[#title_feedzy_rewrite]

President Trump’s new retaliatory tariff policy on imported equipment from Asia has significantly increased the cost of Bitcoin mining in the U.S. While mining firms struggle with disrupted supply chains, some suggest that BTC prices could face short-term pressure due to miner distress.

“Replay of China’s 2021 Bitcoin Mining Ban” from U.S.

In a move many in the industry liken to a “replay of China’s 2021 Bitcoin mining ban,” President Donald Trump and the U.S. administration have imposed tariffs of up to 145% on high-tech equipment imported from China, including Bitcoin mining rigs.

Not only China, but several Asian countries involved in the supply chain and assembly of mining machines will also face elevated tariffs.

Many U.S.-based Bitcoin mining companies rushed to import equipment before the tariffs took effect, with some even chartering private planes to ship mining rigs – incurring costs between 2 million USD and 3.5 million USD, two to four times the usual rate, according to Bloomberg.

Read more: Crypto Market Jumped Back After Trump’s Tariff Delay Bombshell

However, this rush is only a temporary solution. Starting April 9, the price of Bitcoin mining equipment is expected to surge, especially for rigs sourced from China, which still dominates the global supply chain.

“Combined with the pressure from retaliatory tariffs, mining rig prices will rise further, and miners’ profit margins will be increasingly squeezed,” said Csepcsar – CMO of Braiins.

Hashrate index – Source: Thanh Nien Times

Bloomberg also reported that the two largest Bitcoin mining rig manufacturers in the world – Bitmain and MicroBT, have been forced to adjust their supply chains, relocating part of their assembly operations to countries such as Malaysia or Eastern Europe.

Meanwhile, major U.S. mining firms like Riot Platforms and Marathon Digital also saw a slight decline in their stock prices following the news of the new tariffs.

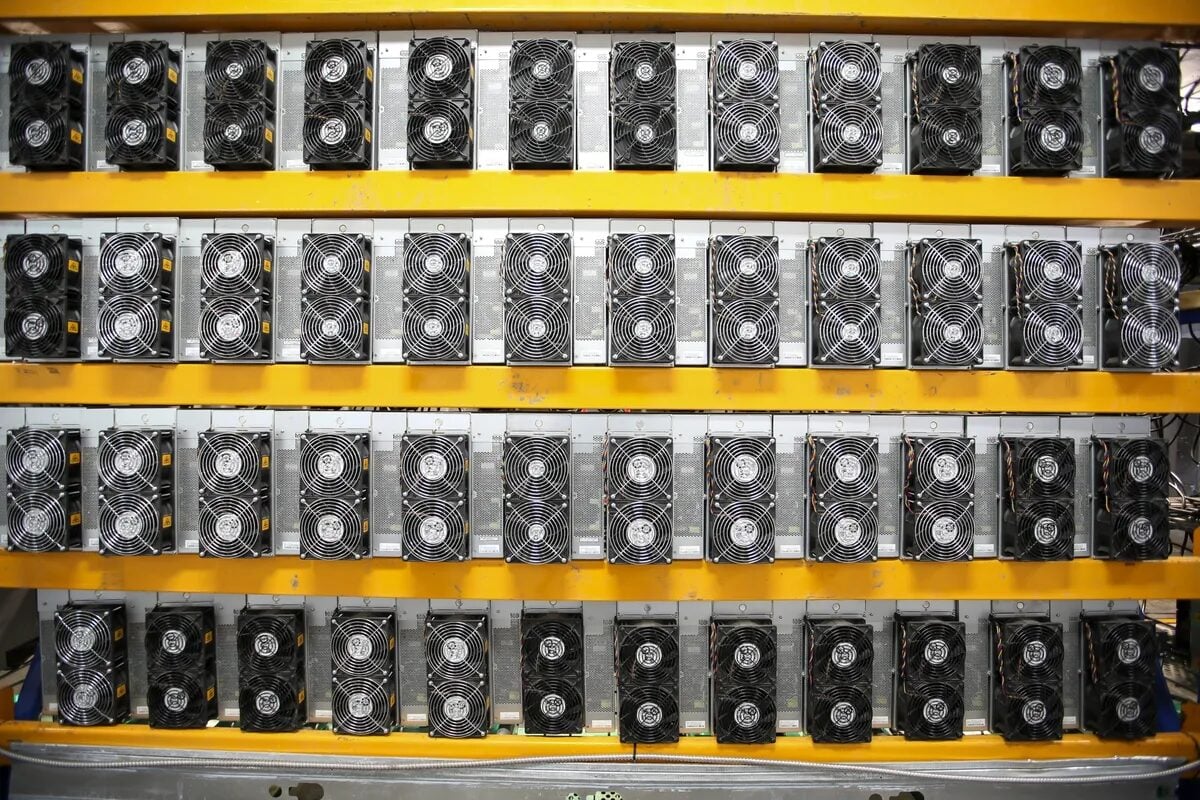

Bitcoin miners – Source: Bloomberg

The U.S. May No Longer Leading the Hashrate Race

This raises the question: Is the U.S. currently accounts for nearly 40% of the global Bitcoin hashrate, pushing itself out of the leading position?

When a country controls a significant share of hashrate, it can:

- Create jobs and contribute to GDP through infrastructure investment, electricity generation, and auxiliary services.

- Utilize surplus electricity, turning mining into a tool for stabilizing the national power grid.

- Attract international investment into sectors like technology, AI, and renewable energy.

Losing this advantage could not only weaken the U.S. domestic mining industry but also diminish the country’s role in the global digital finance ecosystem. Competitors such as Russia and Kazakhstan – both of which enjoy cheap electricity and favorable climates, may gradually reclaim market share.

“If the trade war continues to escalate, regions with low tariffs and favorable conditions could experience a major rise,” said Csepcsar.

Jaran Mellerud from Luxor notes U.S. miners won’t shut down soon, since tariffs affect only new equipment. As such, he believes the total U.S. hashrate hasn’t declined, but its growth has slowed.

A few days ago, Donald Trump introduced massive tariffs on the import of Bitcoin mining machines to the US

This could have enormous implications for the entire bitcoin mining industry

Keep reading to learn more

pic.twitter.com/cbg37RNq7n

— Jaran Mellerud

(@JMellerud) April 8, 2025

Nevertheless, mounting tariff pressure on Bitcoin miners could impact BTC’s price in the short term.

Bitcoin, sensitive to hashrate shifts, may drop if supply chains break or miners move to unstable regions. Slower hardware investment and unstable supply chains may put downward pressure on BTC in the short term.

Observers caution that rising hashrate in Russia or Kazakhstan may raise risks of policy control and transparency issues.

Conclusion

If the U.S. maintains its current hashrate and supply chains adapt smoothly, BTC could see a modest recovery. Conversely, if the hashrate shifts abroad, particularly to regions with political risk, BTC could see a modest recovery. BTC’s price may continue to decline or become highly volatile.

More broadly, the tariff tensions signal a growing geopolitical tug-of-war over who controls the computational backbone of decentralized finance. Bitcoin hashrate now signals digital sovereignty, not just technical strength. Mining dominance lets nations influence energy, upgrades, and crypto policy—impacts go beyond just price moves.

Read more: Just In: Ethereum Precipitously Fell to the Lowest of 2024-2025

The post Trump Tariffs Drive Miners Out of the U.S. appeared first on NFT Evening.