[#title_feedzy_rewrite]

Positioned at the intersection of Layer 1 infrastructure and Layer 2 rollup execution, Initia is designed to offer developers a highly customizable environment with native support for multiple virtual machines – including MoveVM, WasmVM, and EVM.

Backed by leading investors like Binance Labs and Delphi Digital, and approaching its Token Generation Event (TGE), Initia has already captured significant market attention through its dual-layer architecture, active testnet participation, and growing speculation on pre-market trading platforms.

About Initia

Initia is a Layer 1 blockchain platform built on the Cosmos SDK, integrated with Layer 2 rollup solutions to create an “interwoven” multichain ecosystem.

The project has attracted investment from major venture capital firms such as Hack VC, Delphi Digital, and Binance Labs. Its Series A funding round valued the project at approximately $350 million.

Currently, Initia is preparing for its mainnet launch – expected in early 2025, following two successful testnets that drew 194,294 eligible users for its token airdrop.

Additionally, Initia has announced that two major exchanges, Bybit, Kraken, MEXC, Gate.io… will list the INIT token at the time of its Token Generation Event (TGE).

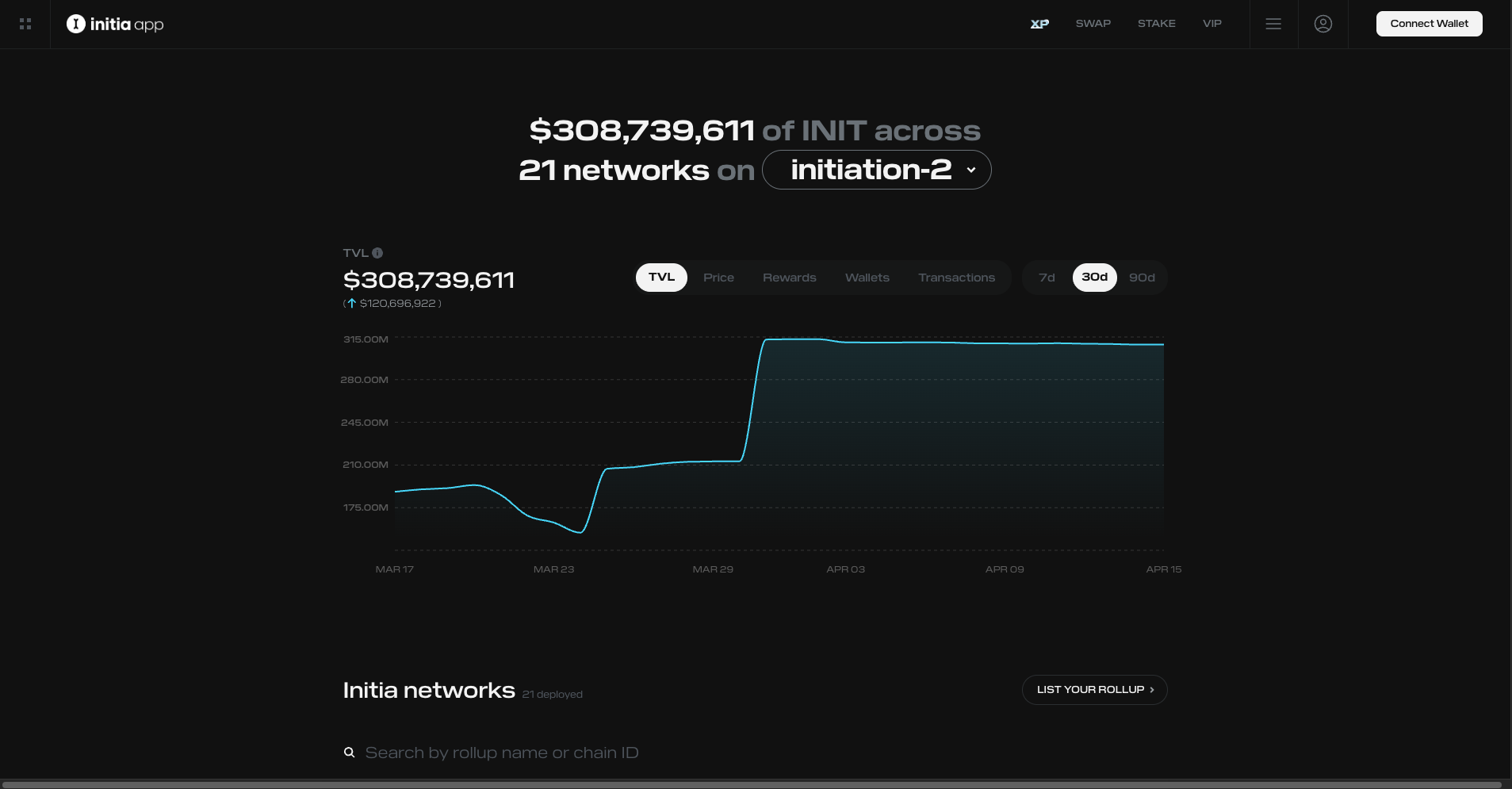

Initia stats – Source: Initia

Initia Tokenomics

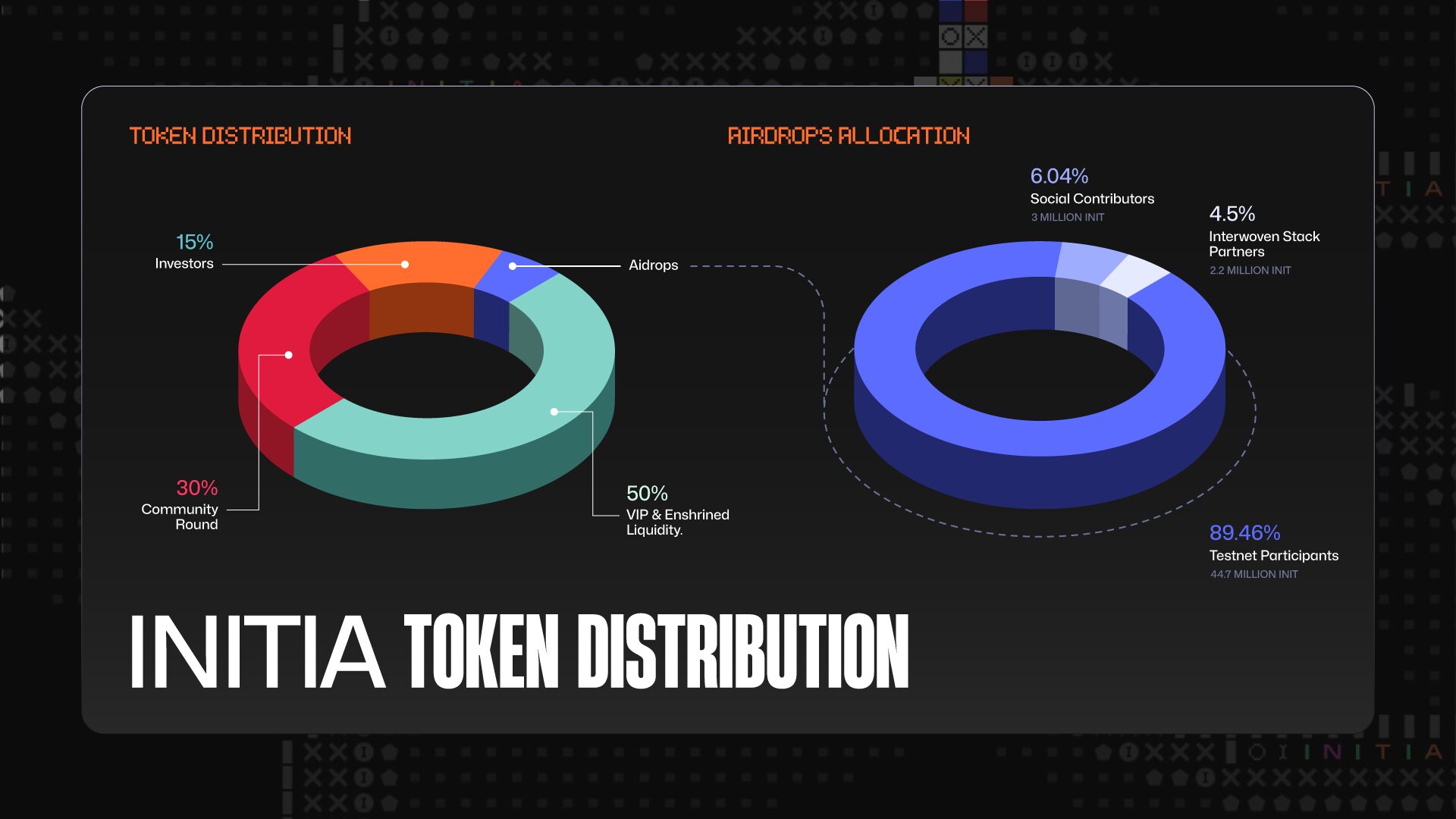

Token Allocation

- VIP & Enshrined: 50%

- Community Round: 30%

- Investor: 15%

- Airdrop: 5%

INIT allocation

INIT Airdrop Allocation

The team has allocated 5% of the total supply (equivalent to 50 million INIT tokens) for the airdrop, distributed among the following three groups:

- Testnet participants: 89.46% (44.7 million INIT)

- Social contributors: 6.04% (3 million INIT)

- Interwoven Stack partners: 4.5% (2.2 million INIT)

Overall, Initia’s airdrop allocation is neither too large nor too small. Therefore, at the time of TGE, the INIT token is unlikely to face significant sell pressure from the airdrop recipients.

