fed’s next moves will be pivotal. Hawkish signals (e.g., hints of rate hikes) could spark a sell-off, while dovish tones (e.g., rate cut confirmations) might ignite a rally. Investors should track Fed statements and prepare exit or entry plans accordingly. Setting stop-losses or take-profit levels can help manage risk during these event-driven waves.

Maintain Liquidity with Stablecoins

Keeping a portion of your portfolio in stablecoins like USDT or USDC offers flexibility. If BTC dips to key support levels like $75,000, liquid reserves allow you to buy in without scrambling for funds. This approach also protects against prolonged downturns, giving you room to maneuver as the market adjusts.

Adopt a Dollar-Cost Averaging (DCA) Strategy

Timing the market in this environment is risky. Instead, consider DCA—buying fixed amounts of BTC at regular intervals. This method averages your entry price over time, reducing the impact of volatility. For example, weekly purchases could smooth out exposure to sudden drops or spikes, making it ideal for long-term holders.

In recent days, the price of Bitcoin has experienced significant fluctuations, plunging below $80,000 and then rebounding above $85,000. Yet, the road ahead remains uncertain, shaped by unresolved tariffs, Fed policy shifts, and wavering institutional flows. For investors, this is a time for discipline—avoiding reckless bets, staying informed, and balancing risk with opportunity.

The post Bitcoin Plunges Amid Fallout from Trump’s Tariff Policy appeared first on NFT Evening.