[#title_feedzy_rewrite]

Hyperliquid, an emerging Layer 1 blockchain, has surged in prominence following its record-breaking airdrop in November 2024, positioning itself as a formidable contender in the DeFi space. Its rapid rise invites comparisons with Ethereum, the leading Layer 1 blockchain.

While Ethereum boasts a massive Total Value Locked (TVL), Hyperliquid’s ability to generate significantly higher fees despite a smaller TVL highlights a fascinating dynamic in blockchain economics, driven by their distinct designs and market focuses.

Hyperliquid is Starring: The Numbers Speak

Hyperliquid is a high-performance Layer 1 blockchain tailored for decentralized perpetual futures trading. As of April 2025, its TVL is approximately $627.27 million, a fraction of Ethereum’s but impressive for a specialized platform. The recent airdrop of 310 million HYPE tokens to 94,000 users, valued at $7.6 billion, catapulted Hyperliquid into the spotlight, driving user adoption and trading volume.

Learn more: What is Hyperliquid?

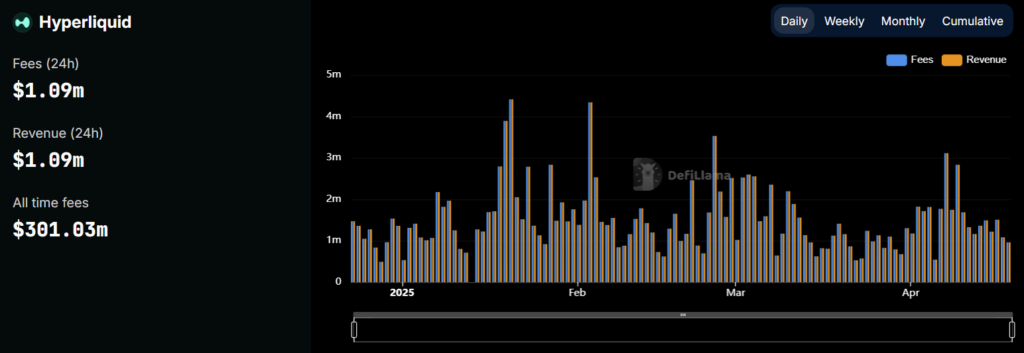

Source: DefilLama

Ethereum, the backbone of DeFi, commands a TVL of over $46 billion, dwarfing Hyperliquid’s. Hosting over 1,216 projects, it supports a diverse ecosystem of dApps, NFTs, and DeFi protocols. Recent updates include the Dencun upgrade (March 2024), which slashed Layer 2 fees by 95%, and growing restaking adoption via EigenLayer.

However, Ethereum’s chain fees have struggled, standing at $300,000 in the last 24 hours compared to Hyperliquid’s $1 million. Throughout Q1 2025, Ethereum’s performance faltered, with fees hitting record lows due to reduced network activity recently amid the chaos of the overall market and lower gas prices post-Dencun. Despite its unmatched validator count (1.05 million) and decentralization, Ethereum’s revenue has lagged, as its high TVL reflects passive activities like staking rather than high-turnover trading.

Source: DefilLama

The contrast is stark: Ethereum’s TVL is nearly 80 times Hyperliquid’s, yet Hyperliquid generates over three times the daily fees. This gap widened in Q1 2025, as Ethereum’s fees repeatedly hit historic lows, while Hyperliquid’s DEX thrived despite whale-induced volatility. The airdrop further amplified Hyperliquid’s appeal, boosting its user base to over 230,000 and daily trading volume to $470 million.

Source: Artemis

Why Hyperliquid’s Fee Surge?

Hyperliquid’s fee advantage stems from its specialized design and market fit. Its perpetual futures DEX, built on the Hyperliquid L1 with HyperBFT consensus, delivers sub-second latency and 100,000 orders per second, rivaling centralized exchanges.

The platform’s high-leverage trading (up to 50x) and low-cost structure drive massive trading volumes, amplifying fee generation. The HLP Vault, a unique feature, aggregates fees from transactions, funding, and clearing, ensuring efficient revenue capture.

In contrast, Ethereum’s gas fees, distributed to validators, depend on network congestion and are less tied to TVL, which is often locked in low-turnover protocols like Aave or Lido. The Dencun upgrade, while improving scalability, slashed fees, reducing Ethereum’s revenue.

Hyperliquid’s airdrop also played a pivotal role, drawing traders and sustaining TVL growth post-TGE, unlike typical post-airdrop declines seen in projects like Scroll. Its community-focused tokenomics, allocating 76.2% of HYPE tokens to users, further fueled engagement.

Hyperliquid Ecosystem after Its Raising Performance

Hyperliquid has evolved from a perpetual futures DEX into a multidimensional Web3 ecosystem since launching HyperEVM, an Ethereum-compatible blockchain, in February 2025. HyperEVM’s high-performance design, with quick block times and parallel processing, supports over 100 dApps across DeFi, NFTs, GameFi, AI, and liquid staking.

Projects like Hyperlend and Timeswap innovate in lending, while Cluster and Solv Protocol enhance liquid staking. Native DEXs (HyperSwap, Spectra) and AI-driven tools (Beats AI, HCR Bot) showcase its versatility.

NFT collections like Wealthy Hypio Babies and GameFi platforms like Hyperverse drive community engagement. Bridges (Wormhole, HyBridge) and oracles (Pyth Network) ensure interoperability, while meme tokens like Autist add viral appeal. Hyperliquid’s vision, likened to a “Solana on EVM,” aims for ultra-fast, scalable experiences, positioning it as a foundation for Web3 innovation. Its diverse ecosystem, built on a trader-centric core, signals a shift from a niche DEX to a broad, competitive platform.

Read more: Hyperliquid Ecosystem: From Perp DEX to Emerging Crypto Ecosystem

The post Hyperliquid Destroyed Ethereum in Daily Fees Gained appeared first on NFT Evening.