In addition, with a total supply of 1 billion tokens and pre-market trading on Bitget, MEXC and Aevo currently ranging from $0.60 to $0.70 per INIT, Initia is currently valued at around $600 – 700 million in FDV.

| Allocation for airdrop | Criteria | |

| Testnet participants | 89.46% | Users who engaged in two testnet of Initia |

| Social contributors | 6.04% | Community member with specific role on Discord, active social on X |

| Interwoven Stack Partners | 4.5% | Active users from partners: LayerZero, IBC and MilkTIA |

INIT Price Prediction

Market Comparison

The price comparison table in this article will include projects with similar technology and strategic direction to Initia. Specifically, two prominent projects selected for comparison are Celestia (TIA) and Movement (MOVE).

Initia vs Celestia

From a technological perspective, both Initia and Celestia pursue a modular blockchain architecture, separating core layers such as consensus, execution, and data storage.

The key difference lies in their development direction:

- Celestia aims to become a foundational layer for all types of blockchains, focusing exclusively on data availability (DA) solutions.

- Initia, on the other hand, seeks to build an integrated multichain ecosystem that serves both as an infrastructure layer and a comprehensive development environment for decentralized applications (dApps).

As of the time of writing, Celestia (TIA) has a market capitalization of approximately $1.5 billion and a fully diluted valuation (FDV) of around $2.7 billion, with its token trading in the $2.4 – 2.5 range. TIA reached a local peak of nearly $20 shortly after its launch in late 2023, before correcting in line with the broader market trend.

Meanwhile, Initia is still pre-TGE, with pre-market prices of $0.60 to $0.70 – implying an FDV of roughly $600 – 700 million. This already positions INIT at more than 25% of Celestia’s FDV, despite the project not yet having a functioning mainnet or any deployed Minitia chains in production. The fact that INIT’s valuation is approaching Celestia’s suggests that speculation is driving its pricing, rather than proven adoption.

With macro uncertainty and high pre-launch pricing, Initia faces notable short-term risks. To avoid post-TGE price shocks, it may be prudent for the team to list INIT at a more conservative range of $0.30 – $0.40, particularly if trading conditions remain weak – thereby creating a more organic growth path similar to how Arbitrum or Optimism scaled post-launch.

That said, the two projects serve very different segments of the modular blockchain stack. If Initia realizes its multichain vision, it could support dozens of scalable, interoperable, app-specific rollups.

It could justify a valuation on par with or even exceeding Celestia’s. A $2.5 billion FDV would imply a token price of around $2.5.

Initia vs Movement

Both Initia and Movement follow the appchain model, enabling apps to launch independent, customizable chains.

Movement uses a “Move-as-a-Service” model, easing deployment for Move-based projects across infrastructures. In contrast, Initia supports multiple tech stacks with shared security and liquidity in one unified network.

MOVE trades at ~$0.30 with a $745M market cap and ~$3B FDV. Of this, 2.45 billion tokens have already entered circulation, accounting for 24.5% of the total supply.

MOVE peaked near $1.45 post-mainnet and Binance/OKX listings before correcting with the market in Q1 2025.

Technologically and investment-wise, Initia rivals Movement, yet its FDV is just one-fifth (~$630M). As such, INIT could potentially reach a price of $3, matching Movement’s current FDV.

This is a realistic scenario — if Initia harnesses its tech and attracts a strong developer community.

Initia Price Prediction

Without major exchange listings, INIT may mirror DYM’s path — moderate FDV and flat post-TGE price action.

If listed on Binance, INIT could debut with a higher FDV similar to MOVE and TIA. INIT could launch closer to the $1–1.5 range with upward momentum, provided post-listing activity supports sustained demand.

Conclusion

Based on the analysis above, Initia demonstrates strong potential to become a core infrastructure hub for future appchains.

Although it has yet to undergo its TGE, the current fully diluted valuation (~$630–700 million), corresponding to a token price of $0.63–$0.70, already reflects high market expectations.

Initia could hit $3B in FDV, pushing the INIT price near $3.

Read more: ETH Price Prediction in April: Short & Mid Term Analysis.

The post Initia Price Prediction: Pre & Post-TGE Pathway appeared first on NFT Evening.