[#title_feedzy_rewrite]

$AERGO demonstrated remarkable resilience following its delisting from the Binance spot market on March 28, 2025, skyrocketing 10x to $0.57, bolstered by activity on Upbit and Binance Futures. This unexpected turnaround, echoed by significant price increases in $ARDR (280%) and $ARK (60%) during Binance’s April “Vote to Delist” campaign, underscores how Binance’s Monitoring Tags and delisting events can create volatile, high-risk, high-reward scenarios for traders.

$AERGO’s Price Rebound

On March 21, 2025, Binance announced AERGO’s spot market delisting, effective March 28, sending its price down 6% to $0.06845. While most delisted coins tend to fade into obscurity, $AERGO, the native token of a hybrid blockchain platform backed by Samsung’s Blocko, managed to defy expectations. After being delisted by Binance, $AERGO skyrocketed 10x to a peak of $0.57 with a $920 million volume surge before being relisted on Binance Futures.

Compare this event to other delisted tokens like BAL and CREAM, removed on April 16, 2025. They plummeted, with $CREAM losing a significant market cap.

AERGO’s edge? High Upbit volume sustained liquidity with $250M on 9/4, as stated by GEM DETECTER, turning a delisting dip into a speculative frenzy. Traders who spotted this pattern-volume spikes on South Korean exchanges, caught a massive wave, proving that not all delistings spell doom.

Parallel Surges of $ARDR and $ARK

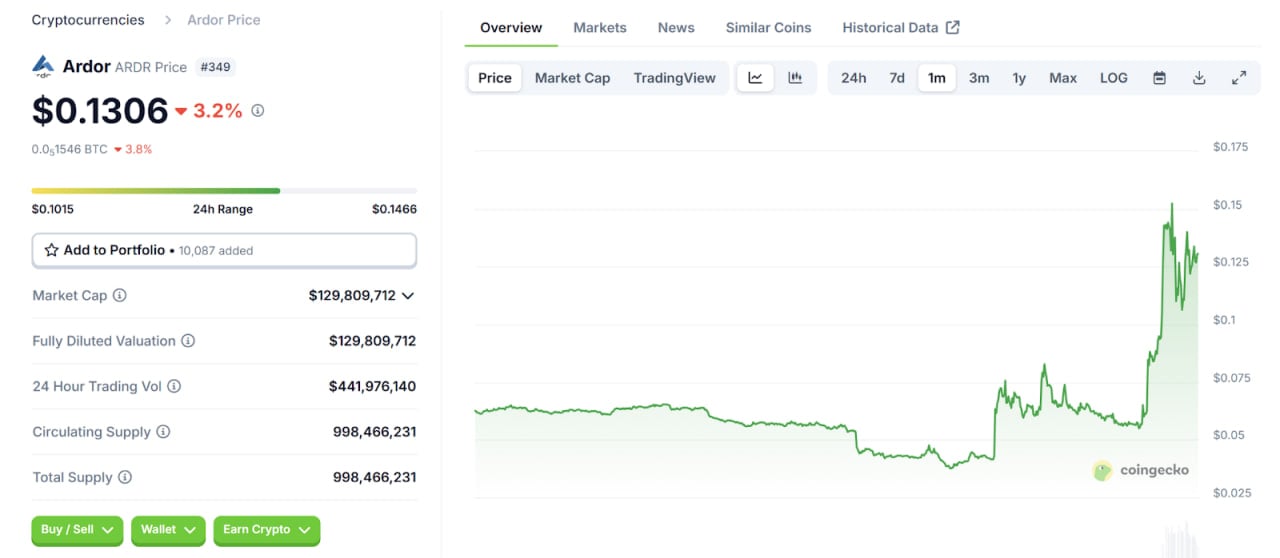

A similar script played out with $ARDR and $ARK, included in Binance’s second “Vote to Delist” campaign from April 10-16, 2025. Despite receiving 3.6% and 5.8% of votes, respectively, neither $ARDR nor $ARK has confirmed delisting, yet their prices experienced a significant surge.

Source: Coingecko

Unlike other tokens in the 2nd “Vote to Delist” Batch like $PDA and $VOXEL, which saw substantial declines, $ARDR surged 280% to $0.15 by April 16, with a 1,100% volume spike. $ARK, less dramatic, likely climbed to $0.52, increasing by nearly 60%. Both these tokens are trader favorites on Bithumb, where high trading volumes sustain liquidity. Similar to $AERGO’s Upbit-driven rally ($250M volume on April 9), Bithumb’s ARDR/KRW and ARK/KRW pairs saw massive activity.

However, the hype didn’t last. $AERGO crashed 63% to $0.18 within 24 hours. $ARDR likely dipped 10-15%, while $ARK stagnated or slid slightly. These corrections highlight the volatility of delist-driven pumps. When momentum fades, traders chasing news often suffer, particularly if projects lack strong fundamentals.

Leveraging Binance’s Risk Indicators

Through the cases above, Binance’s Monitoring Tags can be considered a goldmine for traders. These flags mark coins at risk of delisting due to low liquidity, weak development, or regulatory red flags.

The Vote to Delist campaign, like the one ending April 16, amplifies volatility, creating pump-and-dump setups. To capitalize, track tagged coins via Binance announcements, then check Bithumb and Upbit volume on CoinMarketCap or CoinGecko. A surge, like in $AERGO, $ARDR, and $ARK, often precedes a rally.

Don’t forget to stay proactive: Monitor Binance Square for delist updates and Korean Upbit and Bithumb exchange data for volume clues. $AERGO, $ARDR, and $ARK show what’s possible, but timing and risk management are everything.

The post AERGO’s Turnaround and Binance Delisting Dynamics appeared first on NFT Evening.