[#title_feedzy_rewrite]

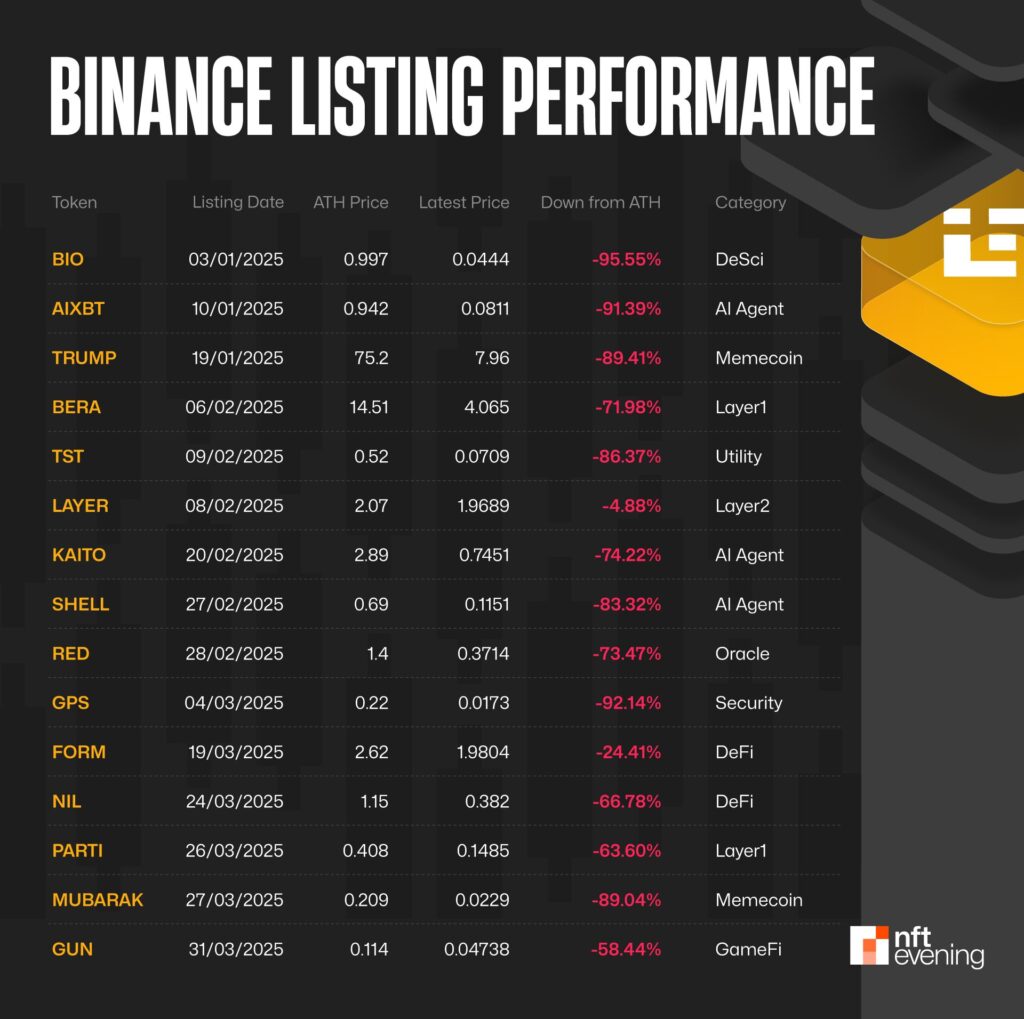

Recently, the consistently poor performance of tokens listed on Binance caused widespread disappointment in the crypto market. With only 2 out of 27 tokens listed in Q1 2025 showing price gains, the remaining 89% have plummeted, some losing up to 90% of their value.

This stark underperformance has sparked widespread skepticism among investors, eroding trust in Binance as a platform for quality projects. Instead, many now view Binance listings as a predictable cycle of hype, pump, and dump. This article explores the extent of this issue, highlights specific cases, and suggests reasons behind the declining confidence in Binance’s listing strategy.

Binance Listings: From Hype to Heartbreak!

The data paints a grim picture. In Q1 2025, Binance listed 27 tokens, but only $LAYER (+86.73%) and $FORM recorded gains. The rest, including high-profile tokens like $TRUMP, $MUBARAK, and $PARTI, suffered significant losses.

For instance, $TRUMP, hyped as a meme coin tied to political narratives, crashed by over 70% shortly after listing due to massive sell-offs. Similarly, $MUBARAK and $PARTI followed a familiar pattern: a brief pump driven by pre-listing hype, followed by a sharp dump as large holders, or “whales,” liquidated their positions.

$TRUMP recent performance – Source: Binance

This consistent underperformance has led investors to question Binance’s vetting process. Many now suspect the exchange prioritizes projects willing to pay high listing fees over those with strong fundamentals. The perception that Binance has become a “dumping ground” for low-quality projects is gaining traction, with communities on X even launching hashtags like #BoycottBinance. Investors increasingly perceive Binance listings as a warning sign rather than an endorsement, which stands in stark contrast to the exchange’s previous reputation.

Why Binance Listings Are Crashing Hard?

A toxic mix of greed, market dynamics, and strategic missteps led to the catastrophic price drops of tokens listed on Binance in 2025. From sky-high listing fees to a meme coin obsession, here’s why newly listed tokens are bleeding value faster than ever.

Sky-High Listing Costs: Draining Projects Dry Before They Fly?

Binance’s listing process isn’t just a pay-to-play game—it’s a resource sink that can cripple projects. Securing a spot on the exchange demands millions of dollars in fees, forcing projects to pour nearly all their financial and operational muscle into the listing itself.

This all-in bet leaves thinly backed projects, which lack robust backers or clear long-term strategies, dangerously exposed. This is exemplified by tokens such as $MUBARAK and $PARTI, which experienced tremendous hype during their pre-listing phase and expended significant resources to secure a spot on Binance. However, their post-launch collapse occurred due to weak fundamentals and stretched budgets that failed to sustain growth.

With no runway left to innovate or execute, these projects falter, their prices tanking—$MUBARAK alone plunged 70%—leaving investors burned and wondering if Binance is a springboard for success or a graveyard for overextended dreams.

Binance’s Liquidity Trap: The Perfect Dump Zone

Binance, with its daily trading volume often surpassing $20 billion, is the preferred destination for projects seeking to cash out. This high liquidity makes it the ideal “final stop” for whales and insiders to unload massive token supplies, triggering brutal pump-and-dump schemes.

Take $MUBARAK, for example: hyped pre-listing, it soared briefly before crashing over 70% as large holders dumped millions of tokens. Similarly, coordinated sell-offs fueled $TRUMP’s 70% post-listing plunge, often implicating market makers like Wintermute. Binance’s liquidity, once a strength, has become a magnet for these predatory tactics, leaving retail investors as collateral damage.

Source: TradingView

Other Reasons to Form a Recipe for Disaster

The broader crypto market in 2025 is a graveyard of confidence, amplifying Binance’s listing woes. The Fear & Greed Index has languished in Fear to Extreme Fear since January, reflecting retail investors’ retreat amid global trade tensions, such as the spike in U.S.-China tariffs to 125%. Furthermore, the liquidity drought makes new tokens easy prey for volatility spikes.

Source: Binance

Worse, Binance’s obsession with meme coins like $TRUMP and $MUBARAK is spectacularly mistimed. The meme coin craze that fueled in late 2024 has fizzled in 2025’s bear market, with investors craving projects offering real-world utility. Binance’s failure to adapt to a market demanding substance over sizzle is torching its reputation.

Other factors include aggressive sell-offs by market makers like Wintermute, as seen in the $ACT token dump, and changes in tokenomics that erode investor confidence, such as $OM’s supply increase and inflation adjustments. These issues, combined with incidents like the FDUSD stablecoin depeg, have fueled distrust in Binance’s transparency and reliability.

Conclusion

The dismal performance of Binance’s recent listings has significantly undermined market confidence. To restore trust, Binance must prioritize quality over quantity in its listings and address concerns about transparency. Until then, investors are likely to remain cautious, viewing Binance not as a launchpad for innovation but as a cautionary tale of hype and disappointment.

The post Binance Low Performance Impacts Severely on Investors’ Belief appeared first on NFT Evening.